ASML Holding ASML is preparing to release its quarterly earnings on Wednesday, 2025-04-16. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect ASML Holding to report an earnings per share (EPS) of $5.76.

Anticipation surrounds ASML Holding's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

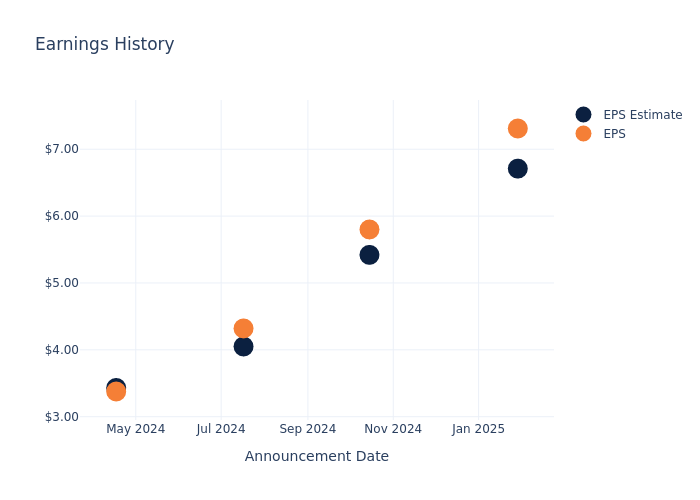

Historical Earnings Performance

In the previous earnings release, the company beat EPS by $0.60, leading to a 3.42% increase in the share price the following trading session.

Here's a look at ASML Holding's past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | 6.71 | 5.42 | 4.05 | 3.430 |

| EPS Actual | 7.31 | 5.80 | 4.32 | 3.377 |

| Price Change % | 3.0% | -6.0% | -1.0% | -2.0% |

Stock Performance

Shares of ASML Holding were trading at $672.87 as of April 14. Over the last 52-week period, shares are down 24.78%. Given that these returns are generally negative, long-term shareholders are likely unhappy going into this earnings release.

Analyst Views on ASML Holding

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on ASML Holding.

Analysts have provided ASML Holding with 1 ratings, resulting in a consensus rating of Outperform. The average one-year price target stands at $1100.0, suggesting a potential 63.48% upside.

Comparing Ratings Among Industry Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of Applied Mat, KLA and Lam Research, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for Applied Mat, with an average 1-year price target of $197.44, suggesting a potential 70.66% downside.

- Analysts currently favor an Neutral trajectory for KLA, with an average 1-year price target of $790.13, suggesting a potential 17.43% upside.

- Analysts currently favor an Outperform trajectory for Lam Research, with an average 1-year price target of $95.0, suggesting a potential 85.88% downside.

Key Findings: Peer Analysis Summary

Within the peer analysis summary, vital metrics for Applied Mat, KLA and Lam Research are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| ASML Holding | Outperform | 27.99% | $4.79B | 15.56% |

| Applied Mat | Buy | 6.84% | $3.50B | 6.30% |

| KLA | Neutral | 23.73% | $1.86B | 23.08% |

| Lam Research | Outperform | 16.44% | $2.07B | 13.79% |

Key Takeaway:

ASML Holding ranks highest in Revenue Growth and Gross Profit among its peers. It also has the highest Return on Equity. Overall, ASML Holding outperforms its peers in key financial metrics.

Unveiling the Story Behind ASML Holding

ASML is the leader in photolithography systems used in manufacturing semiconductors. Photolithography is the process in which a light source is used to expose circuit patterns from a photo mask onto a semiconductor wafer. The latest technological advances in this segment allow chipmakers to continually increase the number of transistors on the same area of silicon, with lithography historically representing a high portion of the cost of making cutting-edge chips. ASML outsources the manufacturing of most of its parts, acting like an assembler. ASML's main clients are TSMC, Samsung, and Intel.

ASML Holding: A Financial Overview

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: ASML Holding's remarkable performance in 3 months is evident. As of 31 December, 2024, the company achieved an impressive revenue growth rate of 27.99%. This signifies a substantial increase in the company's top-line earnings. When compared to others in the Information Technology sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: ASML Holding's net margin excels beyond industry benchmarks, reaching 29.08%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): ASML Holding's ROE excels beyond industry benchmarks, reaching 15.56%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): ASML Holding's ROA excels beyond industry benchmarks, reaching 5.96%. This signifies efficient management of assets and strong financial health.

Debt Management: ASML Holding's debt-to-equity ratio is below the industry average at 0.25, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for ASML Holding visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.