Financial giants have made a conspicuous bearish move on Affirm Holdings. Our analysis of options history for Affirm Holdings AFRM revealed 34 unusual trades.

Delving into the details, we found 38% of traders were bullish, while 61% showed bearish tendencies. Out of all the trades we spotted, 24 were puts, with a value of $1,300,887, and 10 were calls, valued at $343,646.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $25.0 to $75.0 for Affirm Holdings over the recent three months.

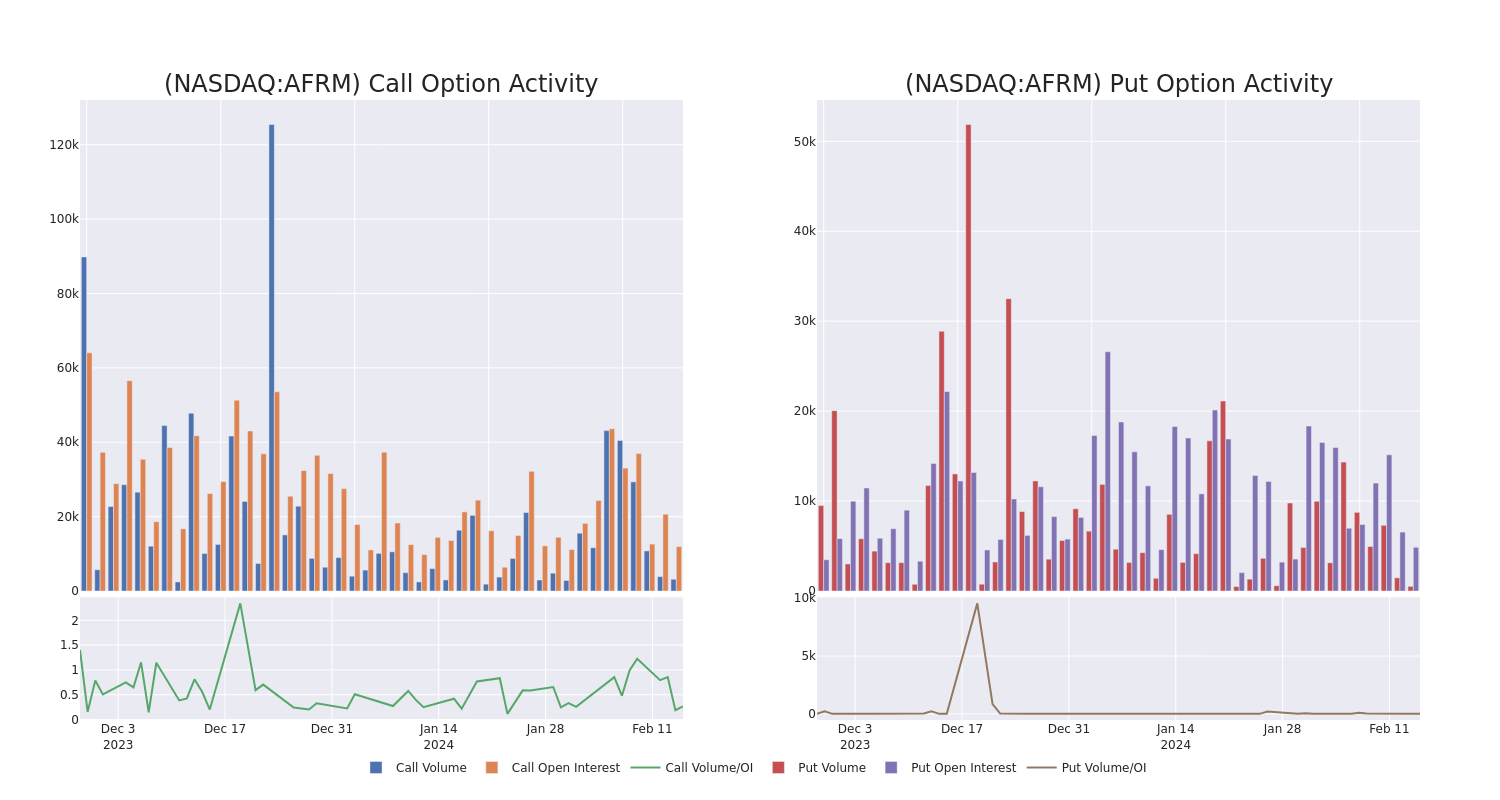

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Affirm Holdings's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Affirm Holdings's substantial trades, within a strike price spectrum from $25.0 to $75.0 over the preceding 30 days.

Affirm Holdings Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| AFRM | PUT | SWEEP | BEARISH | 03/01/24 | $36.00 | $110.9K | 210 | 995 |

| AFRM | PUT | SWEEP | BULLISH | 02/23/24 | $44.00 | $103.0K | 276 | 149 |

| AFRM | PUT | SWEEP | BULLISH | 03/01/24 | $44.00 | $100.8K | 250 | 152 |

| AFRM | PUT | SWEEP | BULLISH | 02/23/24 | $37.00 | $96.5K | 1.4K | 2.0K |

| AFRM | PUT | TRADE | BEARISH | 06/21/24 | $37.50 | $88.9K | 429 | 121 |

About Affirm Holdings

Affirm Holdings Inc offers a platform for digital and mobile-first commerce. It comprises a point-of-sale payment solution for consumers, merchant commerce solutions, and a consumer-focused app. The firm generates its revenue from merchant networks, and through virtual card networks among others. Geographically, it generates a majority share of its revenue from the United States.

Where Is Affirm Holdings Standing Right Now?

- Trading volume stands at 5,263,194, with AFRM's price down by -2.6%, positioned at $37.15.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 77 days.

Professional Analyst Ratings for Affirm Holdings

In the last month, 5 experts released ratings on this stock with an average target price of $29.4.

- In a cautious move, an analyst from Wedbush downgraded its rating to Underperform, setting a price target of $20.

- An analyst from Goldman Sachs persists with their Neutral rating on Affirm Holdings, maintaining a target price of $20.

- Maintaining their stance, an analyst from RBC Capital continues to hold a Sector Perform rating for Affirm Holdings, targeting a price of $50.

- Consistent in their evaluation, an analyst from Stephens & Co. keeps a Underweight rating on Affirm Holdings with a target price of $16.

- Consistent in their evaluation, an analyst from JP Morgan keeps a Neutral rating on Affirm Holdings with a target price of $41.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Affirm Holdings, Benzinga Pro gives you real-time options trades alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.