Across the recent three months, 6 analysts have shared their insights on AVITA Medical RCEL, expressing a variety of opinions spanning from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 6 | 0 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 2 | 0 | 0 | 0 | 0 |

| 3M Ago | 2 | 0 | 0 | 0 | 0 |

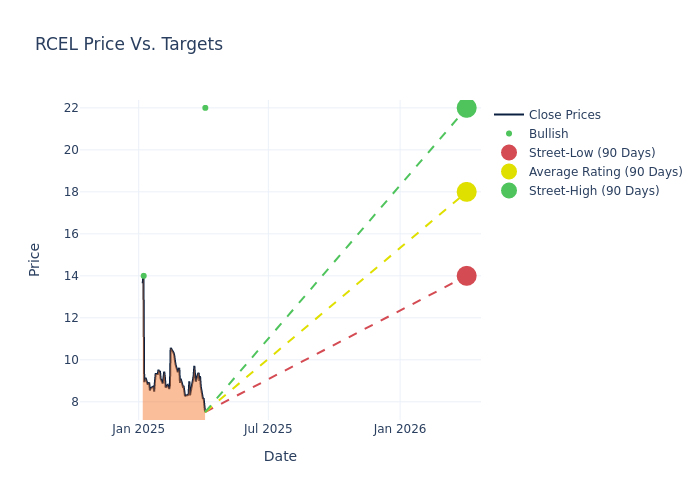

Insights from analysts' 12-month price targets are revealed, presenting an average target of $21.67, a high estimate of $25.00, and a low estimate of $14.00. Observing a downward trend, the current average is 6.47% lower than the prior average price target of $23.17.

Diving into Analyst Ratings: An In-Depth Exploration

The standing of AVITA Medical among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jason Kolbert | D. Boral Capital | Maintains | Buy | $22.00 | $22.00 |

| Jason Kolbert | D. Boral Capital | Maintains | Buy | $22.00 | $22.00 |

| Jason Kolbert | D. Boral Capital | Lowers | Buy | $22.00 | $25.00 |

| Jason Kolbert | D. Boral Capital | Maintains | Buy | $25.00 | $25.00 |

| Brooks O'Neil | Lake Street | Lowers | Buy | $14.00 | $20.00 |

| Jason Kolbert | D. Boral Capital | Maintains | Buy | $25.00 | $25.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to AVITA Medical. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of AVITA Medical compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of AVITA Medical's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on AVITA Medical analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Discovering AVITA Medical: A Closer Look

Avita is a single product company. Its RECELL system is an innovative burn treatment device which creates Spray-on Skin from a small skin sample within 30 minutes, thus avoiding or reducing the need for skin grafts. It's approved for the treatment of adult patients in the US with paediatric clinical trials and expanded indications in soft-tissue reconstruction and vitiligo underway. It is currently in roll-out across the approximately 136 US burn centers. Despite having product approval in Australia, Europe, Canada, and China, Avita is not actively marketing in those territories and focussing instead on the US region. However, it is expected to launch in Japan via distribution partner Cosmotec in second-half fiscal 2022. Avita is domiciled, and has its primary listing, in the US.

Understanding the Numbers: AVITA Medical's Finances

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Growth: Over the 3 months period, AVITA Medical showcased positive performance, achieving a revenue growth rate of 29.67% as of 31 December, 2024. This reflects a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Health Care sector.

Net Margin: AVITA Medical's net margin excels beyond industry benchmarks, reaching -62.96%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): AVITA Medical's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of -138.57%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of -14.42%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: AVITA Medical's debt-to-equity ratio is notably higher than the industry average. With a ratio of 10.22, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Analyst Ratings: Simplified

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.