In today's rapidly changing and highly competitive business world, it is vital for investors and industry enthusiasts to carefully assess companies. In this article, we will perform a comprehensive industry comparison, evaluating Regeneron Pharmaceuticals REGN against its key competitors in the Biotechnology industry. By analyzing important financial metrics, market position, and growth prospects, we aim to provide valuable insights for investors and shed light on company's performance within the industry.

Regeneron Pharmaceuticals Background

Regeneron Pharmaceuticals discovers, develops, and commercializes products that fight eye disease, cardiovascular disease, cancer, and inflammation. The company has several marketed products, including Eylea, approved for wet age-related macular degeneration and other eye diseases; Praluent for LDL cholesterol lowering; Dupixent in immunology; Libtayo in oncology; and Kevzara in rheumatoid arthritis. Regeneron is also developing monoclonal and bispecific antibodies with Sanofi, other collaborators, and independently, and has earlier-stage partnerships that bring new technology to the pipeline, including RNAi (Alnylam) and CRISPR-based gene editing (Intellia).

| Company | P/E | P/B | P/S | ROE | EBITDA (in billions) | Gross Profit (in billions) | Revenue Growth |

|---|---|---|---|---|---|---|---|

| Regeneron Pharmaceuticals Inc | 25.93 | 3.81 | 7.81 | 4.56% | $1.28 | $2.92 | 0.58% |

| AbbVie Inc | 60.39 | 28.07 | 5.36 | 6.94% | $3.85 | $8.6 | -5.42% |

| Amgen Inc | 21.14 | 22.71 | 5.04 | 11.05% | $3.05 | $5.08 | 19.84% |

| Vertex Pharmaceuticals Inc | 28.30 | 5.78 | 10.38 | 5.68% | $1.22 | $2.15 | 9.34% |

| Gilead Sciences Inc | 14.88 | 3.66 | 3.11 | 6.33% | $2.59 | $5.02 | -3.72% |

| Biogen Inc | 24.10 | 1.89 | 2.84 | 1.71% | $0.5 | $1.77 | -6.2% |

| BioNTech SE | 21.24 | 0.97 | 5.17 | 2.28% | $0.46 | $1.3 | -65.43% |

| Genmab A/S | 30.31 | 4.11 | 8.01 | 2.04% | $0.93 | $4.55 | -8.94% |

| Biomarin Pharmaceutical Inc | 103.99 | 3.47 | 7.16 | 0.41% | $0.05 | $0.51 | 20.22% |

| Neurocrine Biosciences Inc | 54 | 6.01 | 7.14 | 6.98% | $0.2 | $0.51 | 25.05% |

| Incyte Corp | 19.89 | 2.28 | 3.22 | 3.97% | $0.29 | $0.94 | 9.35% |

| United Therapeutics Corp | 11.88 | 1.85 | 5.02 | 3.71% | $0.32 | $0.54 | 25.07% |

| Roivant Sciences Ltd | 1.98 | 1.38 | 68.09 | 144.81% | $5.11 | $0.03 | 117.8% |

| Exelixis Inc | 35.19 | 3.06 | 4.02 | 3.71% | $0.09 | $0.46 | 13.15% |

| Average | 32.87 | 6.56 | 10.35 | 15.36% | $1.44 | $2.42 | 11.55% |

By conducting an in-depth analysis of Regeneron Pharmaceuticals, we can identify the following trends:

-

With a Price to Earnings ratio of 25.93, which is 0.79x less than the industry average, the stock shows potential for growth at a reasonable price, making it an interesting consideration for market participants.

-

The current Price to Book ratio of 3.81, which is 0.58x the industry average, is substantially lower than the industry average, indicating potential undervaluation.

-

With a relatively low Price to Sales ratio of 7.81, which is 0.75x the industry average, the stock might be considered undervalued based on sales performance.

-

The company has a lower Return on Equity (ROE) of 4.56%, which is 10.8% below the industry average. This indicates potential inefficiency in utilizing equity to generate profits, which could be attributed to various factors.

-

The company has lower Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $1.28 Billion, which is 0.89x below the industry average. This potentially indicates lower profitability or financial challenges.

-

Compared to its industry, the company has higher gross profit of $2.92 Billion, which indicates 1.21x above the industry average, indicating stronger profitability and higher earnings from its core operations.

-

The company's revenue growth of 0.58% is significantly below the industry average of 11.55%. This suggests a potential struggle in generating increased sales volume.

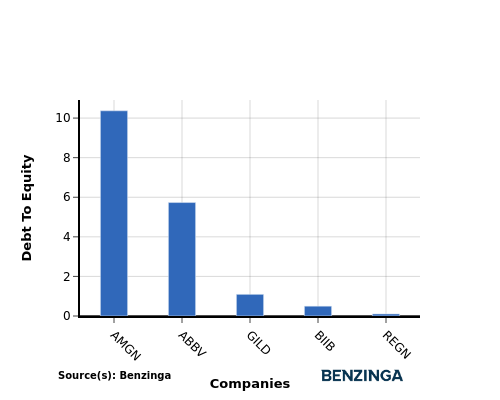

Debt To Equity Ratio

The debt-to-equity (D/E) ratio provides insights into the proportion of debt a company has in relation to its equity and asset value.

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company's financial health and risk profile, aiding in informed decision-making.

In terms of the Debt-to-Equity ratio, Regeneron Pharmaceuticals stands in comparison with its top 4 peers, leading to the following comparisons:

-

Regeneron Pharmaceuticals is in a relatively stronger financial position compared to its top 4 peers, as evidenced by its lower debt-to-equity ratio of 0.1.

-

This implies that the company relies less on debt financing and has a more favorable balance between debt and equity.

Key Takeaways

For Regeneron Pharmaceuticals, the PE, PB, and PS ratios are all low compared to its peers in the Biotechnology industry, indicating potential undervaluation. However, the low ROE and EBITDA suggest lower profitability and operational efficiency. On the positive side, the company has a high gross profit margin, which is favorable. The low revenue growth rate may be a concern for future performance compared to industry peers.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.