High-rolling investors have positioned themselves bullish on Cleanspark CLSK, and it's important for retail traders to take note. \This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in CLSK often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 30 options trades for Cleanspark. This is not a typical pattern.

The sentiment among these major traders is split, with 50% bullish and 50% bearish. Among all the options we identified, there was one put, amounting to $43,200, and 29 calls, totaling $1,474,995.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $5.0 to $37.0 for Cleanspark over the recent three months.

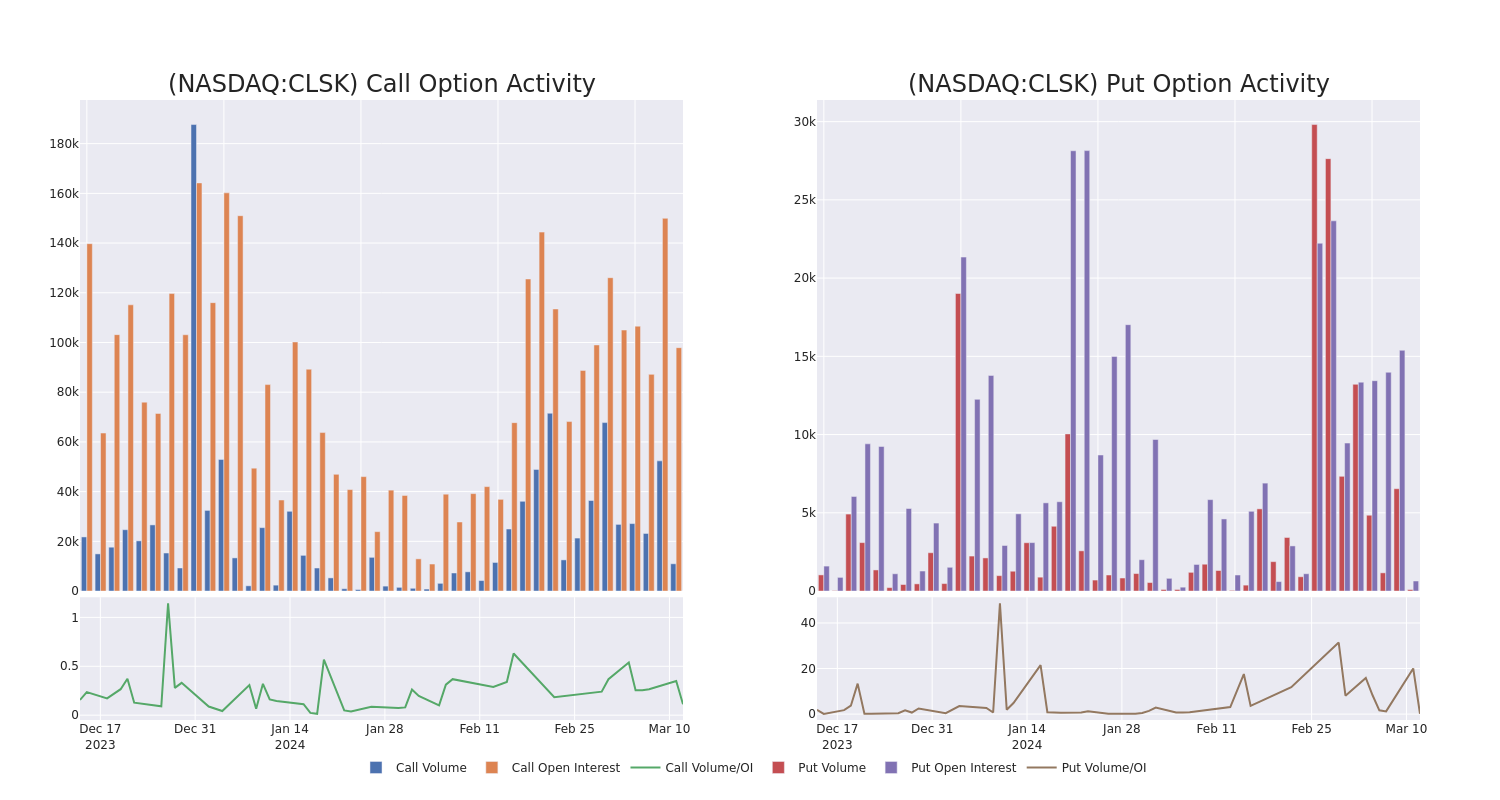

Volume & Open Interest Development

In today's trading context, the average open interest for options of Cleanspark stands at 4285.09, with a total volume reaching 11,066.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Cleanspark, situated within the strike price corridor from $5.0 to $37.0, throughout the last 30 days.

Cleanspark Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| CLSK | CALL | SWEEP | BEARISH | 01/17/25 | $37.00 | $159.0K | 1.6K | 349 |

| CLSK | CALL | TRADE | BULLISH | 01/17/25 | $5.00 | $130.0K | 7.5K | 0 |

| CLSK | CALL | SWEEP | BULLISH | 04/19/24 | $17.00 | $123.4K | 2.1K | 749 |

| CLSK | CALL | TRADE | BEARISH | 03/15/24 | $7.50 | $97.6K | 3.5K | 111 |

| CLSK | CALL | SWEEP | BEARISH | 01/17/25 | $10.00 | $81.7K | 19.8K | 75 |

About Cleanspark

Cleanspark Inc is a bitcoin mining company. Through CleanSpark, Inc., and the Company's wholly owned subsidiaries, the company mines bitcoin. The company entered the bitcoin mining industry through its acquisition of ATL. Bitcoin mining is the sole reportable segment of the company.

After a thorough review of the options trading surrounding Cleanspark, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Cleanspark

- Currently trading with a volume of 13,515,005, the CLSK's price is up by 0.95%, now at $17.07.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 57 days.

What Analysts Are Saying About Cleanspark

3 market experts have recently issued ratings for this stock, with a consensus target price of $26.333333333333332.

- An analyst from Chardan Capital has decided to maintain their Buy rating on Cleanspark, which currently sits at a price target of $26.

- Consistent in their evaluation, an analyst from Chardan Capital keeps a Buy rating on Cleanspark with a target price of $26.

- Maintaining their stance, an analyst from HC Wainwright & Co. continues to hold a Buy rating for Cleanspark, targeting a price of $27.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Cleanspark options trades with real-time alerts from Benzinga Pro.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.