Investors with a lot of money to spend have taken a bearish stance on AGNC Investment AGNC.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with AGNC, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 8 uncommon options trades for AGNC Investment.

This isn't normal.

The overall sentiment of these big-money traders is split between 12% bullish and 87%, bearish.

Out of all of the special options we uncovered, 3 are puts, for a total amount of $109,707, and 5 are calls, for a total amount of $572,529.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $5.0 to $12.0 for AGNC Investment during the past quarter.

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for AGNC Investment options trades today is 3826.25 with a total volume of 9,170.00.

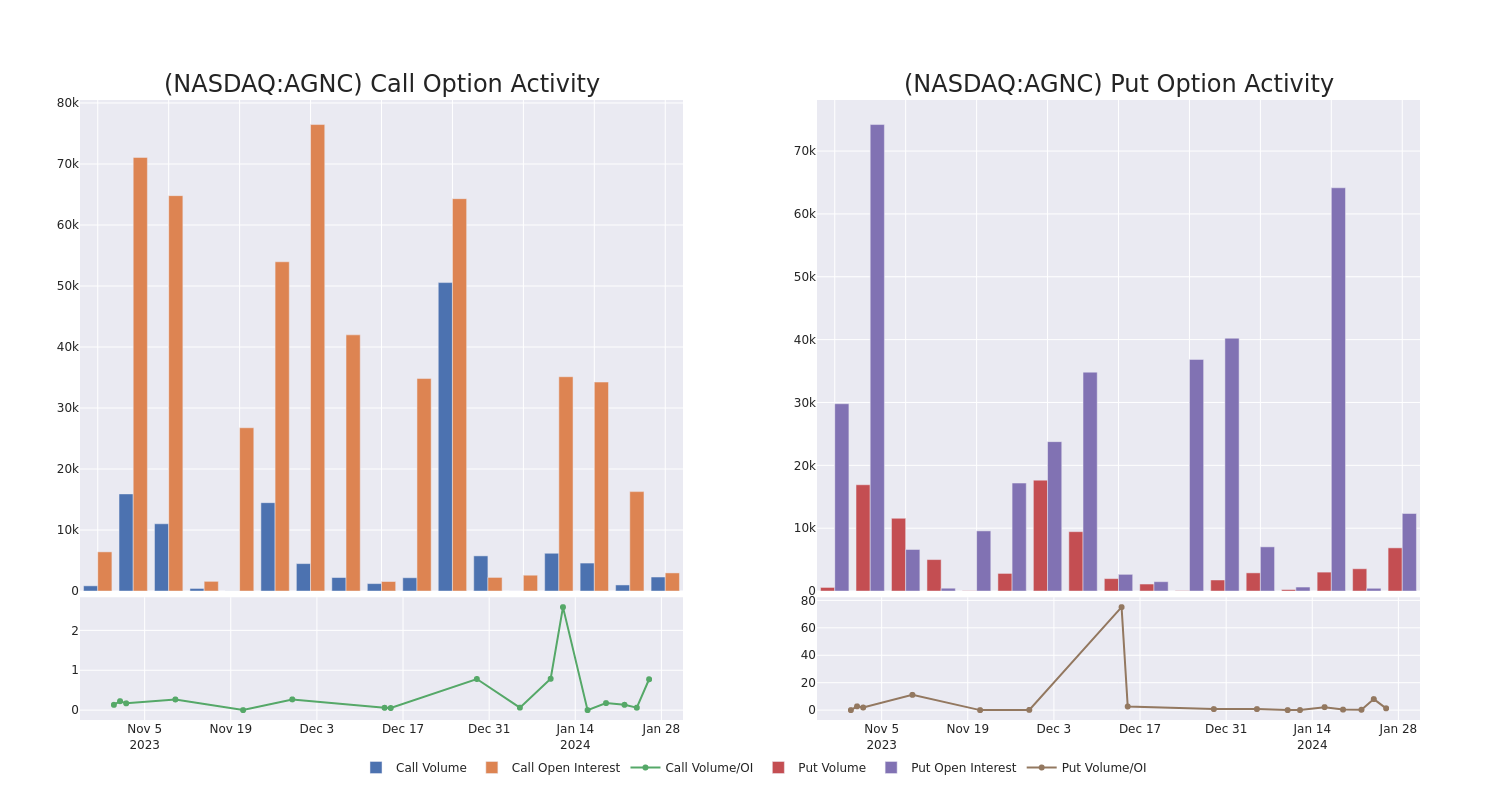

In the following chart, we are able to follow the development of volume and open interest of call and put options for AGNC Investment's big money trades within a strike price range of $5.0 to $12.0 over the last 30 days.

AGNC Investment Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| AGNC | CALL | SWEEP | BEARISH | 01/16/26 | $5.00 | $144.0K | 693 | 899 |

| AGNC | CALL | SWEEP | BEARISH | 01/16/26 | $5.00 | $143.0K | 693 | 599 |

| AGNC | CALL | TRADE | BEARISH | 01/16/26 | $5.00 | $143.0K | 693 | 300 |

| AGNC | CALL | SWEEP | BEARISH | 01/16/26 | $5.00 | $117.1K | 693 | 899 |

| AGNC | PUT | SWEEP | BEARISH | 02/16/24 | $9.50 | $46.4K | 5.2K | 6.8K |

About AGNC Investment

AGNC Investment Corp is a real estate investment trust that invests in agency residential mortgage-backed securities. The firm's asset portfolio is comprised of residential mortgage pass-through securities and collateralized mortgage obligations for which the principal and interest payments are guaranteed by a U.S. Government-sponsored enterprise, such as the Federal National Mortgage Association and the Federal Home Loan Mortgage Corporation, or by a U.S. Government agency, such as the Government National Mortgage Association. It also invests in other types of mortgage and mortgage-related residential and commercial mortgage-backed securities or other investments in or related to, the housing, mortgage or real estate markets.

Following our analysis of the options activities associated with AGNC Investment, we pivot to a closer look at the company's own performance.

Present Market Standing of AGNC Investment

- Trading volume stands at 5,916,181, with AGNC's price up by 0.31%, positioned at $9.85.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 87 days.

Professional Analyst Ratings for AGNC Investment

3 market experts have recently issued ratings for this stock, with a consensus target price of $10.0.

- Consistent in their evaluation, an analyst from Barclays keeps a Equal-Weight rating on AGNC Investment with a target price of $9.

- Consistent in their evaluation, an analyst from RBC Capital keeps a Outperform rating on AGNC Investment with a target price of $11.

- Maintaining their stance, an analyst from RBC Capital continues to hold a Outperform rating for AGNC Investment, targeting a price of $10.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for AGNC Investment, Benzinga Pro gives you real-time options trades alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.