Financial giants have made a conspicuous bearish move on Linde. Our analysis of options history for Linde LIN revealed 19 unusual trades.

Delving into the details, we found 42% of traders were bullish, while 57% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $246,372, and 17 were calls, valued at $1,965,302.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $385.0 to $465.0 for Linde over the last 3 months.

Volume & Open Interest Development

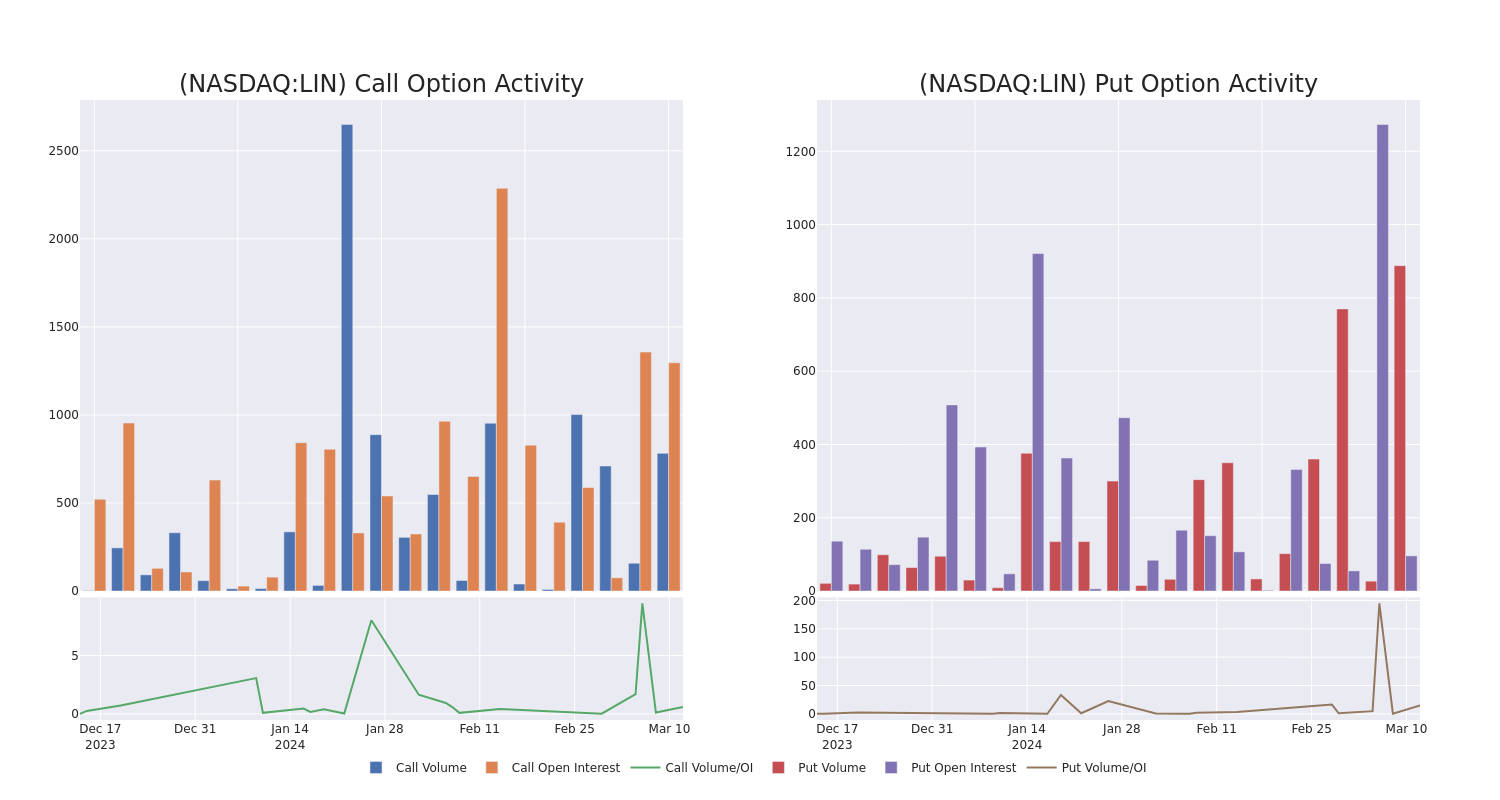

In today's trading context, the average open interest for options of Linde stands at 198.86, with a total volume reaching 1,670.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Linde, situated within the strike price corridor from $385.0 to $465.0, throughout the last 30 days.

Linde Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| LIN | CALL | SWEEP | NEUTRAL | 01/17/25 | $400.00 | $243.8K | 315 | 41 |

| LIN | CALL | SWEEP | BEARISH | 07/19/24 | $385.00 | $188.4K | 102 | 100 |

| LIN | CALL | SWEEP | BEARISH | 07/19/24 | $385.00 | $188.4K | 102 | 60 |

| LIN | CALL | SWEEP | BEARISH | 01/17/25 | $400.00 | $186.8K | 315 | 81 |

| LIN | CALL | TRADE | BULLISH | 01/16/26 | $460.00 | $184.2K | 96 | 37 |

About Linde

Linde is the largest industrial gas supplier in the world, with operations in over 100 countries. The firm's main products are atmospheric gases (including oxygen, nitrogen, and argon) and process gases (including hydrogen, carbon dioxide, and helium), as well as equipment used in industrial gas production. Linde serves a wide variety of end markets, including chemicals, manufacturing, healthcare, and steelmaking. Linde generated approximately $33 billion in revenue in 2023.

Linde's Current Market Status

- Trading volume stands at 1,341,921, with LIN's price down by -0.41%, positioned at $467.56.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 44 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Linde options trades with real-time alerts from Benzinga Pro.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.