Deep-pocketed investors have adopted a bearish approach towards Nike NKE, and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in NKE usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 10 extraordinary options activities for Nike. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 30% leaning bullish and 70% bearish. Among these notable options, 3 are puts, totaling $159,450, and 7 are calls, amounting to $708,377.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $100.0 and $130.0 for Nike, spanning the last three months.

Insights into Volume & Open Interest

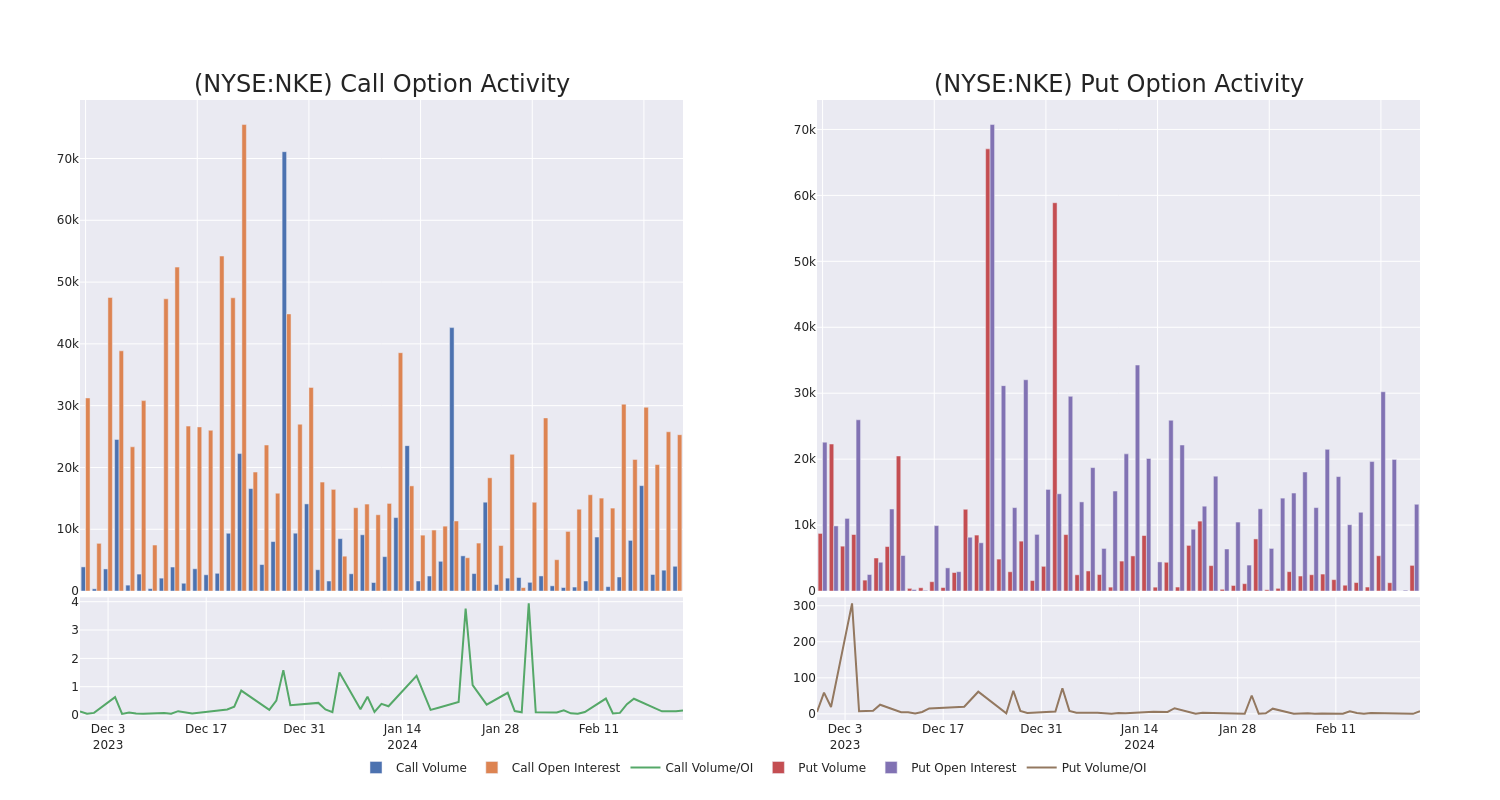

In today's trading context, the average open interest for options of Nike stands at 3118.29, with a total volume reaching 3,591.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Nike, situated within the strike price corridor from $100.0 to $130.0, throughout the last 30 days.

Nike Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| NKE | CALL | SWEEP | BEARISH | 03/15/24 | $105.00 | $387.9K | 11.7K | 1.4K |

| NKE | CALL | SWEEP | BULLISH | 01/16/26 | $130.00 | $130.2K | 1.4K | 120 |

| NKE | PUT | SWEEP | NEUTRAL | 01/17/25 | $100.00 | $78.8K | 5.6K | 50 |

| NKE | CALL | TRADE | BULLISH | 03/01/24 | $100.00 | $53.7K | 380 | 90 |

| NKE | PUT | SWEEP | BULLISH | 03/22/24 | $114.00 | $42.7K | 0 | 45 |

About Nike

Nike is the largest athletic footwear and apparel brand in the world. Key categories include basketball, running, and football (soccer). Footwear generates about two thirds of its sales. Its brands include Nike, Jordan, and Converse (casual footwear). Nike sells products worldwide through company-owned stores, franchised stores, and third-party retailers. The firm also operates e-commerce platforms in more than 40 countries. Nearly all its production is outsourced to contract manufacturers in more than 30 countries. Nike was founded in 1964 and is based in Beaverton, Oregon.

Following our analysis of the options activities associated with Nike, we pivot to a closer look at the company's own performance.

Nike's Current Market Status

- With a volume of 1,157,351, the price of NKE is down -0.17% at $105.46.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 24 days.

Professional Analyst Ratings for Nike

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $110.0.

- An analyst from Oppenheimer downgraded its action to Perform with a price target of $110.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Nike options trades with real-time alerts from Benzinga Pro.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.