Throughout the last three months, 5 analysts have evaluated JetBlue Airways JBLU, offering a diverse set of opinions from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 0 | 2 | 2 | 1 |

| Last 30D | 0 | 0 | 0 | 1 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 1 | 1 |

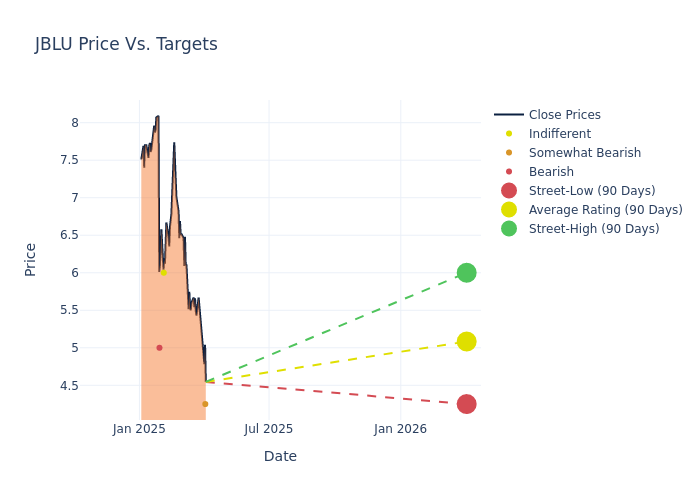

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $5.95, a high estimate of $8.00, and a low estimate of $4.25. This current average has decreased by 4.8% from the previous average price target of $6.25.

Interpreting Analyst Ratings: A Closer Look

The perception of JetBlue Airways by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Andrew Didora | B of A Securities | Lowers | Underperform | $4.25 | $5.25 |

| Christopher Stathoulopoulos | Susquehanna | Lowers | Neutral | $6.00 | $8.00 |

| Thomas Wadewitz | UBS | Lowers | Sell | $5.00 | $5.50 |

| Andrew Didora | B of A Securities | Maintains | Underperform | $6.50 | $6.50 |

| Christopher Stathoulopoulos | Susquehanna | Raises | Neutral | $8.00 | $6.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to JetBlue Airways. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of JetBlue Airways compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of JetBlue Airways's stock. This analysis reveals shifts in analysts' expectations over time.

For valuable insights into JetBlue Airways's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on JetBlue Airways analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

About JetBlue Airways

JetBlue Airways Corp is a low-cost airline that offers high-quality service, including assigned seating and in-flight entertainment. It served approximately 100 destinations in the United States, the Caribbean and Latin America, Canada, and England. The company currently operates Airbus A321, Airbus A320, Airbus A321neo, and Embraer E190 aircraft types. The company has one operating segment, Air Transportation Services, which provides services in the United States, the Caribbean, Latin America, Canada, and Europe. The majority of revenue is generated from the Domestic & Canada segment.

Financial Milestones: JetBlue Airways's Journey

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Revenue Challenges: JetBlue Airways's revenue growth over 3 months faced difficulties. As of 31 December, 2024, the company experienced a decline of approximately -2.06%. This indicates a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: JetBlue Airways's net margin excels beyond industry benchmarks, reaching -1.93%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): JetBlue Airways's ROE stands out, surpassing industry averages. With an impressive ROE of -1.67%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): JetBlue Airways's ROA excels beyond industry benchmarks, reaching -0.26%. This signifies efficient management of assets and strong financial health.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 3.46, caution is advised due to increased financial risk.

What Are Analyst Ratings?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.