Analog Devices ADI is gearing up to announce its quarterly earnings on Tuesday, 2024-11-26. Here's a quick overview of what investors should know before the release.

Analysts are estimating that Analog Devices will report an earnings per share (EPS) of $1.64.

The announcement from Analog Devices is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

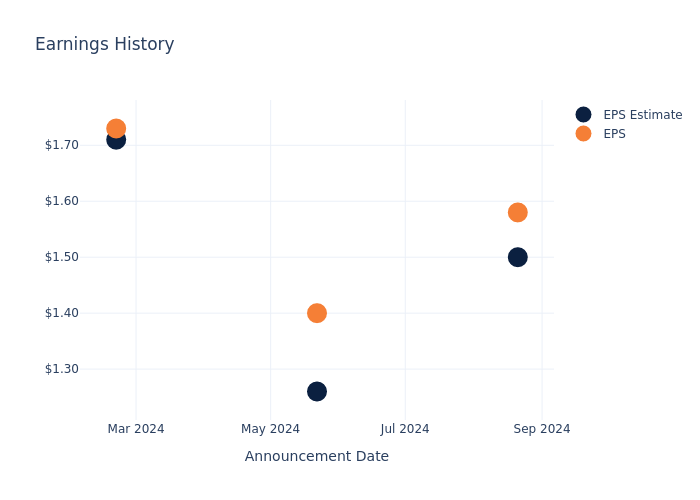

Past Earnings Performance

The company's EPS beat by $0.08 in the last quarter, leading to a 2.46% drop in the share price on the following day.

Here's a look at Analog Devices's past performance and the resulting price change:

| Quarter | Q3 2024 | Q2 2024 | Q1 2024 | Q4 2023 |

|---|---|---|---|---|

| EPS Estimate | 1.50 | 1.26 | 1.71 | 2 |

| EPS Actual | 1.58 | 1.40 | 1.73 | 2.01 |

| Price Change % | -2.0% | -2.0% | -1.0% | 1.0% |

Tracking Analog Devices's Stock Performance

Shares of Analog Devices were trading at $214.59 as of November 22. Over the last 52-week period, shares are up 17.13%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Insights Shared by Analysts on Analog Devices

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Analog Devices.

A total of 3 analyst ratings have been received for Analog Devices, with the consensus rating being Neutral. The average one-year price target stands at $234.33, suggesting a potential 9.2% upside.

Analyzing Analyst Ratings Among Peers

In this analysis, we delve into the analyst ratings and average 1-year price targets of Intel, Micron Technology and Marvell Tech, three key industry players, offering insights into their relative performance expectations and market positioning.

- Intel is maintaining an Neutral status according to analysts, with an average 1-year price target of $23.33, indicating a potential 89.13% downside.

- The prevailing sentiment among analysts is an Buy trajectory for Micron Technology, with an average 1-year price target of $139.26, implying a potential 35.1% downside.

- The consensus outlook from analysts is an Buy trajectory for Marvell Tech, with an average 1-year price target of $95.21, indicating a potential 55.63% downside.

Analysis Summary for Peers

The peer analysis summary outlines pivotal metrics for Intel, Micron Technology and Marvell Tech, demonstrating their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Analog Devices | Neutral | -24.84% | $1.31B | 1.11% |

| Intel | Neutral | -6.17% | $2.00B | -15.50% |

| Micron Technology | Buy | 93.27% | $2.74B | 1.99% |

| Marvell Tech | Buy | -5.07% | $587.60M | -1.35% |

Key Takeaway:

Analog Devices ranks at the bottom for Revenue Growth with a negative percentage, while one peer shows a significant positive growth. Analog Devices also ranks at the bottom for Gross Profit, with one peer having a higher gross profit. For Return on Equity, Analog Devices is in the middle compared to its peers. Overall, Analog Devices is positioned lower compared to its peers in terms of financial performance metrics.

Discovering Analog Devices: A Closer Look

Analog Devices is a leading analog, mixed signal, and digital signal processing chipmaker. The firm has a significant market share lead in converter chips, which are used to translate analog signals to digital and vice versa. The company serves tens of thousands of customers, and more than half of its chip sales are made to industrial and automotive end markets. Analog Devices' chips are also incorporated into wireless infrastructure equipment.

Analog Devices: Financial Performance Dissected

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Decline in Revenue: Over the 3 months period, Analog Devices faced challenges, resulting in a decline of approximately -24.84% in revenue growth as of 31 July, 2024. This signifies a reduction in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: Analog Devices's net margin excels beyond industry benchmarks, reaching 16.96%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Analog Devices's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 1.11%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 0.8%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Analog Devices's debt-to-equity ratio is below the industry average at 0.23, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for Analog Devices visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.