Today, January 25, 2024, Village Super Market VLGEA will distribute a dividend payout of $0.25 per share, highlighting an annualized dividend yield of 4.00%. Shareholders who owned the stock before the ex-dividend date on January 03, 2024 will be eligible for this payout.

Village Super Market Recent Dividend Payouts

| Ex-Date | Payments per year | Dividend | Yield | Announced | Record | Payable |

|---|---|---|---|---|---|---|

| 2024-01-03 | 4 | $0.25 | 4.0% | 2023-12-15 | 2024-01-04 | 2024-01-25 |

| 2023-10-04 | 4 | $0.25 | 4.48% | 2023-09-15 | 2023-10-05 | 2023-10-26 |

| 2023-07-05 | 4 | $0.25 | 4.4% | 2023-06-16 | 2023-07-06 | 2023-07-27 |

| 2023-04-05 | 4 | $0.25 | 4.41% | 2023-03-23 | 2023-04-06 | 2023-04-27 |

| 2023-01-04 | 4 | $0.25 | 4.27% | 2022-12-16 | 2023-01-05 | 2023-01-26 |

| 2022-10-05 | 4 | $0.25 | 4.74% | 2022-09-16 | 2022-10-06 | 2022-10-27 |

| 2022-07-06 | 4 | $0.25 | 4.38% | 2022-06-20 | 2022-07-07 | 2022-07-28 |

| 2022-04-06 | 4 | $0.25 | 4.12% | 2022-03-21 | 2022-04-07 | 2022-04-28 |

| 2022-01-05 | 4 | $0.25 | 4.48% | 2021-12-17 | 2022-01-06 | 2022-01-27 |

| 2021-10-06 | 4 | $0.25 | 4.61% | 2021-09-17 | 2021-10-07 | 2021-10-28 |

| 2021-07-07 | 4 | $0.25 | 4.17% | 2021-06-11 | 2021-07-08 | 2021-07-29 |

| 2021-03-31 | 4 | $0.25 | 3.87% | 2021-03-12 | 2021-04-01 | 2021-04-22 |

Village Super Market is the leader in terms of dividend yield compared to its industry peers, with Natural Grocers NGVC having the highest annualized dividend yield at 2.57%.

Analyzing Village Super Market Financial Health

Companies that pay out steady cash dividends are attractive to income-seeking investors, and companies that are financially healthy tend to maintain their dividend payout schedule. For this reason, investors can find it insightful to see if a company has been increasing or decreasing their dividend payout schedule and if their earnings are growing.

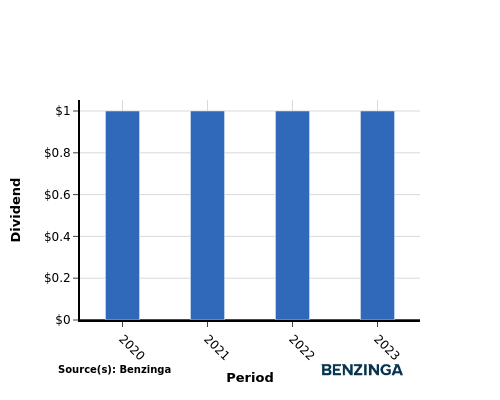

YoY Growth in Dividend Per Share

Throughout the period of 2020 to 2023, the company maintained a steady dividend per share of $1.00. This demonstrates the company's commitment to a stable dividend policy, which can be reassuring for investors looking for reliable income sources.

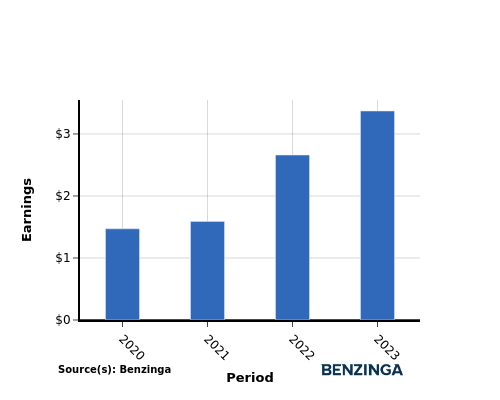

YoY Earnings Growth For Village Super Market

From 2020 to 2023, Village Super Market experienced a growth in earnings per share, with an increase from $1.47 to $3.37. This positive earnings trend indicates the company's potential to enhance their cash dividend payout, which can benefit income-seeking investors.

Recap

This article delves into the recent dividend payout of Village Super Market and its implications for shareholders. Presently, the company is distributing a dividend of $0.25 per share, leading to an annualized dividend yield of 4.00%.

Village Super Market is the leader in terms of dividend yield compared to its industry peers, with Natural Grocers having the highest annualized dividend yield at 2.57%.

While the dividend per share remains unchanged during the period of 2020 to 2023, the upward trajectory of earnings per share for Village Super Market indicates a favorable financial position, potentially paving the way for sustained profit distribution to shareholders.

To remain updated on any changes in financials or dividend disbursements, investors should closely observe the company's performance in the coming quarters.

[Track real-time stock fluctuations for Village Super Market on Benzinga.](https://www.benzinga.com/quote/Village Super Market (NASDAQ: VLGEA))

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.