Lululemon Athletica LULU is set to give its latest quarterly earnings report on Thursday, 2024-12-05. Here's what investors need to know before the announcement.

Analysts estimate that Lululemon Athletica will report an earnings per share (EPS) of $2.69.

Investors in Lululemon Athletica are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

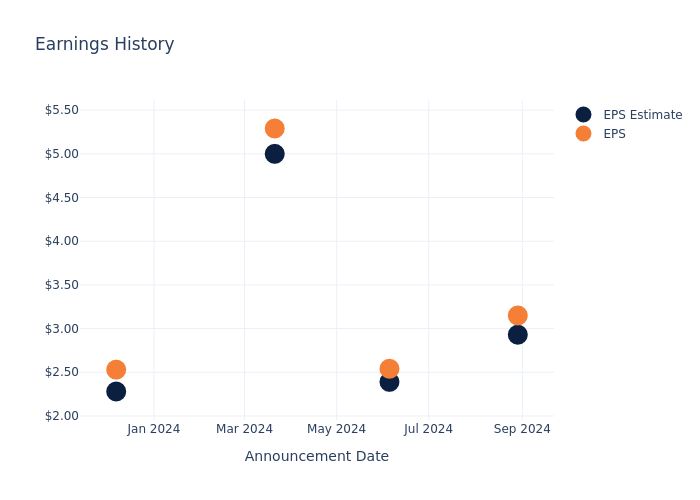

Earnings Track Record

In the previous earnings release, the company beat EPS by $0.22, leading to a 0.18% increase in the share price the following trading session.

Here's a look at Lululemon Athletica's past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 2.93 | 2.39 | 5 | 2.28 |

| EPS Actual | 3.15 | 2.54 | 5.29 | 2.53 |

| Price Change % | 0.0% | 5.0% | -16.0% | 5.0% |

Market Performance of Lululemon Athletica's Stock

Shares of Lululemon Athletica were trading at $340.66 as of December 03. Over the last 52-week period, shares are down 26.84%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

Analyst Opinions on Lululemon Athletica

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Lululemon Athletica.

With 6 analyst ratings, Lululemon Athletica has a consensus rating of Outperform. The average one-year price target is $355.67, indicating a potential 4.41% upside.

Analyzing Analyst Ratings Among Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of Tapestry, Ralph Lauren and Amer Sports, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Tapestry is maintaining an Outperform status according to analysts, with an average 1-year price target of $61.24, indicating a potential 82.02% downside.

- As per analysts' assessments, Ralph Lauren is favoring an Buy trajectory, with an average 1-year price target of $226.77, suggesting a potential 33.43% downside.

- Amer Sports received a Buy consensus from analysts, with an average 1-year price target of $22.83, implying a potential 93.3% downside.

Peer Metrics Summary

The peer analysis summary offers a detailed examination of key metrics for Tapestry, Ralph Lauren and Amer Sports, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Lululemon Athletica | Outperform | 7.33% | $1.41B | 9.52% |

| Tapestry | Outperform | -0.38% | $1.13B | 6.35% |

| Ralph Lauren | Buy | 5.70% | $1.16B | 6.15% |

| Amer Sports | Buy | 17.41% | $747.30M | 1.38% |

Key Takeaway:

Lululemon Athletica ranks at the top for Revenue Growth and Gross Profit among its peers. It is in the middle for Consensus and Return on Equity compared to others in the analysis.

Delving into Lululemon Athletica's Background

Lululemon Athletica designs, distributes, and markets athletic apparel, footwear, and accessories for women, men, and girls. Lululemon offers pants, shorts, tops, and jackets for both leisure and athletic activities such as yoga and running. The company also sells fitness accessories, such as bags, yoga mats, and equipment. Lululemon sells its products through more than 700 company-owned stores in about 20 countries, e-commerce, outlets, and wholesale accounts. The company was founded in 1998 and is based in Vancouver, Canada.

Key Indicators: Lululemon Athletica's Financial Health

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Growth: Lululemon Athletica displayed positive results in 3 months. As of 31 July, 2024, the company achieved a solid revenue growth rate of approximately 7.33%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Consumer Discretionary sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 16.57%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Lululemon Athletica's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 9.52% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Lululemon Athletica's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 5.79%, the company showcases efficient use of assets and strong financial health.

Debt Management: Lululemon Athletica's debt-to-equity ratio is below the industry average. With a ratio of 0.36, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for Lululemon Athletica visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.