Dollar Gen DG is gearing up to announce its quarterly earnings on Thursday, 2024-12-05. Here's a quick overview of what investors should know before the release.

Analysts are estimating that Dollar Gen will report an earnings per share (EPS) of $0.95.

Investors in Dollar Gen are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

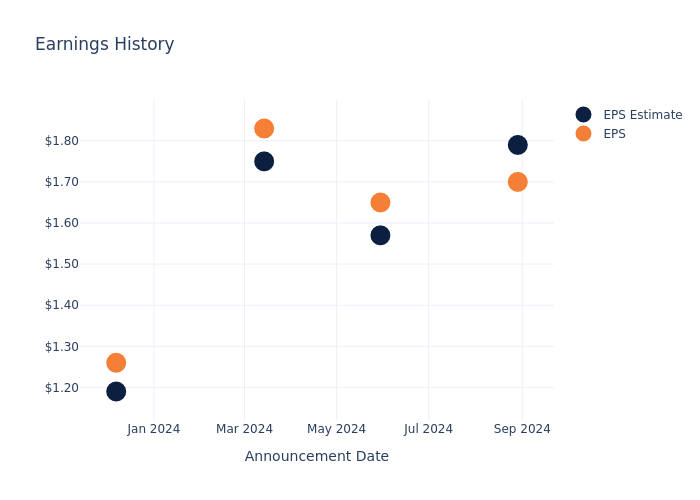

Historical Earnings Performance

Last quarter the company missed EPS by $0.09, which was followed by a 1.26% drop in the share price the next day.

Here's a look at Dollar Gen's past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 1.79 | 1.57 | 1.75 | 1.19 |

| EPS Actual | 1.70 | 1.65 | 1.83 | 1.26 |

| Price Change % | -1.0% | 7.000000000000001% | 1.0% | -4.0% |

Performance of Dollar Gen Shares

Shares of Dollar Gen were trading at $79.02 as of December 03. Over the last 52-week period, shares are down 40.27%. Given that these returns are generally negative, long-term shareholders are likely a little upset going into this earnings release.

Analyst Views on Dollar Gen

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Dollar Gen.

The consensus rating for Dollar Gen is Neutral, based on 9 analyst ratings. With an average one-year price target of $88.67, there's a potential 12.21% upside.

Comparing Ratings Among Industry Peers

The analysis below examines the analyst ratings and average 1-year price targets of Dollar Tree and BJ's Wholesale Club, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- The prevailing sentiment among analysts is an Neutral trajectory for Dollar Tree, with an average 1-year price target of $82.67, implying a potential 4.62% upside.

- For BJ's Wholesale Club, analysts project an Buy trajectory, with an average 1-year price target of $101.0, indicating a potential 27.82% upside.

Analysis Summary for Peers

The peer analysis summary offers a detailed examination of key metrics for Dollar Tree and BJ's Wholesale Club, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Dollar Gen | Neutral | 4.23% | $3.06B | 5.25% |

| Dollar Tree | Neutral | 0.73% | $2.22B | 1.80% |

| BJ's Wholesale Club | Buy | 3.55% | $975.48M | 9.12% |

Key Takeaway:

Dollar Gen ranks highest in revenue growth among its peers. It also leads in gross profit margin. However, it has the lowest return on equity compared to its peers.

Discovering Dollar Gen: A Closer Look

With more than 20,000 locations, Dollar General's banner is nearly ubiquitous across the rural United States. Dollar General serves as a convenient shopping destination for fill-in store trips, with its value proposition most relevant to consumers in small communities with a dearth of shopping options. The retailer operates a frugal store of about 7,500 square feet and primarily offers an assortment of branded and private-label consumable items (80% of net sales) such as paper and cleaning products, packaged and perishable food, tobacco, and health and beauty items at low prices. Dollar General also offers a limited assortment of seasonal merchandise, home products, and apparel. The firm sells most items at a price point of $10 or less.

Unraveling the Financial Story of Dollar Gen

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Over the 3 months period, Dollar Gen showcased positive performance, achieving a revenue growth rate of 4.23% as of 31 July, 2024. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Consumer Staples sector.

Net Margin: Dollar Gen's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 3.66% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Dollar Gen's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 5.25%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Dollar Gen's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 1.19%, the company may face hurdles in achieving optimal financial returns.

Debt Management: Dollar Gen's debt-to-equity ratio stands notably higher than the industry average, reaching 2.51. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

To track all earnings releases for Dollar Gen visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.