Whales with a lot of money to spend have taken a noticeably bullish stance on Cloudflare.

Looking at options history for Cloudflare NET we detected 10 trades.

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 50% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $244,064 and 6, calls, for a total amount of $342,747.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $80.0 to $130.0 for Cloudflare over the recent three months.

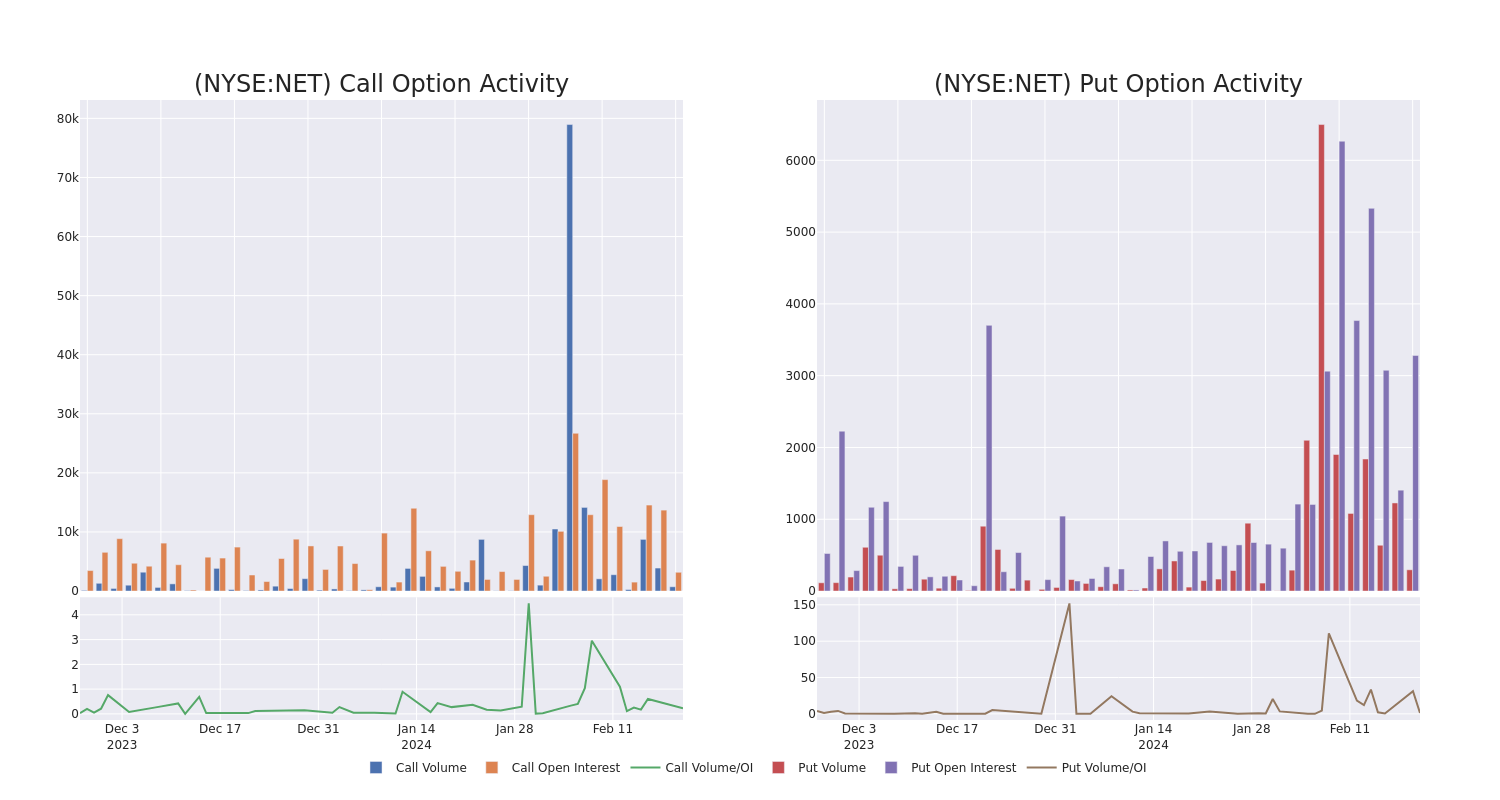

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Cloudflare's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Cloudflare's whale trades within a strike price range from $80.0 to $130.0 in the last 30 days.

Cloudflare Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| NET | CALL | SWEEP | BEARISH | 01/17/25 | $130.00 | $141.5K | 20 | 315 |

| NET | PUT | SWEEP | BULLISH | 07/19/24 | $80.00 | $79.8K | 221 | 179 |

| NET | PUT | SWEEP | BULLISH | 01/17/25 | $90.00 | $73.6K | 507 | 52 |

| NET | PUT | SWEEP | BULLISH | 03/15/24 | $95.00 | $64.8K | 2.4K | 35 |

| NET | CALL | TRADE | NEUTRAL | 03/28/24 | $95.00 | $60.0K | 1.0K | 100 |

About Cloudflare

Cloudflare is a software company based in San Francisco, California, that offers security and web performance offerings by utilizing a distributed, serverless content delivery network, or CDN. The firm's edge computing platform, Workers, leverages this network by providing clients the ability to deploy, and execute code without maintaining servers.

Where Is Cloudflare Standing Right Now?

- Trading volume stands at 2,000,262, with NET's price down by -4.1%, positioned at $93.97.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 64 days.

Professional Analyst Ratings for Cloudflare

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $110.4.

- Consistent in their evaluation, an analyst from Susquehanna keeps a Neutral rating on Cloudflare with a target price of $115.

- An analyst from Cantor Fitzgerald downgraded its action to Neutral with a price target of $100.

- An analyst from Needham has decided to maintain their Buy rating on Cloudflare, which currently sits at a price target of $135.

- An analyst from DZ Bank has revised its rating downward to Hold, adjusting the price target to $110.

- Consistent in their evaluation, an analyst from Morgan Stanley keeps a Equal-Weight rating on Cloudflare with a target price of $92.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Cloudflare, Benzinga Pro gives you real-time options trades alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.