Expedia Group EXPE has been analyzed by 21 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 2 | 14 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 1 | 2 | 0 | 0 |

| 2M Ago | 2 | 1 | 7 | 0 | 0 |

| 3M Ago | 3 | 0 | 4 | 0 | 0 |

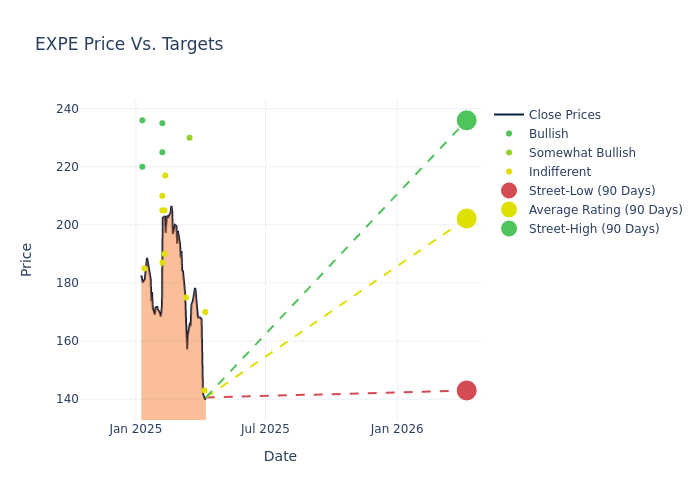

Insights from analysts' 12-month price targets are revealed, presenting an average target of $199.1, a high estimate of $236.00, and a low estimate of $143.00. This current average reflects an increase of 4.42% from the previous average price target of $190.67.

Diving into Analyst Ratings: An In-Depth Exploration

An in-depth analysis of recent analyst actions unveils how financial experts perceive Expedia Group. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|---------------|--------------------|--------------------| |Doug Anmuth |JP Morgan |Lowers |Neutral | $170.00|$205.00 | |Ken Gawrelski |Wells Fargo |Lowers |Equal-Weight | $143.00|$199.00 | |Jed Kelly |Oppenheimer |Lowers |Outperform | $230.00|$235.00 | |Greg Miller |Truist Securities |Raises |Hold | $175.00|$163.00 | |Ronald Josey |Citigroup |Raises |Neutral | $217.00|$200.00 | |Shyam Patil |Susquehanna |Raises |Neutral | $205.00|$190.00 | |Brian Pitz |BMO Capital |Raises |Market Perform | $190.00|$165.00 | |Trevor Young |Barclays |Raises |Equal-Weight | $187.00|$166.00 | |Deepak Mathivanan |Cantor Fitzgerald |Raises |Neutral | $210.00|$180.00 | |Jed Kelly |Oppenheimer |Raises |Outperform | $235.00|$210.00 | |Naved Khan |B. Riley Securities |Raises |Buy | $235.00|$220.00 | |Daniel Kurnos |Benchmark |Raises |Buy | $225.00|$200.00 | |Ken Gawrelski |Wells Fargo |Raises |Equal-Weight | $199.00|$168.00 | |Tom White |DA Davidson |Raises |Neutral | $205.00|$190.00 | |Daniel Kurnos |Benchmark |Maintains |Buy | $200.00|$200.00 | |Deepak Mathivanan |Cantor Fitzgerald |Lowers |Neutral | $180.00|$190.00 | |Ken Gawrelski |Wells Fargo |Lowers |Equal-Weight | $168.00|$172.00 | |Brian Nowak |Morgan Stanley |Raises |Equal-Weight | $185.00|$180.00 | |Trevor Young |Barclays |Raises |Equal-Weight | $166.00|$153.00 | |Eric Sheridan |Goldman Sachs |Raises |Buy | $236.00|$208.00 | |John Staszak |Argus Research |Raises |Buy | $220.00|$210.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Expedia Group. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Expedia Group compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

To gain a panoramic view of Expedia Group's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Expedia Group analyst ratings.

Discovering Expedia Group: A Closer Look

Expedia is the world's second-largest online travel agency by bookings, offering services for lodging (80% of total 2024 sales), air tickets (3%), rental cars, cruises, in-destination, and other (10%), and advertising revenue (7%). Expedia operates a number of branded travel booking sites, but its three core online travel agency brands are Expedia, Hotels.com, and Vrbo. It also has a metasearch brand, Trivago. Transaction fees for online bookings account for the bulk of sales and profits.

Key Indicators: Expedia Group's Financial Health

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Revenue Growth: Over the 3M period, Expedia Group showcased positive performance, achieving a revenue growth rate of 10.29% as of 31 December, 2024. This reflects a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Consumer Discretionary sector.

Net Margin: Expedia Group's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 9.39% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Expedia Group's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 20.77%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Expedia Group's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.31% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Expedia Group's debt-to-equity ratio surpasses industry norms, standing at 4.19. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

Understanding the Relevance of Analyst Ratings

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.