Petco Health and Wellness WOOF will release its quarterly earnings report on Thursday, 2024-12-05. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Petco Health and Wellness to report an earnings per share (EPS) of $-0.03.

Petco Health and Wellness bulls will hope to hear the company announce they've not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

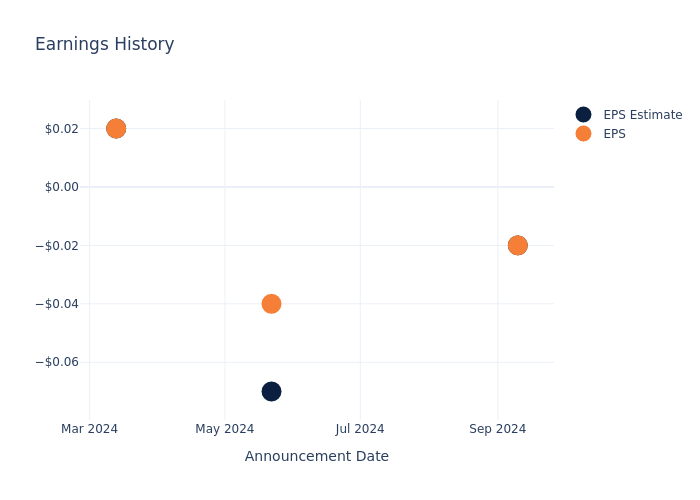

Performance in Previous Earnings

In the previous earnings release, the company missed EPS by $0.00, leading to a 32.9% increase in the share price the following trading session.

Here's a look at Petco Health and Wellness's past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.02 | -0.07 | 0.02 | 0.02 |

| EPS Actual | -0.02 | -0.04 | 0.02 | -0.05 |

| Price Change % | 33.0% | 10.0% | -18.0% | 11.0% |

Stock Performance

Shares of Petco Health and Wellness were trading at $5.17 as of December 03. Over the last 52-week period, shares are up 50.29%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Opinions on Petco Health and Wellness

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Petco Health and Wellness.

Analysts have given Petco Health and Wellness a total of 6 ratings, with the consensus rating being Outperform. The average one-year price target is $4.25, indicating a potential 17.79% downside.

Understanding Analyst Ratings Among Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of Sally Beauty Holdings, Upbound Group and ODP, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- The prevailing sentiment among analysts is an Neutral trajectory for Sally Beauty Holdings, with an average 1-year price target of $13.75, implying a potential 165.96% upside.

- As per analysts' assessments, Upbound Group is favoring an Neutral trajectory, with an average 1-year price target of $35.5, suggesting a potential 586.65% upside.

- ODP is maintaining an Neutral status according to analysts, with an average 1-year price target of $28.0, indicating a potential 441.59% upside.

Peer Analysis Summary

The peer analysis summary presents essential metrics for Sally Beauty Holdings, Upbound Group and ODP, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Petco Health and Wellness | Outperform | -0.46% | $580.73M | -2.16% |

| Sally Beauty Holdings | Neutral | 1.48% | $479.20M | 7.97% |

| Upbound Group | Neutral | 9.17% | $511.09M | 5.11% |

| ODP | Neutral | -11.31% | $364M | 6.63% |

Key Takeaway:

Petco Health and Wellness ranks at the bottom for Revenue Growth and Gross Profit, indicating lower performance in these areas compared to its peers. However, it ranks in the middle for Return on Equity, suggesting a moderate level of profitability relative to others. Overall, there is room for improvement in revenue generation and gross profit margins to align with industry peers.

Get to Know Petco Health and Wellness Better

Petco Health and Wellness Co Inc is a pet health and wellness company focused on improving the lives of pets, pet parents, and its partners with approximately 1,423 pet care centers offering pet care products such as puppy food, treats, nutrition, and supplies through retail outlets and online platforms. The company generates revenue from the sale of products and services such as dog and cat food, supplies, and companion animals, among others.

Key Indicators: Petco Health and Wellness's Financial Health

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Petco Health and Wellness's revenue growth over a period of 3 months has faced challenges. As of 31 July, 2024, the company experienced a revenue decline of approximately -0.46%. This indicates a decrease in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Discretionary sector.

Net Margin: Petco Health and Wellness's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of -1.63%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Petco Health and Wellness's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of -2.16%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of -0.47%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Petco Health and Wellness's debt-to-equity ratio is notably higher than the industry average. With a ratio of 2.64, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.