Comcast CMCSA is gearing up to announce its quarterly earnings on Thursday, 2025-04-24. Here's a quick overview of what investors should know before the release.

Analysts are estimating that Comcast will report an earnings per share (EPS) of $1.00.

Anticipation surrounds Comcast's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

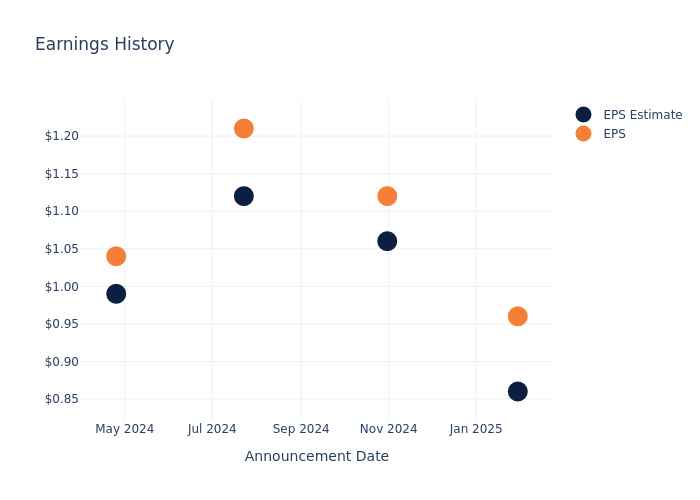

Earnings History Snapshot

During the last quarter, the company reported an EPS beat by $0.10, leading to a 1.23% increase in the share price on the subsequent day.

Here's a look at Comcast's past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.86 | 1.06 | 1.12 | 0.99 |

| EPS Actual | 0.96 | 1.12 | 1.21 | 1.04 |

| Price Change % | 1.0% | -0.0% | -1.0% | 2.0% |

Stock Performance

Shares of Comcast were trading at $34.2 as of April 22. Over the last 52-week period, shares are down 8.05%. Given that these returns are generally negative, long-term shareholders are likely unhappy going into this earnings release.

Insights Shared by Analysts on Comcast

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Comcast.

Analysts have given Comcast a total of 15 ratings, with the consensus rating being Neutral. The average one-year price target is $40.63, indicating a potential 18.8% upside.

Peer Ratings Overview

In this comparison, we explore the analyst ratings and average 1-year price targets of Charter Communications and Cable One, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for Charter Communications, with an average 1-year price target of $392.0, suggesting a potential 1046.2% upside.

- Analysts currently favor an Neutral trajectory for Cable One, with an average 1-year price target of $405.0, suggesting a potential 1084.21% upside.

Snapshot: Peer Analysis

The peer analysis summary presents essential metrics for Charter Communications and Cable One, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Comcast | Neutral | 2.11% | $21.89B | 5.58% |

| Charter Communications | Buy | 1.57% | $14.48B | 9.88% |

| Cable One | Neutral | -5.97% | $287.36M | -5.72% |

Key Takeaway:

Comcast ranks highest in gross profit and return on equity among its peers. It is in the middle for consensus rating and revenue growth. However, it ranks lowest in revenue growth.

All You Need to Know About Comcast

Comcast is made up of three parts. The core cable business owns networks capable of providing television, internet access, and phone services to 63 million US homes and businesses, or nearly half of the country. About 50% of the locations in this territory subscribe to at least one Comcast service. Comcast acquired NBCUniversal from General Electric in 2011. NBCU owns several cable networks, including CNBC, MSNBC, and USA, the NBC network, the Peacock streaming platform, several local NBC affiliates, Universal Studios, and several theme parks. Sky, acquired in 2018, is a large television provider in the UK and has invested heavily in proprietary content to build this position. Sky is also a large pay-television provider in Italy and has a presence in Germany and Austria.

Comcast: A Financial Overview

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: Comcast's revenue growth over a period of 3 months has been noteworthy. As of 31 December, 2024, the company achieved a revenue growth rate of approximately 2.11%. This indicates a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Communication Services sector.

Net Margin: Comcast's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 14.97%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Comcast's ROE excels beyond industry benchmarks, reaching 5.58%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Comcast's ROA stands out, surpassing industry averages. With an impressive ROA of 1.78%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Comcast's debt-to-equity ratio is below the industry average. With a ratio of 1.16, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for Comcast visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.