Financial giants have made a conspicuous bearish move on Okta. Our analysis of options history for Okta OKTA revealed 32 unusual trades.

Delving into the details, we found 37% of traders were bullish, while 62% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $140,317, and 29 were calls, valued at $1,618,921.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $75.0 to $165.0 for Okta during the past quarter.

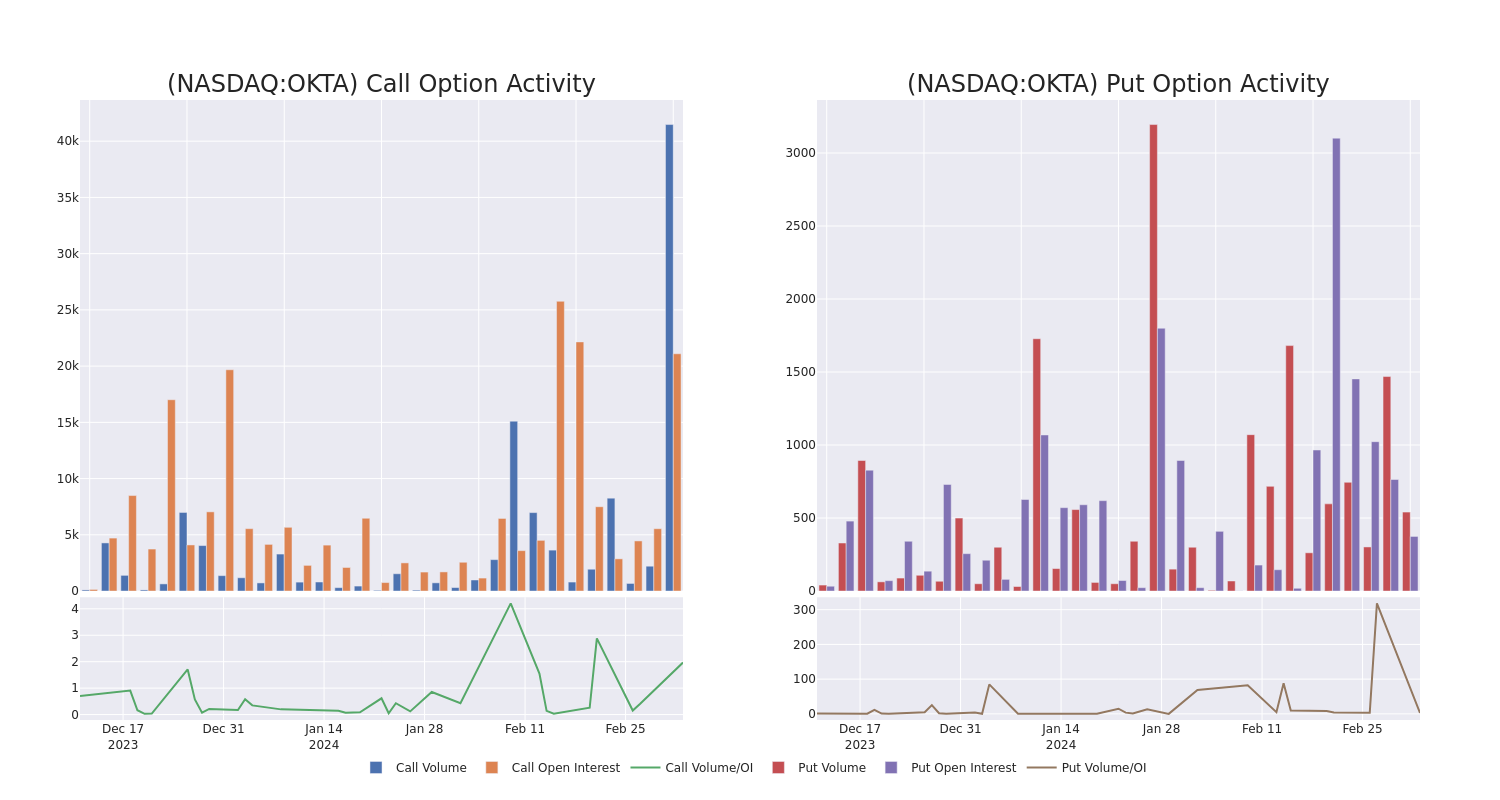

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Okta's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Okta's substantial trades, within a strike price spectrum from $75.0 to $165.0 over the preceding 30 days.

Okta 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| OKTA | CALL | SWEEP | BEARISH | 05/17/24 | $120.00 | $191.4K | 1.0K | 511 |

| OKTA | CALL | TRADE | BULLISH | 03/15/24 | $75.00 | $94.2K | 518 | 48 |

| OKTA | CALL | SWEEP | BEARISH | 03/15/24 | $90.00 | $93.3K | 3.8K | 0 |

| OKTA | CALL | TRADE | BEARISH | 03/15/24 | $90.00 | $89.4K | 3.8K | 100 |

| OKTA | CALL | SWEEP | BULLISH | 03/15/24 | $110.00 | $79.8K | 5.3K | 9.3K |

About Okta

Okta is a cloud-native security company that focuses on identity and access management. The San Francisco-based firm went public in 2017 and focuses on two key client stakeholder groups: workforces and customers. Okta's workforce offerings enable a company's employees to securely access its cloud-based and on-premises resources. The firm's customer offerings allow its clients' customers to securely access the client's applications.

Having examined the options trading patterns of Okta, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Okta

- With a trading volume of 1,564,325, the price of OKTA is up by 1.02%, reaching $109.6.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 86 days from now.

What The Experts Say On Okta

5 market experts have recently issued ratings for this stock, with a consensus target price of $113.6.

- An analyst from Canaccord Genuity has decided to maintain their Hold rating on Okta, which currently sits at a price target of $95.

- Showing optimism, an analyst from B of A Securities upgrades its rating to Buy with a revised price target of $135.

- Maintaining their stance, an analyst from Piper Sandler continues to hold a Neutral rating for Okta, targeting a price of $110.

- Consistent in their evaluation, an analyst from Baird keeps a Outperform rating on Okta with a target price of $108.

- Consistent in their evaluation, an analyst from Goldman Sachs keeps a Buy rating on Okta with a target price of $120.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Okta options trades with real-time alerts from Benzinga Pro.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.