Financial giants have made a conspicuous bearish move on Workday. Our analysis of options history for Workday WDAY revealed 19 unusual trades.

Delving into the details, we found 31% of traders were bullish, while 68% showed bearish tendencies. Out of all the trades we spotted, 10 were puts, with a value of $932,601, and 9 were calls, valued at $309,015.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $210.0 to $350.0 for Workday over the last 3 months.

Analyzing Volume & Open Interest

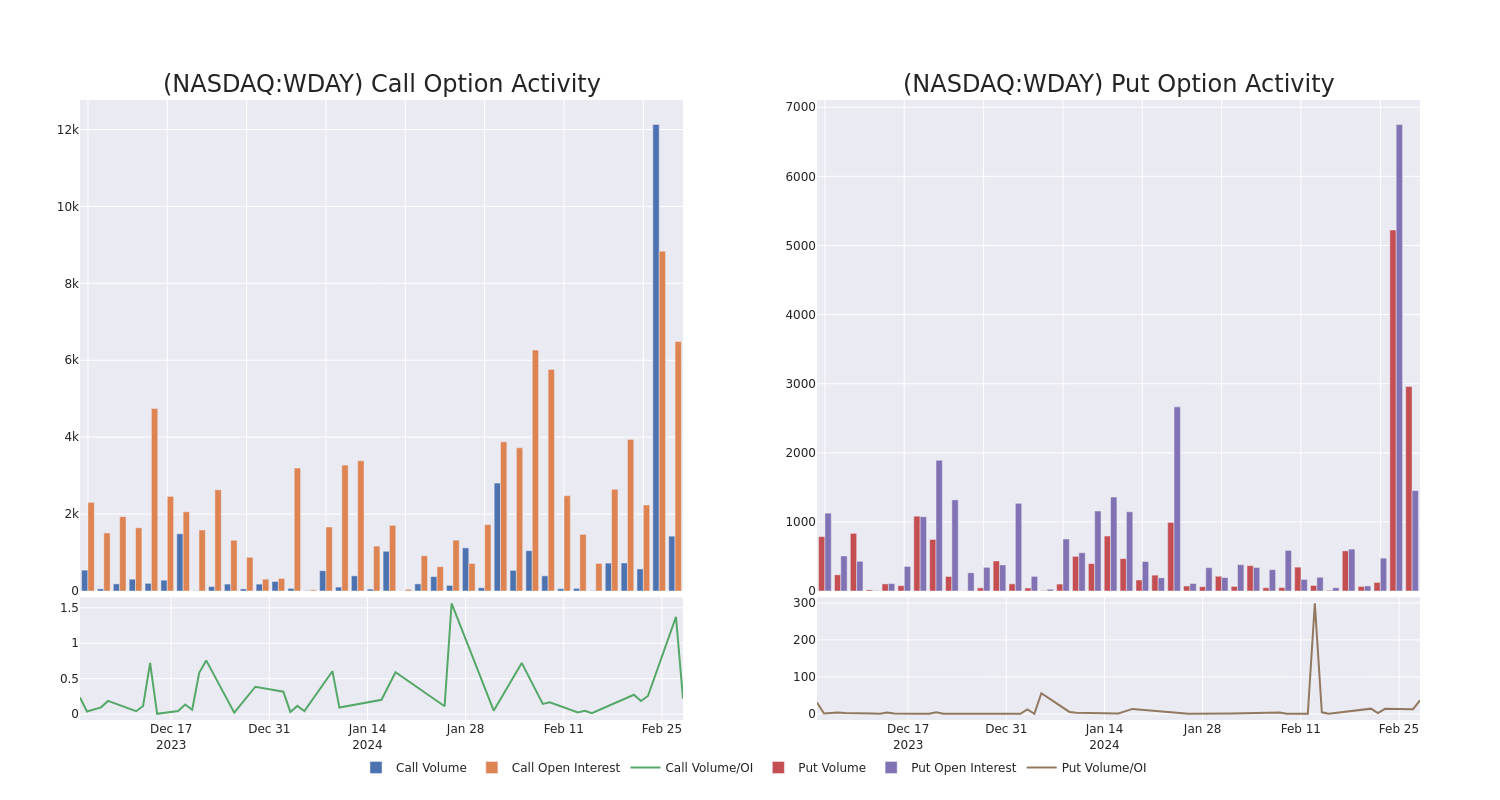

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Workday's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Workday's whale activity within a strike price range from $210.0 to $350.0 in the last 30 days.

Workday 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| WDAY | PUT | TRADE | BEARISH | 03/01/24 | $295.00 | $200.0K | 910 | 76 |

| WDAY | PUT | SWEEP | NEUTRAL | 03/15/24 | $287.50 | $140.4K | 85 | 252 |

| WDAY | PUT | TRADE | BEARISH | 03/15/24 | $335.00 | $136.0K | 6 | 32 |

| WDAY | PUT | SWEEP | BEARISH | 03/15/24 | $285.00 | $111.2K | 122 | 536 |

| WDAY | PUT | TRADE | BEARISH | 03/15/24 | $295.00 | $100.1K | 76 | 125 |

About Workday

Workday is a software company that offers human capital management, or HCM, financial management, and business planning solutions. Known for being a cloud-only software provider, Workday is headquartered in Pleasanton, California. Founded in 2005, Workday now employs over 18,000 employees.

Following our analysis of the options activities associated with Workday, we pivot to a closer look at the company's own performance.

Workday's Current Market Status

- Currently trading with a volume of 718,180, the WDAY's price is down by -0.2%, now at $294.46.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 85 days.

What Analysts Are Saying About Workday

In the last month, 5 experts released ratings on this stock with an average target price of $321.6.

- An analyst from Needham persists with their Buy rating on Workday, maintaining a target price of $350.

- In a cautious move, an analyst from DA Davidson downgraded its rating to Neutral, setting a price target of $300.

- Maintaining their stance, an analyst from Wells Fargo continues to hold a Overweight rating for Workday, targeting a price of $350.

- Reflecting concerns, an analyst from JMP Securities lowers its rating to Market Outperform with a new price target of $315.

- Maintaining their stance, an analyst from Citigroup continues to hold a Neutral rating for Workday, targeting a price of $293.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Workday options trades with real-time alerts from Benzinga Pro.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.