In today's rapidly changing and fiercely competitive business landscape, it is essential for investors and industry enthusiasts to thoroughly analyze companies. In this article, we will conduct a comprehensive industry comparison, evaluating Microsoft MSFT against its key competitors in the Software industry. By examining key financial metrics, market position, and growth prospects, we aim to provide valuable insights for investors and shed light on company's performance within the industry.

Microsoft Background

Microsoft develops and licenses consumer and enterprise software. It is known for its Windows operating systems and Office productivity suite. The company is organized into three equally sized broad segments: productivity and business processes (legacy Microsoft Office, cloud-based Office 365, Exchange, SharePoint, Skype, LinkedIn, Dynamics), intelligence cloud (infrastructure- and platform-as-a-service offerings Azure, Windows Server OS, SQL Server), and more personal computing (Windows Client, Xbox, Bing search, display advertising, and Surface laptops, tablets, and desktops).

| Company | P/E | P/B | P/S | ROE | EBITDA (in billions) | Gross Profit (in billions) | Revenue Growth |

|---|---|---|---|---|---|---|---|

| Microsoft Corp | 31.17 | 9.50 | 11.04 | 8.17% | $36.79 | $47.83 | 12.27% |

| Oracle Corp | 35.85 | 25.60 | 7.82 | 19.27% | $5.89 | $9.94 | 6.4% |

| ServiceNow Inc | 120.49 | 17.71 | 15.64 | 4.06% | $0.62 | $2.33 | 21.34% |

| Palo Alto Networks Inc | 103.96 | 19.11 | 15.22 | 4.35% | $0.41 | $1.66 | 14.29% |

| Fortinet Inc | 43.56 | 50.68 | 12.76 | 43.82% | $0.66 | $1.35 | 17.31% |

| Gen Digital Inc | 27.02 | 7.90 | 4.43 | 7.48% | $0.45 | $0.79 | 4.01% |

| Monday.Com Ltd | 426.71 | 13.04 | 14.27 | 2.3% | $0.07 | $0.24 | 32.29% |

| Dolby Laboratories Inc | 30.32 | 3.15 | 6.05 | 2.72% | $0.11 | $0.32 | 13.13% |

| CommVault Systems Inc | 42.69 | 24.79 | 7.77 | 3.9% | $0.02 | $0.21 | 21.13% |

| Qualys Inc | 27.71 | 9.85 | 7.92 | 9.49% | $0.05 | $0.13 | 10.11% |

| SolarWinds Corp | 28.72 | 2.25 | 4.02 | 5.26% | $0.07 | $0.19 | 6.14% |

| Progress Software Corp | 35.21 | 5.36 | 3.20 | 0.27% | $0.05 | $0.18 | 21.47% |

| Teradata Corp | 19.72 | 16.27 | 1.28 | 19.38% | $0.06 | $0.24 | -10.5% |

| Rapid7 Inc | 70.88 | 102.39 | 2.12 | -25.97% | $0.02 | $0.15 | 5.36% |

| Average | 77.91 | 22.93 | 7.88 | 7.41% | $0.65 | $1.36 | 12.5% |

By conducting an in-depth analysis of Microsoft, we can identify the following trends:

-

A Price to Earnings ratio of 31.17 significantly below the industry average by 0.4x suggests undervaluation. This can make the stock appealing for those seeking growth.

-

The current Price to Book ratio of 9.5, which is 0.41x the industry average, is substantially lower than the industry average, indicating potential undervaluation.

-

With a relatively high Price to Sales ratio of 11.04, which is 1.4x the industry average, the stock might be considered overvalued based on sales performance.

-

The company has a higher Return on Equity (ROE) of 8.17%, which is 0.76% above the industry average. This suggests efficient use of equity to generate profits and demonstrates profitability and growth potential.

-

The Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $36.79 Billion is 56.6x above the industry average, highlighting stronger profitability and robust cash flow generation.

-

The company has higher gross profit of $47.83 Billion, which indicates 35.17x above the industry average, indicating stronger profitability and higher earnings from its core operations.

-

The company's revenue growth of 12.27% is significantly lower compared to the industry average of 12.5%. This indicates a potential fall in the company's sales performance.

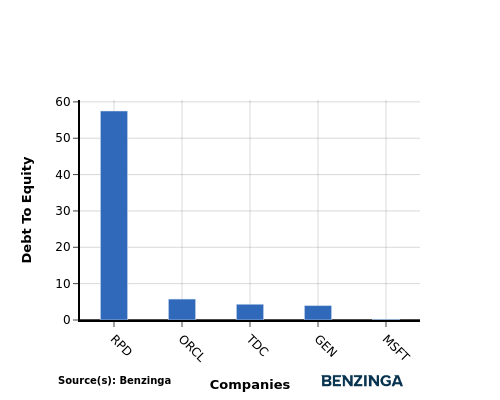

Debt To Equity Ratio

The debt-to-equity (D/E) ratio is a financial metric that helps determine the level of financial risk associated with a company's capital structure.

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company's financial health and risk profile, aiding in informed decision-making.

By considering the Debt-to-Equity ratio, Microsoft can be compared to its top 4 peers, leading to the following observations:

-

When considering the debt-to-equity ratio, Microsoft exhibits a stronger financial position compared to its top 4 peers.

-

This indicates that the company has a favorable balance between debt and equity, with a lower debt-to-equity ratio of 0.21, which can be perceived as a positive aspect by investors.

Key Takeaways

For Microsoft in the Software industry, the PE and PB ratios suggest the stock is undervalued compared to peers, indicating potential for growth. However, the high PS ratio implies the stock may be overvalued based on revenue. On the other hand, the high ROE, EBITDA, and gross profit ratios indicate strong profitability and operational efficiency. The low revenue growth may be a concern for future performance compared to industry peers.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.