Amidst the fast-paced and highly competitive business environment of today, conducting comprehensive company analysis is essential for investors and industry enthusiasts. In this article, we will delve into an extensive industry comparison, evaluating Palantir Technologies PLTR in comparison to its major competitors within the Software industry. By analyzing critical financial metrics, market position, and growth potential, our objective is to provide valuable insights for investors and offer a deeper understanding of company's performance in the industry.

Palantir Technologies Background

Palantir is an analytical software company that focuses on leveraging data to create efficiencies in its clients' organizations. The firm serves commercial and government clients via its Foundry and Gotham platforms, respectively. The Denver-based company was founded in 2003 and went public in 2020.

| Company | P/E | P/B | P/S | ROE | EBITDA (in billions) | Gross Profit (in billions) | Revenue Growth |

|---|---|---|---|---|---|---|---|

| Palantir Technologies Inc | 236.78 | 13.57 | 22.01 | 2.8% | $0.11 | $0.5 | 19.61% |

| Salesforce Inc | 65.79 | 4.49 | 7.80 | 2.46% | $2.75 | $7.14 | 10.77% |

| Adobe Inc | 45.33 | 13.75 | 10.90 | 3.88% | $1.21 | $4.59 | 11.32% |

| SAP SE | 54.99 | 4.58 | 6.40 | 3.05% | $2.32 | $6.2 | 5.02% |

| Intuit Inc | 62.64 | 10.15 | 11.52 | 2.08% | $0.6 | $2.53 | 11.34% |

| Synopsys Inc | 58.21 | 12.06 | 13.36 | 7.01% | $0.53 | $1.32 | 21.15% |

| Cadence Design Systems Inc | 76.86 | 23.51 | 19.58 | 9.94% | $0.41 | $0.96 | 18.75% |

| Workday Inc | 49.31 | 8.40 | 9.39 | 16.16% | $0.24 | $1.46 | 16.75% |

| Roper Technologies Inc | 41.32 | 3.23 | 9.15 | 2.26% | $0.72 | $1.13 | 12.76% |

| Autodesk Inc | 51.29 | 24.78 | 8.45 | 16.9% | $0.35 | $1.34 | 3.89% |

| Datadog Inc | 882.29 | 20.24 | 20.33 | 2.82% | $0.07 | $0.48 | 25.62% |

| Ansys Inc | 56.85 | 5.28 | 12.54 | 5.29% | $0.37 | $0.74 | 15.99% |

| AppLovin Corp | 72.30 | 18.70 | 7.82 | 14.58% | $0.37 | $0.68 | 35.73% |

| PTC Inc | 89.64 | 7.56 | 9.74 | 2.42% | $0.16 | $0.44 | 18.09% |

| MicroStrategy Inc | 44.91 | 9.67 | 39.61 | 5.93% | $-0.04 | $0.1 | -6.09% |

| Zoom Video Communications Inc | 28.54 | 2.27 | 4.03 | 3.87% | $0.2 | $0.87 | 2.56% |

| Tyler Technologies Inc | 103.82 | 5.82 | 8.83 | 1.34% | $0.09 | $0.21 | 6.35% |

| Bentley Systems Inc | 50.07 | 17 | 13.55 | 22.81% | $0.05 | $0.24 | 8.26% |

| NICE Ltd | 45.17 | 4.36 | 6.43 | 2.49% | $0.19 | $0.42 | 9.61% |

| Manhattan Associates Inc | 81 | 50.54 | 15.40 | 19.96% | $0.06 | $0.13 | 20.27% |

| Dynatrace Inc | 67.32 | 6.87 | 9.68 | 2.3% | $0.05 | $0.3 | 22.74% |

| Average | 101.38 | 12.66 | 12.23 | 7.38% | $0.53 | $1.56 | 13.54% |

When conducting a detailed analysis of Palantir Technologies, the following trends become clear:

-

The current Price to Earnings ratio of 236.78 is 2.34x higher than the industry average, indicating the stock is priced at a premium level according to the market sentiment.

-

It could be trading at a premium in relation to its book value, as indicated by its Price to Book ratio of 13.57 which exceeds the industry average by 1.07x.

-

The Price to Sales ratio of 22.01, which is 1.8x the industry average, suggests the stock could potentially be overvalued in relation to its sales performance compared to its peers.

-

The Return on Equity (ROE) of 2.8% is 4.58% below the industry average, suggesting potential inefficiency in utilizing equity to generate profits.

-

Compared to its industry, the company has lower Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $110 Million, which is 0.21x below the industry average, potentially indicating lower profitability or financial challenges.

-

The gross profit of $500 Million is 0.32x below that of its industry, suggesting potential lower revenue after accounting for production costs.

-

The company is experiencing remarkable revenue growth, with a rate of 19.61%, outperforming the industry average of 13.54%.

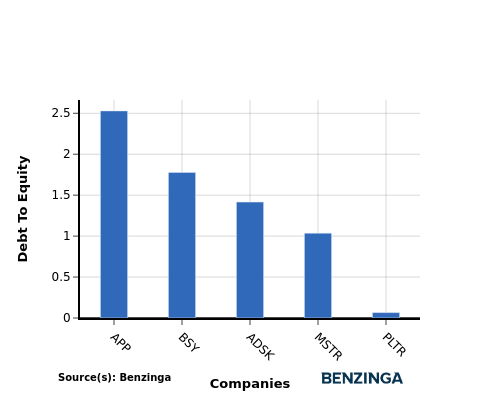

Debt To Equity Ratio

The debt-to-equity (D/E) ratio is a key indicator of a company's financial health and its reliance on debt financing.

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company's financial health and risk profile, aiding in informed decision-making.

When evaluating Palantir Technologies alongside its top 4 peers in terms of the Debt-to-Equity ratio, the following insights arise:

-

When considering the debt-to-equity ratio, Palantir Technologies exhibits a stronger financial position compared to its top 4 peers.

-

This indicates that the company has a favorable balance between debt and equity, with a lower debt-to-equity ratio of 0.07, which can be perceived as a positive aspect by investors.

Key Takeaways

For Palantir Technologies in the Software industry, the PE, PB, and PS ratios are all high compared to peers, indicating potentially overvalued stock. The low ROE, EBITDA, and gross profit suggest lower profitability and operational efficiency compared to industry peers. However, the high revenue growth rate indicates strong top-line growth potential relative to competitors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.