Deep-pocketed investors have adopted a bullish approach towards Linde LIN, and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in LIN usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 62 extraordinary options activities for Linde. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 59% leaning bullish and 40% bearish. Among these notable options, 6 are puts, totaling $468,610, and 56 are calls, amounting to $2,780,066.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $380.0 to $500.0 for Linde over the recent three months.

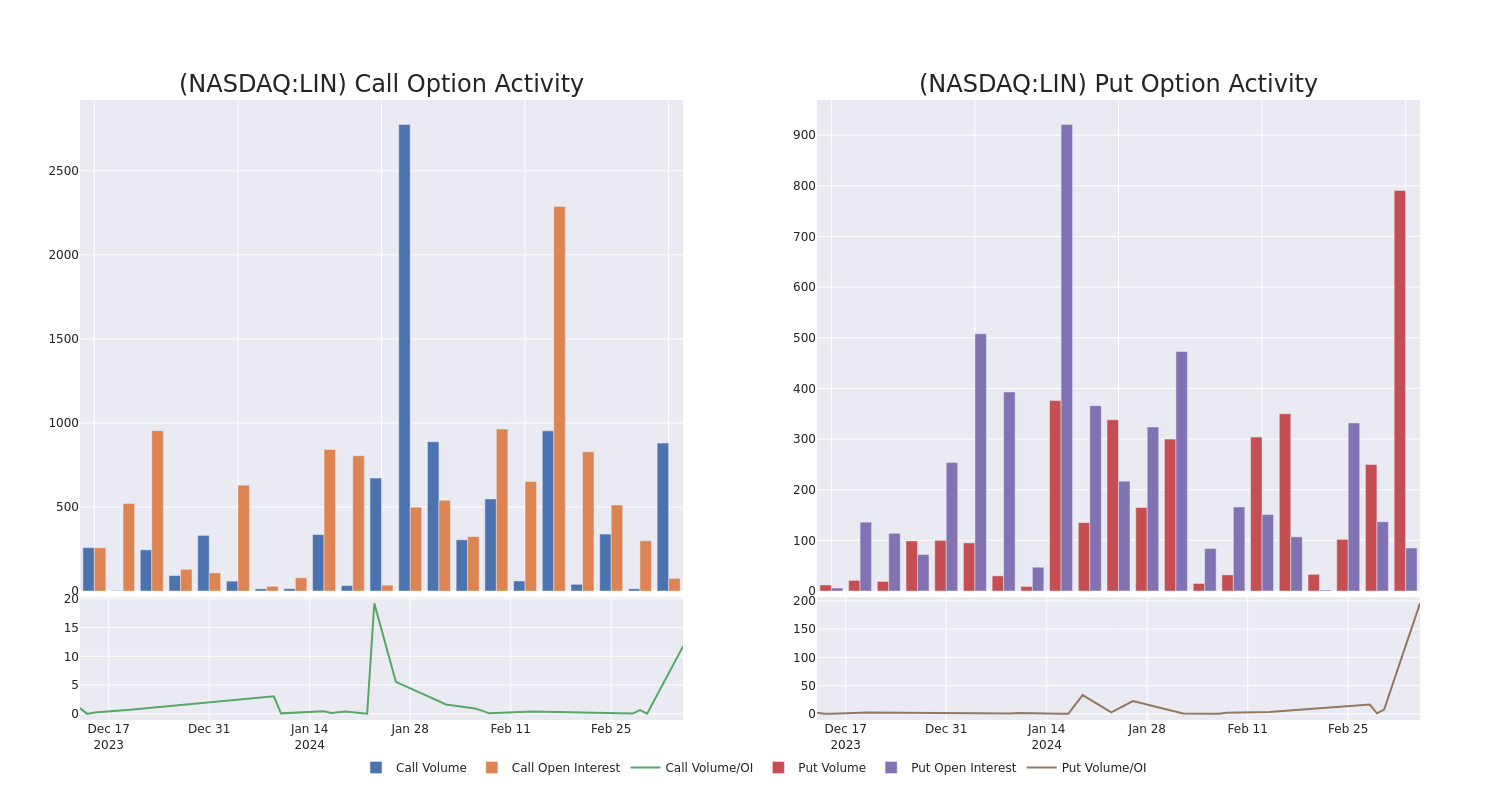

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Linde's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Linde's substantial trades, within a strike price spectrum from $380.0 to $500.0 over the preceding 30 days.

Linde Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| LIN | PUT | TRADE | BULLISH | 04/19/24 | $465.00 | $228.0K | 72 | 232 |

| LIN | CALL | TRADE | BULLISH | 01/16/26 | $470.00 | $183.5K | 73 | 3 |

| LIN | CALL | SWEEP | BEARISH | 01/17/25 | $480.00 | $142.7K | 339 | 126 |

| LIN | CALL | SWEEP | BEARISH | 01/17/25 | $480.00 | $92.4K | 339 | 241 |

| LIN | CALL | SWEEP | BULLISH | 10/18/24 | $460.00 | $86.4K | 336 | 268 |

About Linde

Linde is the largest industrial gas supplier in the world, with operations in over 100 countries. The firm's main products are atmospheric gases (including oxygen, nitrogen, and argon) and process gases (including hydrogen, carbon dioxide, and helium), as well as equipment used in industrial gas production. Linde serves a wide variety of end markets, including chemicals, manufacturing, healthcare, and steelmaking. Linde generated approximately $33 billion in revenue in 2023.

Present Market Standing of Linde

- With a trading volume of 972,654, the price of LIN is down by -0.12%, reaching $463.04.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 49 days from now.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Linde options trades with real-time alerts from Benzinga Pro.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.