Signet Jewelers SIG is set to give its latest quarterly earnings report on Thursday, 2024-12-05. Here's what investors need to know before the announcement.

Analysts estimate that Signet Jewelers will report an earnings per share (EPS) of $0.31.

Signet Jewelers bulls will hope to hear the company announce they've not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

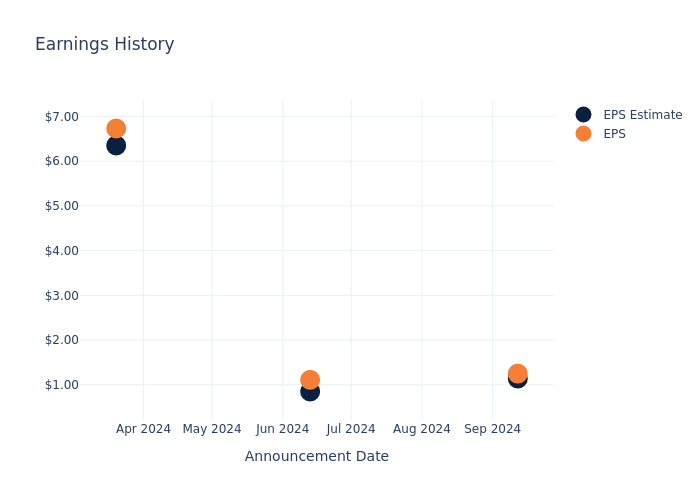

Earnings History Snapshot

Last quarter the company beat EPS by $0.11, which was followed by a 4.84% increase in the share price the next day.

Here's a look at Signet Jewelers's past performance and the resulting price change:

| Quarter | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.14 | 0.85 | 6.35 | 0.18 |

| EPS Actual | 1.25 | 1.11 | 6.73 | 0.24 |

| Price Change % | 5.0% | -5.0% | -0.0% | 6.0% |

Performance of Signet Jewelers Shares

Shares of Signet Jewelers were trading at $98.31 as of December 03. Over the last 52-week period, shares are down 0.98%. Given that these returns are generally negative, long-term shareholders are likely unhappy going into this earnings release.

Analyst Insights on Signet Jewelers

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Signet Jewelers.

Signet Jewelers has received a total of 8 ratings from analysts, with the consensus rating as Neutral. With an average one-year price target of $97.62, the consensus suggests a potential 0.7% downside.

Analyzing Analyst Ratings Among Peers

The analysis below examines the analyst ratings and average 1-year price targets of Academy Sports, Five Below and Warby Parker, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- The consensus outlook from analysts is an Neutral trajectory for Academy Sports, with an average 1-year price target of $62.0, indicating a potential 36.93% downside.

- As per analysts' assessments, Five Below is favoring an Neutral trajectory, with an average 1-year price target of $95.55, suggesting a potential 2.81% downside.

- As per analysts' assessments, Warby Parker is favoring an Outperform trajectory, with an average 1-year price target of $21.12, suggesting a potential 78.52% downside.

Insights: Peer Analysis

Within the peer analysis summary, vital metrics for Academy Sports, Five Below and Warby Parker are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Signet Jewelers | Neutral | -7.60% | $566.30M | -5.08% |

| Academy Sports | Neutral | -2.15% | $558.73M | 7.39% |

| Five Below | Neutral | 9.37% | $271.79M | 2.07% |

| Warby Parker | Outperform | 13.30% | $104.87M | -1.22% |

Key Takeaway:

Signet Jewelers ranks at the bottom for Revenue Growth and Gross Profit, while it is in the middle for Return on Equity. The company's Consensus rating is neutral.

All You Need to Know About Signet Jewelers

Signet Jewelers Ltd is a retailer of diamond jewelry. Its merchandise mix includes bridal, fashion, watches and others. The bridal category includes engagement, wedding and anniversary purchases. Its segments are the North America segment, the International segment, and the Other segment. The North America segment contributes to the majority of the revenue. The North America segment generates revenue from Mall and Off-mall & Outlet.

Signet Jewelers: Delving into Financials

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Challenges: Signet Jewelers's revenue growth over 3 months faced difficulties. As of 31 July, 2024, the company experienced a decline of approximately -7.6%. This indicates a decrease in top-line earnings. When compared to others in the Consumer Discretionary sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Signet Jewelers's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of -6.81%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of -5.08%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of -1.73%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Signet Jewelers's debt-to-equity ratio is below the industry average. With a ratio of 0.54, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for Signet Jewelers visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.