In today's rapidly evolving and fiercely competitive business landscape, it is crucial for investors and industry analysts to conduct comprehensive company evaluations. In this article, we will undertake an in-depth industry comparison, assessing Amazon.com AMZN alongside its primary competitors in the Broadline Retail industry. By meticulously examining crucial financial indicators, market positioning, and growth potential, we aim to provide valuable insights to investors and shed light on company's performance within the industry.

Amazon.com Background

Amazon is the leading online retailer and marketplace for third party sellers. Retail related revenue represents approximately 75% of total, followed by Amazon Web Services' cloud computing, storage, database, and other offerings (15%), advertising services (5% to 10%), and other the remainder. International segments constitute 25% to 30% of Amazon's non-AWS sales, led by Germany, the United Kingdom, and Japan.

| Company | P/E | P/B | P/S | ROE | EBITDA (in billions) | Gross Profit (in billions) | Revenue Growth |

|---|---|---|---|---|---|---|---|

| Amazon.com Inc | 50.89 | 9.66 | 4.10 | 6.19% | $32.08 | $31.0 | 11.04% |

| Alibaba Group Holding Ltd | 19.78 | 1.73 | 1.79 | 4.64% | $54.02 | $92.47 | 5.21% |

| PDD Holdings Inc | 11.06 | 4.06 | 3.22 | 9.38% | $29.18 | $59.65 | 44.33% |

| MercadoLibre Inc | 67.24 | 24.01 | 5.26 | 10.37% | $0.72 | $2.44 | 35.27% |

| JD.com Inc | 13.22 | 1.89 | 0.41 | 5.22% | $15.92 | $45.04 | 5.12% |

| Coupang Inc | 40.69 | 9.94 | 1.44 | 1.74% | $0.28 | $2.27 | 27.2% |

| eBay Inc | 16.92 | 5.94 | 3.34 | 11.59% | $0.95 | $1.85 | 3.04% |

| Vipshop Holdings Ltd | 7.06 | 1.47 | 0.53 | 2.76% | $1.47 | $4.96 | -9.18% |

| Dillard's Inc | 12.28 | 3.86 | 1.15 | 6.37% | $0.21 | $0.63 | -3.53% |

| MINISO Group Holding Ltd | 23.43 | 5.53 | 3.82 | 6.68% | $0.88 | $2.03 | 19.29% |

| Ollie's Bargain Outlet Holdings Inc | 33.88 | 4.31 | 3.12 | 2.24% | $0.06 | $0.21 | 7.79% |

| Macy's Inc | 25.69 | 1.05 | 0.19 | 0.66% | $0.29 | $2.04 | -2.68% |

| Nordstrom Inc | 15.34 | 4.05 | 0.27 | 4.75% | $0.3 | $1.31 | 4.34% |

| Savers Value Village Inc | 24.59 | 4.18 | 1.24 | 5.09% | $0.07 | $0.22 | 0.53% |

| Kohl's Corp | 6.11 | 0.40 | 0.09 | 0.58% | $0.28 | $1.57 | -8.49% |

| Groupon Inc | 15.41 | 10.57 | 0.79 | 34.72% | $0.03 | $0.1 | -9.48% |

| Average | 22.18 | 5.53 | 1.78 | 7.12% | $6.98 | $14.45 | 7.92% |

Upon analyzing Amazon.com, the following trends can be observed:

-

At 50.89, the stock's Price to Earnings ratio significantly exceeds the industry average by 2.29x, suggesting a premium valuation relative to industry peers.

-

With a Price to Book ratio of 9.66, which is 1.75x the industry average, Amazon.com might be considered overvalued in terms of its book value, as it is trading at a higher multiple compared to its industry peers.

-

The stock's relatively high Price to Sales ratio of 4.1, surpassing the industry average by 2.3x, may indicate an aspect of overvaluation in terms of sales performance.

-

With a Return on Equity (ROE) of 6.19% that is 0.93% below the industry average, it appears that the company exhibits potential inefficiency in utilizing equity to generate profits.

-

The company exhibits higher Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $32.08 Billion, which is 4.6x above the industry average, implying stronger profitability and robust cash flow generation.

-

With higher gross profit of $31.0 Billion, which indicates 2.15x above the industry average, the company demonstrates stronger profitability and higher earnings from its core operations.

-

The company is experiencing remarkable revenue growth, with a rate of 11.04%, outperforming the industry average of 7.92%.

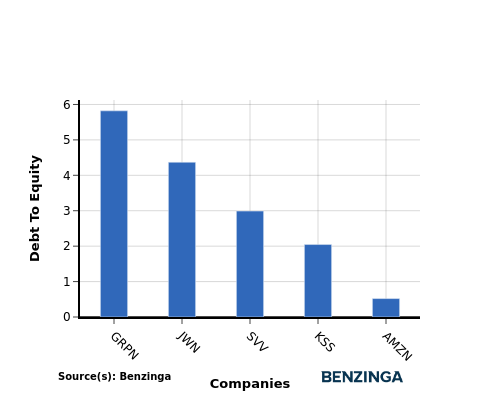

Debt To Equity Ratio

The debt-to-equity (D/E) ratio provides insights into the proportion of debt a company has in relation to its equity and asset value.

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company's financial health and risk profile, aiding in informed decision-making.

By analyzing Amazon.com in relation to its top 4 peers based on the Debt-to-Equity ratio, the following insights can be derived:

-

When comparing the debt-to-equity ratio, Amazon.com is in a stronger financial position compared to its top 4 peers.

-

The company has a lower level of debt relative to its equity, indicating a more favorable balance between the two with a lower debt-to-equity ratio of 0.52.

Key Takeaways

For Amazon.com, the PE, PB, and PS ratios are all high compared to its peers in the Broadline Retail industry, indicating that the stock may be overvalued. The low ROE suggests that Amazon.com is not generating strong returns on shareholder equity. However, the high EBITDA, gross profit, and revenue growth show that the company is performing well in terms of operational efficiency and revenue generation compared to its industry peers.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.