Deep-pocketed investors have adopted a bearish approach towards Bank of America BAC, and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in BAC usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 19 extraordinary options activities for Bank of America. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 42% leaning bullish and 57% bearish. Among these notable options, 7 are puts, totaling $303,538, and 12 are calls, amounting to $617,557.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $23.0 to $40.0 for Bank of America over the last 3 months.

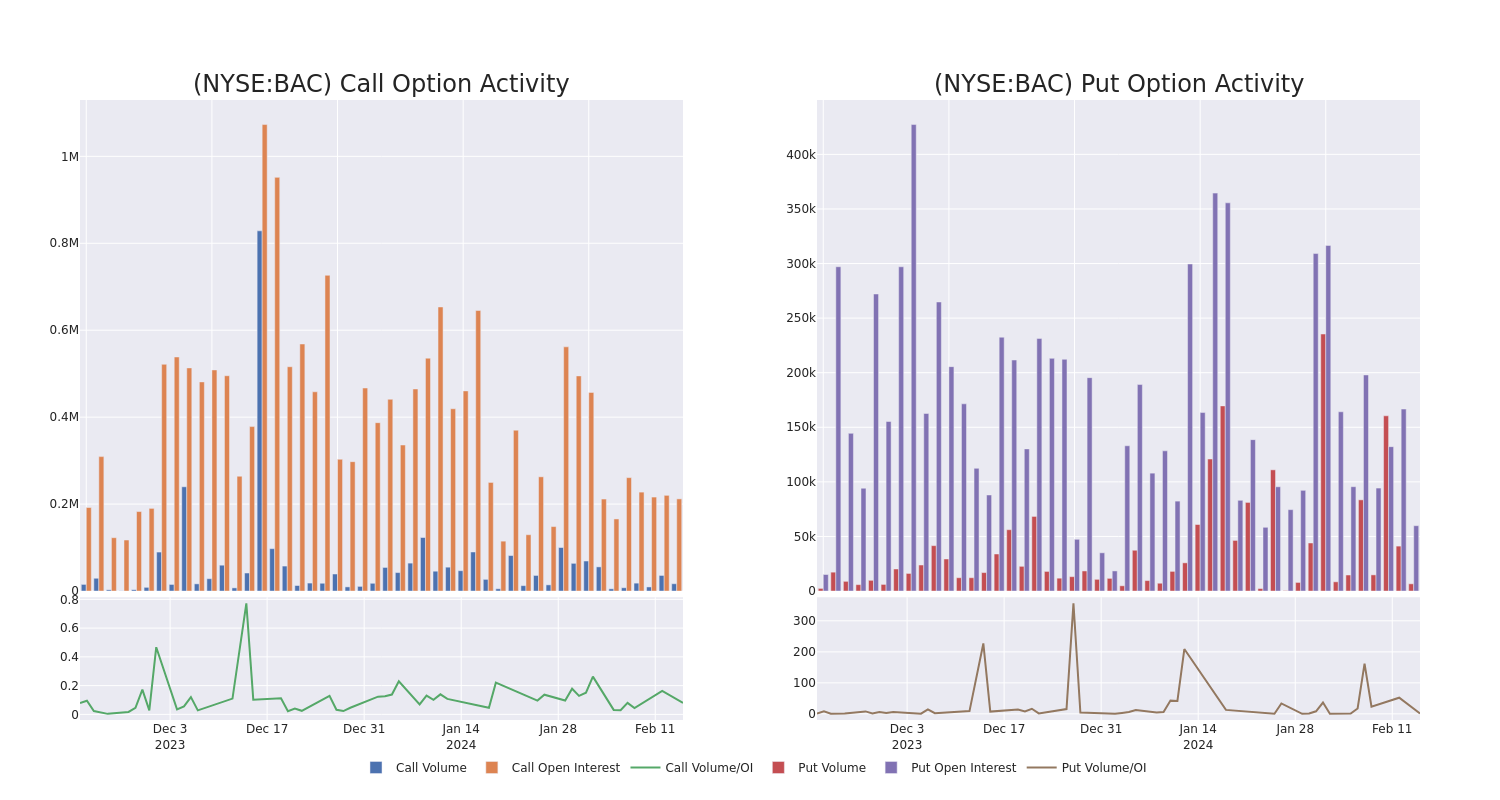

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Bank of America's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Bank of America's significant trades, within a strike price range of $23.0 to $40.0, over the past month.

Bank of America Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| BAC | CALL | SWEEP | BULLISH | 10/18/24 | $35.00 | $130.3K | 2.1K | 517 |

| BAC | PUT | SWEEP | BULLISH | 01/17/25 | $23.00 | $96.2K | 43.0K | 2.0K |

| BAC | CALL | SWEEP | BULLISH | 03/15/24 | $37.00 | $95.0K | 54.5K | 10.3K |

| BAC | CALL | TRADE | BULLISH | 06/20/25 | $30.00 | $81.6K | 14.6K | 51 |

| BAC | PUT | SWEEP | BEARISH | 02/16/24 | $34.00 | $51.6K | 12.6K | 2.5K |

About Bank of America

Bank of America is one of the largest financial institutions in the United States, with more than $2.5 trillion in assets. It is organized into four major segments: consumer banking, global wealth and investment management, global banking, and global markets. Bank of America's consumer-facing lines of business include its network of branches and deposit-gathering operations, retail lending products, credit and debit cards, and small-business services. The company's Merrill Lynch operations provide brokerage and wealth-management services, as does its private bank. Wholesale lines of business include investment banking, corporate and commercial real estate lending, and capital markets operations. Bank of America has operations in several countries but is primarily U.S.-focused.

Where Is Bank of America Standing Right Now?

- Currently trading with a volume of 13,273,494, the BAC's price is up by 2.25%, now at $33.88.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 61 days.

What Analysts Are Saying About Bank of America

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $45.5.

- In a positive move, an analyst from Morgan Stanley has upgraded their rating to Overweight and adjusted the price target to $41.

- Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on Bank of America with a target price of $50.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Bank of America, Benzinga Pro gives you real-time options trades alerts.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.