Best Buy Co BBY is set to give its latest quarterly earnings report on Tuesday, 2024-11-26. Here's what investors need to know before the announcement.

Analysts estimate that Best Buy Co will report an earnings per share (EPS) of $1.29.

Anticipation surrounds Best Buy Co's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

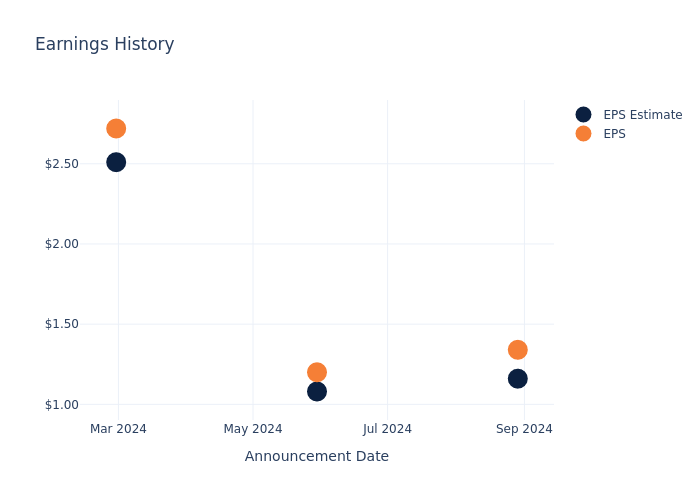

Historical Earnings Performance

The company's EPS beat by $0.18 in the last quarter, leading to a 0.22% increase in the share price on the following day.

Here's a look at Best Buy Co's past performance and the resulting price change:

| Quarter | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.16 | 1.08 | 2.51 | 1.19 |

| EPS Actual | 1.34 | 1.20 | 2.72 | 1.29 |

| Price Change % | 0.0% | 4.0% | -4.0% | 1.0% |

Best Buy Co Share Price Analysis

Shares of Best Buy Co were trading at $89.54 as of November 22. Over the last 52-week period, shares are up 30.91%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts' Perspectives on Best Buy Co

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Best Buy Co.

A total of 17 analyst ratings have been received for Best Buy Co, with the consensus rating being Buy. The average one-year price target stands at $106.65, suggesting a potential 19.11% upside.

Comparing Ratings Among Industry Peers

The analysis below examines the analyst ratings and average 1-year price targets of and GameStop, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- The prevailing sentiment among analysts is an Underperform trajectory for GameStop, with an average 1-year price target of $10.0, implying a potential 88.83% downside.

Key Findings: Peer Analysis Summary

Within the peer analysis summary, vital metrics for and GameStop are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Best Buy Co | Buy | -3.08% | $2.19B | 9.40% |

| GameStop | Underperform | -31.41% | $248.80M | 0.52% |

Key Takeaway:

Best Buy Co has a higher consensus rating compared to its peer. It has a positive revenue growth rate, while its peer has a negative growth rate. Best Buy Co also has a higher gross profit margin. Additionally, Best Buy Co has a significantly higher return on equity compared to its peer. Overall, Best Buy Co outperforms its peer across all key metrics analyzed.

All You Need to Know About Best Buy Co

With $43.5 billion in consolidated 2023 sales, Best Buy is the largest pure-play consumer electronics retailer in the US, boasting roughly 8.3% share of the North American market and north of 33% share of offline sales in the region, per our calculations, CTA, and Euromonitor data. The firm generates the bulk of its sales in-store, with mobile phones and tablets, computers, and appliances representing its three largest categories. Recent investments in e-commerce fulfillment, accelerated by the covid-19 pandemic, have seen the US e-commerce channel roughly double from prepandemic levels, with management estimating that it will represent a mid-30% proportion of sales moving forward.

Best Buy Co's Economic Impact: An Analysis

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Decline in Revenue: Over the 3 months period, Best Buy Co faced challenges, resulting in a decline of approximately -3.08% in revenue growth as of 31 July, 2024. This signifies a reduction in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Consumer Discretionary sector.

Net Margin: Best Buy Co's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 3.13% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 9.4%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Best Buy Co's ROA excels beyond industry benchmarks, reaching 1.92%. This signifies efficient management of assets and strong financial health.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.32, caution is advised due to increased financial risk.

To track all earnings releases for Best Buy Co visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.