Gilead Sciences GILD will release its quarterly earnings report on Thursday, 2025-04-24. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Gilead Sciences to report an earnings per share (EPS) of $1.75.

Anticipation surrounds Gilead Sciences's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

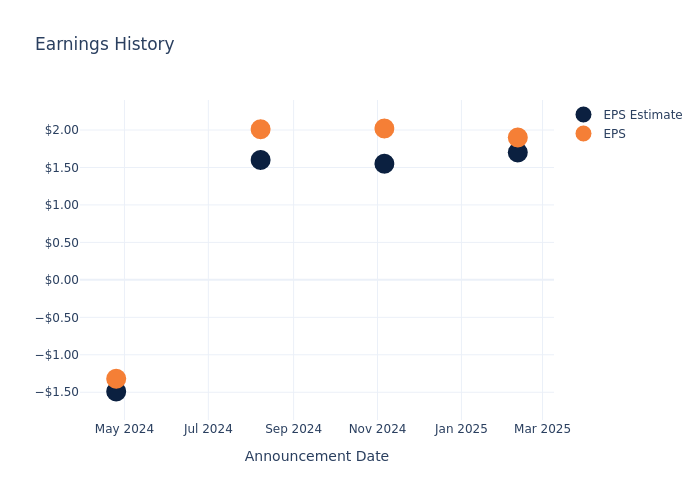

Earnings History Snapshot

The company's EPS beat by $0.20 in the last quarter, leading to a 7.46% increase in the share price on the following day.

Here's a look at Gilead Sciences's past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.7 | 1.55 | 1.60 | -1.49 |

| EPS Actual | 1.9 | 2.02 | 2.01 | -1.32 |

| Price Change % | 7.000000000000001% | 7.000000000000001% | -3.0% | 0.0% |

Gilead Sciences Share Price Analysis

Shares of Gilead Sciences were trading at $105.51 as of April 22. Over the last 52-week period, shares are up 61.94%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Observations about Gilead Sciences

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Gilead Sciences.

Analysts have given Gilead Sciences a total of 15 ratings, with the consensus rating being Outperform. The average one-year price target is $117.07, indicating a potential 10.96% upside.

Comparing Ratings with Competitors

The below comparison of the analyst ratings and average 1-year price targets of Vertex Pharmaceuticals, Amgen and Regeneron Pharmaceuticals, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Vertex Pharmaceuticals, with an average 1-year price target of $479.06, suggesting a potential 354.04% upside.

- Analysts currently favor an Neutral trajectory for Amgen, with an average 1-year price target of $309.43, suggesting a potential 193.27% upside.

- Analysts currently favor an Outperform trajectory for Regeneron Pharmaceuticals, with an average 1-year price target of $818.33, suggesting a potential 675.59% upside.

Insights: Peer Analysis

The peer analysis summary provides a snapshot of key metrics for Vertex Pharmaceuticals, Amgen and Regeneron Pharmaceuticals, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Gilead Sciences | Outperform | 6.40% | $5.99B | 9.43% |

| Vertex Pharmaceuticals | Neutral | 15.66% | $2.49B | 5.70% |

| Amgen | Neutral | 10.86% | $5.97B | 9.36% |

| Regeneron Pharmaceuticals | Outperform | 10.33% | $3.22B | 3.13% |

Key Takeaway:

Gilead Sciences ranks highest in Gross Profit among its peers. It is in the middle for Revenue Growth and Return on Equity.

About Gilead Sciences

Gilead Sciences develops and markets therapies to treat life-threatening infectious diseases, with the core of its portfolio focused on HIV and hepatitis B and C. Gilead's acquisition of Pharmasset brought rights to hepatitis C drug Sovaldi, which is also part of newer combination regimens that remain standards of care. Gilead is also growing its presence in the oncology market via acquisitions, led by CAR-T cell therapy Yescarta/Tecartus (from Kite) and breast and bladder cancer therapy Trodelvy (from Immunomedics).

Gilead Sciences: Delving into Financials

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: Gilead Sciences's revenue growth over a period of 3 months has been noteworthy. As of 31 December, 2024, the company achieved a revenue growth rate of approximately 6.4%. This indicates a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: Gilead Sciences's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of 23.56%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): Gilead Sciences's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 9.43% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Gilead Sciences's ROA excels beyond industry benchmarks, reaching 3.14%. This signifies efficient management of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 1.38, Gilead Sciences adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for Gilead Sciences visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.