In today's fast-paced and highly competitive business world, it is crucial for investors and industry followers to conduct comprehensive company evaluations. In this article, we will delve into an extensive industry comparison, evaluating Vertiv Hldgs VRT in relation to its major competitors in the Electrical Equipment industry. By closely examining key financial metrics, market standing, and growth prospects, our objective is to provide valuable insights and highlight company's performance in the industry.

Vertiv Hldgs Background

Vertiv Holdings Co brings together hardware, software, analytics and ongoing services to ensure its customers vital applications run continuously, perform optimally and grow with their business needs. The company solves the important challenges faced by data centers, communication networks and commercial and industrial facilities with a portfolio of power, cooling and IT infrastructure solutions and services that extends from the cloud to the edge of the network. Its services include critical power, thermal management, racks and enclosures, monitoring and management, and other services. Its three business segments include the Americas, Asia Pacific; and Europe, Middle East & Africa.

| Company | P/E | P/B | P/S | ROE | EBITDA (in billions) | Gross Profit (in billions) | Revenue Growth |

|---|---|---|---|---|---|---|---|

| Vertiv Holdings Co | 93.03 | 26.24 | 5.40 | -0.35% | $0.09 | $0.57 | 7.76% |

| Eaton Corp PLC | 39.01 | 6.85 | 5.61 | 4.28% | $1.26 | $2.22 | 8.39% |

| Emerson Electric Co | 33.53 | 3.08 | 3.91 | 0.69% | $0.65 | $1.92 | 22.06% |

| AMETEK Inc | 29.73 | 4.37 | 5.82 | 3.51% | $0.51 | $0.59 | 8.71% |

| Rockwell Automation Inc | 26.77 | 8.80 | 3.51 | 7.41% | $0.43 | $0.83 | -6.57% |

| Hubbell Inc | 29.56 | 7.26 | 3.90 | 5.08% | $0.28 | $0.45 | 8.85% |

| nVent Electric PLC | 23.30 | 4.13 | 3.96 | 3.31% | $0.2 | $0.36 | 18.09% |

| Generac Holdings Inc | 37.99 | 3.51 | 2.10 | 1.0% | $0.1 | $0.32 | 0.15% |

| Acuity Brands Inc | 21.95 | 3.76 | 2.15 | 4.23% | $0.15 | $0.41 | -4.0% |

| Atkore Inc | 9.83 | 3.65 | 1.77 | 8.97% | $0.21 | $0.29 | -11.5% |

| EnerSys | 14.48 | 2.24 | 1.08 | 4.5% | $0.11 | $0.25 | -6.38% |

| Array Technologies Inc | 22.34 | 7.32 | 1.21 | 3.63% | $0.05 | $0.08 | -15.04% |

| Powell Industries Inc | 18.76 | 4.81 | 2.26 | 8.81% | $0.04 | $0.06 | 48.8% |

| Vicor Corp | 54.44 | 2.78 | 3.81 | 0.48% | $0.01 | $0.05 | -9.48% |

| Shoals Technologies Group Inc | 44.18 | 2.31 | 2.70 | 3.1% | $0.03 | $0.06 | 37.81% |

| Thermon Group Holdings Inc | 23.38 | 2.43 | 2.35 | 3.48% | $0.03 | $0.06 | 11.72% |

| Preformed Line Products Co | 12.48 | 1.53 | 1.02 | 2.31% | $0.02 | $0.04 | -22.51% |

| Average | 27.61 | 4.3 | 2.95 | 4.05% | $0.25 | $0.5 | 5.57% |

After examining Vertiv Hldgs, the following trends can be inferred:

-

The current Price to Earnings ratio of 93.03 is 3.37x higher than the industry average, indicating the stock is priced at a premium level according to the market sentiment.

-

With a Price to Book ratio of 26.24, which is 6.1x the industry average, Vertiv Hldgs might be considered overvalued in terms of its book value, as it is trading at a higher multiple compared to its industry peers.

-

The Price to Sales ratio of 5.4, which is 1.83x the industry average, suggests the stock could potentially be overvalued in relation to its sales performance compared to its peers.

-

With a Return on Equity (ROE) of -0.35% that is 4.4% below the industry average, it appears that the company exhibits potential inefficiency in utilizing equity to generate profits.

-

Compared to its industry, the company has lower Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $90 Million, which is 0.36x below the industry average, potentially indicating lower profitability or financial challenges.

-

Compared to its industry, the company has higher gross profit of $570 Million, which indicates 1.14x above the industry average, indicating stronger profitability and higher earnings from its core operations.

-

With a revenue growth of 7.76%, which surpasses the industry average of 5.57%, the company is demonstrating robust sales expansion and gaining market share.

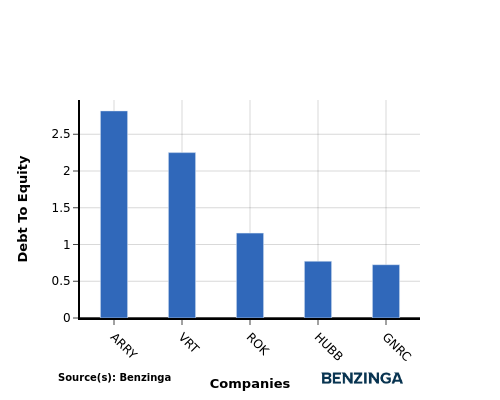

Debt To Equity Ratio

The debt-to-equity (D/E) ratio helps evaluate the capital structure and financial leverage of a company.

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company's financial health and risk profile, aiding in informed decision-making.

By considering the Debt-to-Equity ratio, Vertiv Hldgs can be compared to its top 4 peers, leading to the following observations:

-

Vertiv Hldgs falls in the middle of the list when considering the debt-to-equity ratio.

-

This indicates that the company has a moderate level of debt relative to its equity with a debt-to-equity ratio of 2.25, suggesting a balanced financial structure with a reasonable debt-equitymix.

Key Takeaways

For the PE, PB, and PS ratios, Vertiv Hldgs shows high valuation multiples compared to its peers in the Electrical Equipment industry, indicating potentially overvalued stock. On the other hand, the low ROE and EBITDA, along with high gross profit and revenue growth, suggest a mixed performance in terms of profitability and operational efficiency when compared to industry peers.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.