Canadian Solar CSIQ is gearing up to announce its quarterly earnings on Thursday, 2024-12-05. Here's a quick overview of what investors should know before the release.

Analysts are estimating that Canadian Solar will report an earnings per share (EPS) of $-0.17.

Anticipation surrounds Canadian Solar's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

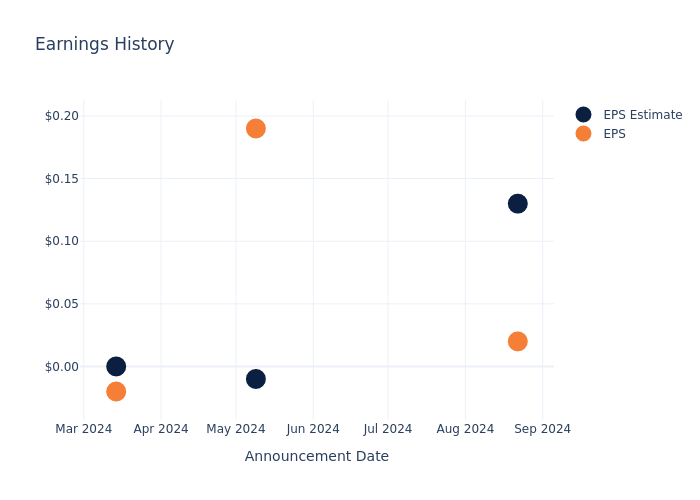

Earnings Track Record

Last quarter the company missed EPS by $0.11, which was followed by a 9.82% increase in the share price the next day.

Here's a look at Canadian Solar's past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.13 | -0.01 | 0 | 0.82 |

| EPS Actual | 0.02 | 0.19 | -0.02 | 0.32 |

| Price Change % | 10.0% | -9.0% | 0.0% | -5.0% |

Analyst Observations about Canadian Solar

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Canadian Solar.

Analysts have provided Canadian Solar with 2 ratings, resulting in a consensus rating of Buy. The average one-year price target stands at $12.57, suggesting a potential 0.08% downside.

Analyzing Ratings Among Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of Rigetti Computing, CEVA and Indie Semiconductor, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- The consensus among analysts is an Buy trajectory for Rigetti Computing, with an average 1-year price target of $3.0, indicating a potential 76.15% downside.

- CEVA received a Buy consensus from analysts, with an average 1-year price target of $34.33, implying a potential 172.89% upside.

- For Indie Semiconductor, analysts project an Buy trajectory, with an average 1-year price target of $8.75, indicating a potential 30.45% downside.

Peer Analysis Summary

The peer analysis summary offers a detailed examination of key metrics for Rigetti Computing, CEVA and Indie Semiconductor, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Canadian Solar | Buy | -30.82% | $282.09M | 0.15% |

| Rigetti Computing | Buy | -23.41% | $1.20M | -12.11% |

| CEVA | Buy | 13.02% | $23.25M | -0.50% |

| Indie Semiconductor | Buy | -10.77% | $21.23M | -10.69% |

Key Takeaway:

Canadian Solar is positioned at the top for Revenue Growth and Gross Profit among its peers. However, it ranks at the bottom for Return on Equity.

About Canadian Solar

Canadian Solar Inc is a Canadian solar power company. It is an integrated provider of solar power products, services, and system solutions. The company engages in designing, developing, and manufacturing solar ingots, wafers, cells, modules, and other solar power products. It operates through two business segments CSI Solar and Recurrent Energy segment. The CSI Solar segment designs, develops, and manufactures solar ingots, wafers, cells, modules, and other solar power and battery storage products. Its Recurrent segment primarily comprises solar and battery storage project development and sale, O&M and asset management services for operational projects, sale of electricity, and investment in retained assets.

Key Indicators: Canadian Solar's Financial Health

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Challenges: Canadian Solar's revenue growth over 3 months faced difficulties. As of 30 June, 2024, the company experienced a decline of approximately -30.82%. This indicates a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: Canadian Solar's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 0.23% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 0.15%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Canadian Solar's ROA stands out, surpassing industry averages. With an impressive ROA of 0.03%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.86, caution is advised due to increased financial risk.

To track all earnings releases for Canadian Solar visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.