In the dynamic and fiercely competitive business environment, conducting a thorough analysis of companies is crucial for investors and industry enthusiasts. In this article, we will perform an extensive industry comparison, evaluating NVIDIA NVDA in relation to its major competitors in the Semiconductors & Semiconductor Equipment industry. By closely examining crucial financial metrics, market position, and growth prospects, we aim to offer valuable insights for investors and shed light on company's performance within the industry.

NVIDIA Background

Nvidia is a leading developer of graphics processing units. Traditionally, GPUs were used to enhance the experience on computing platforms, most notably in gaming applications on PCs. GPU use cases have since emerged as important semiconductors used in artificial intelligence. Nvidia not only offers AI GPUs, but also a software platform, Cuda, used for AI model development and training. Nvidia is also expanding its data center networking solutions, helping to tie GPUs together to handle complex workloads.

| Company | P/E | P/B | P/S | ROE | EBITDA (in billions) | Gross Profit (in billions) | Revenue Growth |

|---|---|---|---|---|---|---|---|

| NVIDIA Corp | 55.60 | 52.34 | 30.91 | 31.13% | $22.86 | $26.16 | 93.61% |

| Taiwan Semiconductor Manufacturing Co Ltd | 35.42 | 9.33 | 14.03 | 8.36% | $555.05 | $439.35 | 38.95% |

| Broadcom Inc | 186.29 | 16.64 | 22.26 | 6.49% | $7.29 | $9.0 | 51.2% |

| Advanced Micro Devices Inc | 108.21 | 3.48 | 8.23 | 1.36% | $1.55 | $3.42 | 17.57% |

| Qualcomm Inc | 18.71 | 7.07 | 4.85 | 11.46% | $3.21 | $5.78 | 18.69% |

| Texas Instruments Inc | 36.29 | 10.31 | 11.41 | 7.86% | $2.09 | $2.47 | -8.41% |

| ARM Holdings PLC | 256.58 | 27.13 | 46.65 | 1.83% | $0.11 | $0.81 | 4.71% |

| Micron Technology Inc | 31.34 | 2.60 | 4.22 | 4.07% | $4.3 | $3.35 | 84.28% |

| Analog Devices Inc | 67.52 | 3.12 | 11.71 | 1.36% | $1.12 | $1.42 | -10.06% |

| Microchip Technology Inc | 40.63 | 5.01 | 5.79 | 1.24% | $0.34 | $0.67 | -48.37% |

| Monolithic Power Systems Inc | 71.98 | 13.24 | 15.32 | 6.35% | $0.17 | $0.34 | 30.59% |

| ASE Technology Holding Co Ltd | 22.03 | 2.52 | 1.33 | 3.16% | $28.59 | $26.43 | 3.85% |

| ON Semiconductor Corp | 13.80 | 2.76 | 3.28 | 4.75% | $0.63 | $0.8 | -19.21% |

| STMicroelectronics NV | 10.60 | 1.32 | 1.70 | 1.98% | $0.74 | $1.23 | -26.63% |

| First Solar Inc | 15.81 | 2.59 | 5.12 | 4.22% | $0.45 | $0.45 | 10.81% |

| United Microelectronics Corp | 9.63 | 1.35 | 2.16 | 4.0% | $29.73 | $20.43 | 5.99% |

| Skyworks Solutions Inc | 25.46 | 2.37 | 3.63 | 0.95% | $0.18 | $0.43 | -15.9% |

| MACOM Technology Solutions Holdings Inc | 143.06 | 9.82 | 15 | 2.67% | $0.05 | $0.11 | 33.47% |

| Lattice Semiconductor Corp | 57.96 | 11.59 | 14.56 | 1.03% | $0.03 | $0.09 | -33.87% |

| Universal Display Corp | 30.14 | 4.49 | 11.11 | 4.29% | $0.08 | $0.13 | 14.57% |

| Average | 62.18 | 7.2 | 10.65 | 4.08% | $33.46 | $27.2 | 8.01% |

By thoroughly analyzing NVIDIA, we can discern the following trends:

-

The stock's Price to Earnings ratio of 55.6 is lower than the industry average by 0.89x, suggesting potential value in the eyes of market participants.

-

With a Price to Book ratio of 52.34, which is 7.27x the industry average, NVIDIA might be considered overvalued in terms of its book value, as it is trading at a higher multiple compared to its industry peers.

-

The stock's relatively high Price to Sales ratio of 30.91, surpassing the industry average by 2.9x, may indicate an aspect of overvaluation in terms of sales performance.

-

The Return on Equity (ROE) of 31.13% is 27.05% above the industry average, highlighting efficient use of equity to generate profits.

-

With lower Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $22.86 Billion, which is 0.68x below the industry average, the company may face lower profitability or financial challenges.

-

With lower gross profit of $26.16 Billion, which indicates 0.96x below the industry average, the company may experience lower revenue after accounting for production costs.

-

The company's revenue growth of 93.61% exceeds the industry average of 8.01%, indicating strong sales performance and market outperformance.

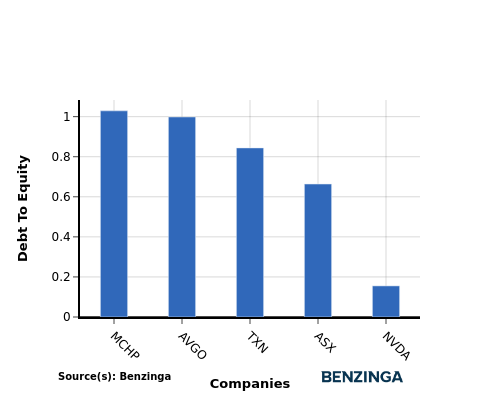

Debt To Equity Ratio

The debt-to-equity (D/E) ratio provides insights into the proportion of debt a company has in relation to its equity and asset value.

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company's financial health and risk profile, aiding in informed decision-making.

By considering the Debt-to-Equity ratio, NVIDIA can be compared to its top 4 peers, leading to the following observations:

-

NVIDIA has a stronger financial position compared to its top 4 peers, as evidenced by its lower debt-to-equity ratio of 0.16.

-

This suggests that the company has a more favorable balance between debt and equity, which can be perceived as a positive indicator by investors.

Key Takeaways

The low P/E ratio suggests that NVIDIA may be undervalued compared to its peers in the Semiconductors & Semiconductor Equipment industry. However, the high P/B and P/S ratios indicate that the stock may be overvalued based on its book value and sales. On the other hand, the high ROE, low EBITDA, low gross profit, and high revenue growth suggest that NVIDIA is performing well in terms of profitability and growth compared to its industry peers.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.