Across the recent three months, 32 analysts have shared their insights on Trade Desk TTD, expressing a variety of opinions spanning from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 12 | 17 | 3 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 3 | 3 | 0 | 0 | 0 |

| 2M Ago | 1 | 3 | 0 | 0 | 0 |

| 3M Ago | 7 | 11 | 3 | 0 | 0 |

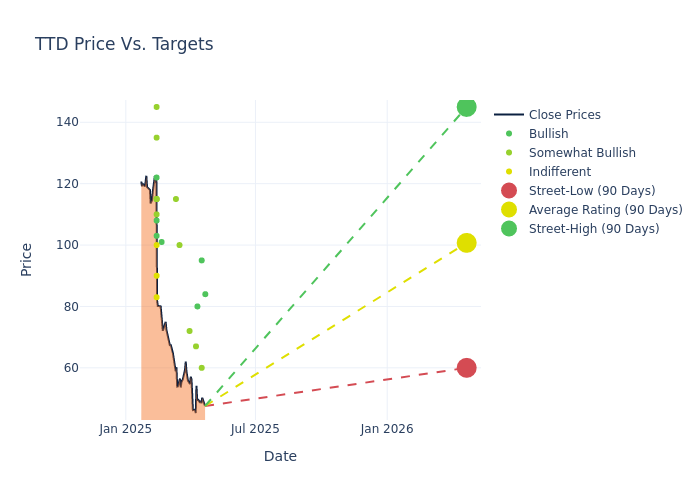

Insights from analysts' 12-month price targets are revealed, presenting an average target of $108.31, a high estimate of $148.00, and a low estimate of $60.00. This current average has decreased by 17.42% from the previous average price target of $131.16.

Investigating Analyst Ratings: An Elaborate Study

The standing of Trade Desk among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|------------------------|---------------|-----------------|--------------------|--------------------| |Laura Martin |Needham |Maintains |Buy | $84.00|$84.00 | |Matthew Cost |Morgan Stanley |Lowers |Overweight | $60.00|$132.00 | |Youssef Squali |Truist Securities |Lowers |Buy | $95.00|$130.00 | |Laura Martin |Needham |Maintains |Buy | $84.00|$84.00 | |Chris Kuntarich |UBS |Lowers |Buy | $80.00|$116.00 | |Justin Patterson |Keybanc |Lowers |Overweight | $67.00|$74.00 | |Alec Brondolo |Wells Fargo |Lowers |Overweight | $72.00|$101.00 | |Justin Patterson |Keybanc |Lowers |Overweight | $74.00|$130.00 | |Matthew Swanson |RBC Capital |Lowers |Outperform | $100.00|$120.00 | |Andrew Boone |Citizens Capital Markets|Maintains |Market Outperform| $115.00|$115.00 | |Laura Martin |Needham |Maintains |Buy | $145.00|$145.00 | |Rob Sanderson |Loop Capital |Lowers |Buy | $101.00|$145.00 | |Chris Kuntarich |UBS |Raises |Buy | $148.00|$116.00 | |Alec Brondolo |Wells Fargo |Lowers |Overweight | $101.00|$142.00 | |Nat Schindler |Scotiabank |Lowers |Sector Perform | $83.00|$133.00 | |Ygal Arounian |Citigroup |Lowers |Buy | $108.00|$140.00 | |Matthew Cost |Morgan Stanley |Lowers |Overweight | $132.00|$145.00 | |Brian Pitz |BMO Capital |Lowers |Outperform | $115.00|$160.00 | |Matthew Swanson |RBC Capital |Lowers |Outperform | $120.00|$140.00 | |Jason Helfstein |Oppenheimer |Lowers |Outperform | $115.00|$135.00 | |Matt Farrell |Piper Sandler |Lowers |Overweight | $110.00|$140.00 | |Deepak Mathivanan |Cantor Fitzgerald |Lowers |Neutral | $100.00|$115.00 | |Justin Patterson |Keybanc |Lowers |Overweight | $130.00|$142.00 | |Matthew Condon |JMP Securities |Lowers |Market Outperform| $115.00|$150.00 | |Mark Kelley |Stifel |Lowers |Buy | $122.00|$144.00 | |Youssef Squali |Truist Securities |Lowers |Buy | $130.00|$155.00 | |Tom White |DA Davidson |Lowers |Buy | $103.00|$134.00 | |Shyam Patil |Susquehanna |Lowers |Positive | $135.00|$150.00 | |Vikram Kesavabhotla |Baird |Lowers |Outperform | $145.00|$160.00 | |Laura Martin |Needham |Maintains |Buy | $145.00|$145.00 | |Shweta Khajuria |Evercore ISI Group |Lowers |In-Line | $90.00|$135.00 | |Alex Markgraff |Keybanc |Raises |Overweight | $142.00|$140.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Trade Desk. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Trade Desk compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Trade Desk's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Trade Desk's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Trade Desk analyst ratings.

Unveiling the Story Behind Trade Desk

The Trade Desk provides a self-service platform that helps advertisers and ad agencies programmatically find and purchase digital ad inventory (display, video, audio, and social) on devices like computers, smartphones, and connected TVs. It uses data in an iterative manner to optimize the performance of ad impressions purchased. The firm's platform is referred to as a demand-side platform in the digital ad industry, and it generates revenue from fees based on a percentage of what its clients spend on advertising.

Trade Desk's Financial Performance

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Revenue Growth: Over the 3M period, Trade Desk showcased positive performance, achieving a revenue growth rate of 22.32% as of 31 December, 2024. This reflects a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Communication Services sector.

Net Margin: Trade Desk's net margin excels beyond industry benchmarks, reaching 24.59%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Trade Desk's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 6.54%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Trade Desk's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 3.14%, the company showcases efficient use of assets and strong financial health.

Debt Management: Trade Desk's debt-to-equity ratio is below the industry average at 0.11, reflecting a lower dependency on debt financing and a more conservative financial approach.

Analyst Ratings: What Are They?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.