9 analysts have shared their evaluations of CubeSmart CUBE during the recent three months, expressing a mix of bullish and bearish perspectives.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 2 | 6 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 2 | 2 | 0 | 0 |

| 3M Ago | 1 | 0 | 2 | 0 | 0 |

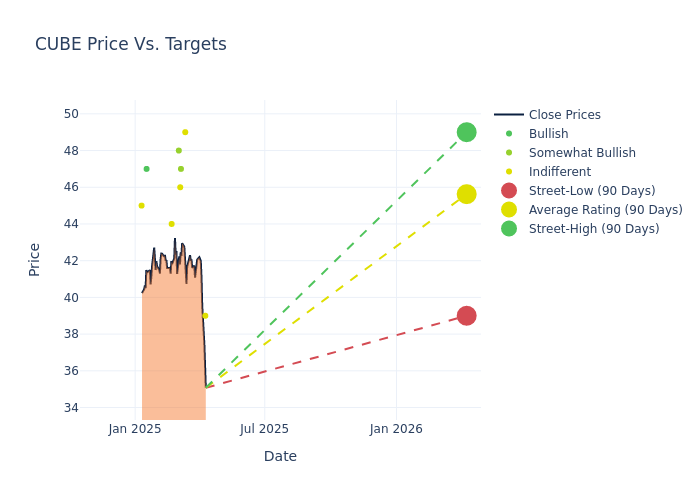

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $46.11, along with a high estimate of $50.00 and a low estimate of $39.00. This current average has decreased by 9.07% from the previous average price target of $50.71.

Investigating Analyst Ratings: An Elaborate Study

The analysis of recent analyst actions sheds light on the perception of CubeSmart by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|---------------|--------------------|--------------------| |Ravi Vaidya |Mizuho |Announces |Neutral | $39.00|- | |Brendan Lynch |Barclays |Lowers |Equal-Weight | $49.00|$50.00 | |Todd Thomas |Keybanc |Announces |Overweight | $47.00|- | |Daniel Tricarico |Scotiabank |Lowers |Sector Perform | $46.00|$52.00 | |Brad Heffern |RBC Capital |Lowers |Outperform | $48.00|$53.00 | |Eric Luebchow |Wells Fargo |Lowers |Equal-Weight | $44.00|$50.00 | |Ki Bin Kim |Truist Securities |Lowers |Buy | $47.00|$50.00 | |Brendan Lynch |Barclays |Lowers |Equal-Weight | $50.00|$54.00 | |Omotayo Okusanya |Deutsche Bank |Lowers |Hold | $45.00|$46.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to CubeSmart. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of CubeSmart compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of CubeSmart's stock. This comparison reveals trends in analysts' expectations over time.

For valuable insights into CubeSmart's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on CubeSmart analyst ratings.

All You Need to Know About CubeSmart

CubeSmart is a real estate investment trust that acquires, owns, and manages self-storage facilities throughout the United States. The company's real estate portfolio is composed of buildings with numerous enclosed storage areas for both residential and commercial customers to rent mainly on a month-by-month basis. Majority of CubeSmart's facilities are located in Florida, Texas, California, New York, and Illinois. Cumulatively, these states account for both the majority of the square footage in the company's real estate portfolio and the majority of its revenue. The company derives nearly all of its revenue from rental income from tenants utilizing its storage facilities.

Financial Milestones: CubeSmart's Journey

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Revenue Growth: CubeSmart's revenue growth over a period of 3M has been noteworthy. As of 31 December, 2024, the company achieved a revenue growth rate of approximately 0.98%. This indicates a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Real Estate sector.

Net Margin: CubeSmart's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 38.06% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): CubeSmart's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 3.6%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): CubeSmart's ROA stands out, surpassing industry averages. With an impressive ROA of 1.62%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: With a below-average debt-to-equity ratio of 1.06, CubeSmart adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Basics of Analyst Ratings

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.