Zynex ZYXI will release its quarterly earnings report on Tuesday, 2025-04-29. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Zynex to report an earnings per share (EPS) of $-0.24.

The announcement from Zynex is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

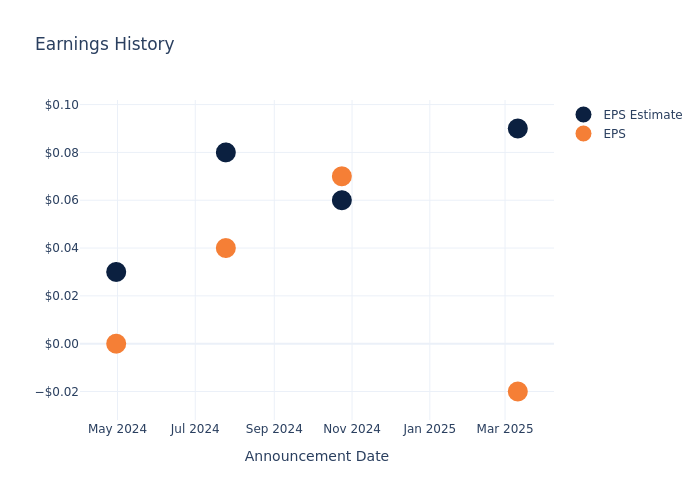

Past Earnings Performance

The company's EPS missed by $0.11 in the last quarter, leading to a 51.29% drop in the share price on the following day.

Here's a look at Zynex's past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.09 | 0.06 | 0.08 | 0.03 |

| EPS Actual | -0.02 | 0.07 | 0.04 | 0 |

| Price Change % | -51.0% | 6.0% | -12.0% | 7.000000000000001% |

Zynex Share Price Analysis

Shares of Zynex were trading at $2.41 as of April 25. Over the last 52-week period, shares are down 79.54%. Given that these returns are generally negative, long-term shareholders are likely a little upset going into this earnings release.

Analyst Opinions on Zynex

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Zynex.

Zynex has received a total of 2 ratings from analysts, with the consensus rating as Buy. With an average one-year price target of $10.25, the consensus suggests a potential 325.31% upside.

Comparing Ratings Among Industry Peers

The below comparison of the analyst ratings and average 1-year price targets of Fractyl Health, Hyperfine and CytoSorbents, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for Fractyl Health, with an average 1-year price target of $11.0, suggesting a potential 356.43% upside.

- Analysts currently favor an Buy trajectory for Hyperfine, with an average 1-year price target of $1.33, suggesting a potential 44.81% downside.

- Analysts currently favor an Buy trajectory for CytoSorbents, with an average 1-year price target of $7.0, suggesting a potential 190.46% upside.

Peers Comparative Analysis Summary

The peer analysis summary outlines pivotal metrics for Fractyl Health, Hyperfine and CytoSorbents, demonstrating their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Zynex | Buy | -2.77% | $35.99M | -1.72% |

| Fractyl Health | Buy | -57.14% | $3K | -63.42% |

| Hyperfine | Buy | -13.59% | $826K | -19.36% |

| CytoSorbents | Buy | 24.52% | $9.40M | -65.41% |

Key Takeaway:

Zynex ranks at the top for Revenue Growth and Gross Profit among its peers. However, it ranks at the bottom for Return on Equity. Overall, Zynex is performing well in terms of revenue and profit compared to its peers, but its return on equity is lower in comparison.

About Zynex

Zynex Inc is engaged in the manufacturing and marketing of medical devices. It operates through one primary business segment, Electrotherapy and Pain Management Products. The business activities of the company are carried out through its subsidiaries. The company designs, manufactures, and markets medical devices that treat chronic and acute pain, as well as activate and exercise muscles for rehabilitative purposes with electrical stimulation. The company operates business as one operating segment which includes two revenue types: Devices and Supplies. Its markets Zynex-manufactured products which include NexWave, NeuroMove, InWave E-Wave, and others.

Financial Milestones: Zynex's Journey

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Zynex's revenue growth over a period of 3 months has faced challenges. As of 31 December, 2024, the company experienced a revenue decline of approximately -2.77%. This indicates a decrease in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: Zynex's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -1.34% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Zynex's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -1.72% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Zynex's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -0.5% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 2.07, caution is advised due to increased financial risk.

To track all earnings releases for Zynex visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.