Investors with a lot of money to spend have taken a bearish stance on Digital Realty Trust DLR.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with DLR, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 9 uncommon options trades for Digital Realty Trust.

This isn't normal.

The overall sentiment of these big-money traders is split between 22% bullish and 77%, bearish.

Out of all of the special options we uncovered, 2 are puts, for a total amount of $192,692, and 7 are calls, for a total amount of $294,995.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $65.0 and $220.0 for Digital Realty Trust, spanning the last three months.

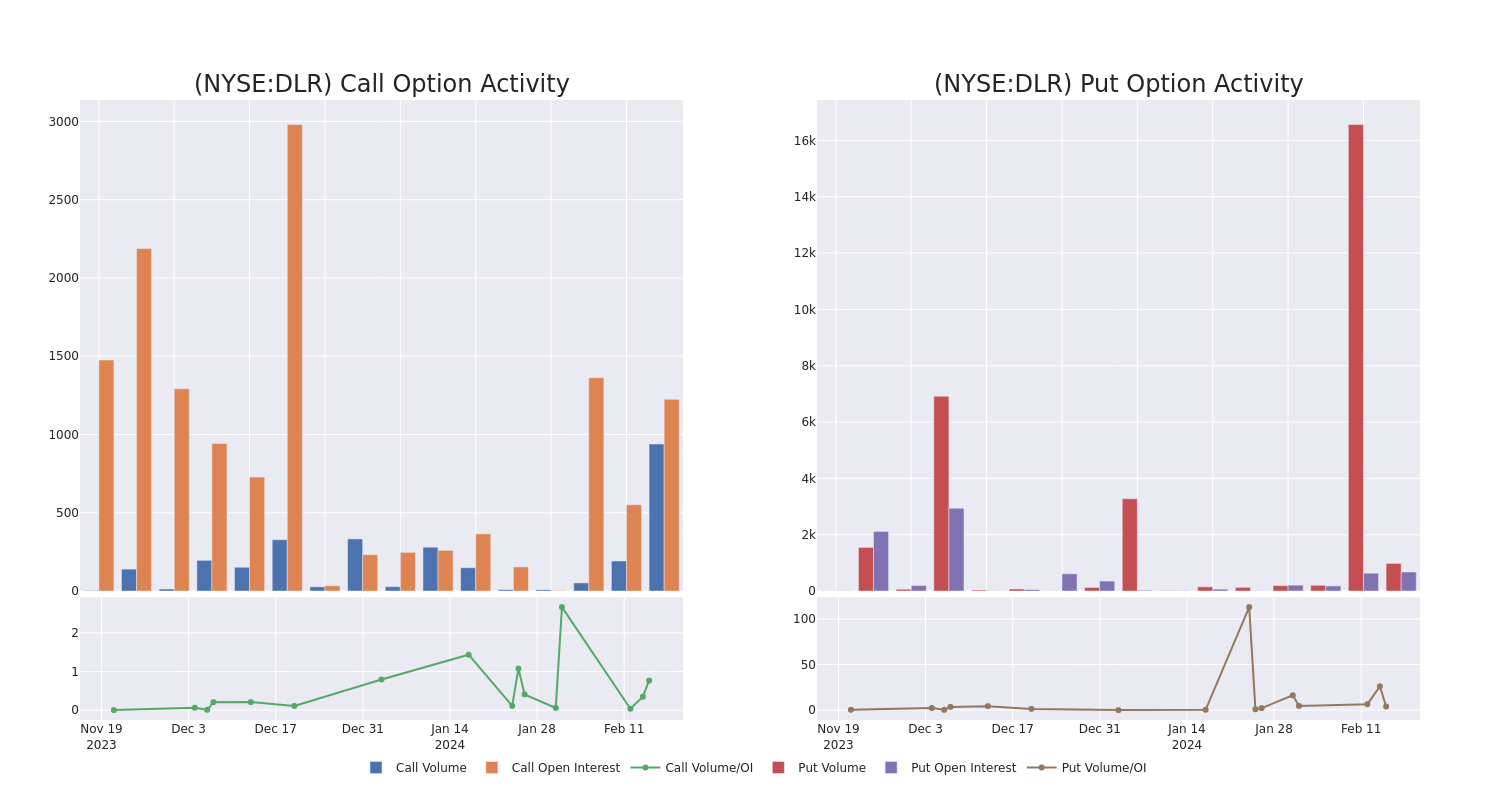

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Digital Realty Trust's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Digital Realty Trust's whale trades within a strike price range from $65.0 to $220.0 in the last 30 days.

Digital Realty Trust Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| DLR | PUT | TRADE | BEARISH | 01/16/26 | $65.00 | $118.3K | 517 | 499 |

| DLR | CALL | SWEEP | BULLISH | 02/23/24 | $155.00 | $78.4K | 81 | 494 |

| DLR | PUT | SWEEP | BEARISH | 06/21/24 | $110.00 | $74.3K | 160 | 482 |

| DLR | CALL | SWEEP | BULLISH | 06/21/24 | $160.00 | $45.1K | 161 | 75 |

| DLR | CALL | SWEEP | BEARISH | 06/21/24 | $160.00 | $39.6K | 161 | 145 |

About Digital Realty Trust

Digital Realty owns and operates over 300 data centers worldwide. It has nearly 40 million rentable square feet across five continents. Digital's offerings range from retail co-location, where an enterprise may rent a single cabinet and rely on Digital to provide all the accommodations, to "cold shells," where hyperscale cloud service providers can simply rent much, or all, of a barren, power-connected building. In recent years, Digital Realty has de-emphasized cold shells and now primarily provides higher-level service to tenants, which outsource their related IT needs to Digital. Digital Realty has also moved more into the co-location business, increasingly serving enterprises and facilitating network and cloud connections. Digital Realty operates as a real estate investment trust.

In light of the recent options history for Digital Realty Trust, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Digital Realty Trust Standing Right Now?

- With a volume of 1,583,522, the price of DLR is up 4.65% at $148.84.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 0 days.

Expert Opinions on Digital Realty Trust

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $139.25.

- An analyst from Barclays has decided to maintain their Underweight rating on Digital Realty Trust, which currently sits at a price target of $110.

- An analyst from Scotiabank upgraded its action to Sector Outperform with a price target of $157.

- An analyst from Stifel has decided to maintain their Buy rating on Digital Realty Trust, which currently sits at a price target of $155.

- Consistent in their evaluation, an analyst from Wells Fargo keeps a Equal-Weight rating on Digital Realty Trust with a target price of $135.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Digital Realty Trust, Benzinga Pro gives you real-time options trades alerts.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.