High-rolling investors have positioned themselves bearish on Stryker SYK, and it's important for retail traders to take note. \This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in SYK often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 10 options trades for Stryker. This is not a typical pattern.

The sentiment among these major traders is split, with 40% bullish and 60% bearish. Among all the options we identified, there was one put, amounting to $39,000, and 9 calls, totaling $557,142.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $300.0 and $370.0 for Stryker, spanning the last three months.

Insights into Volume & Open Interest

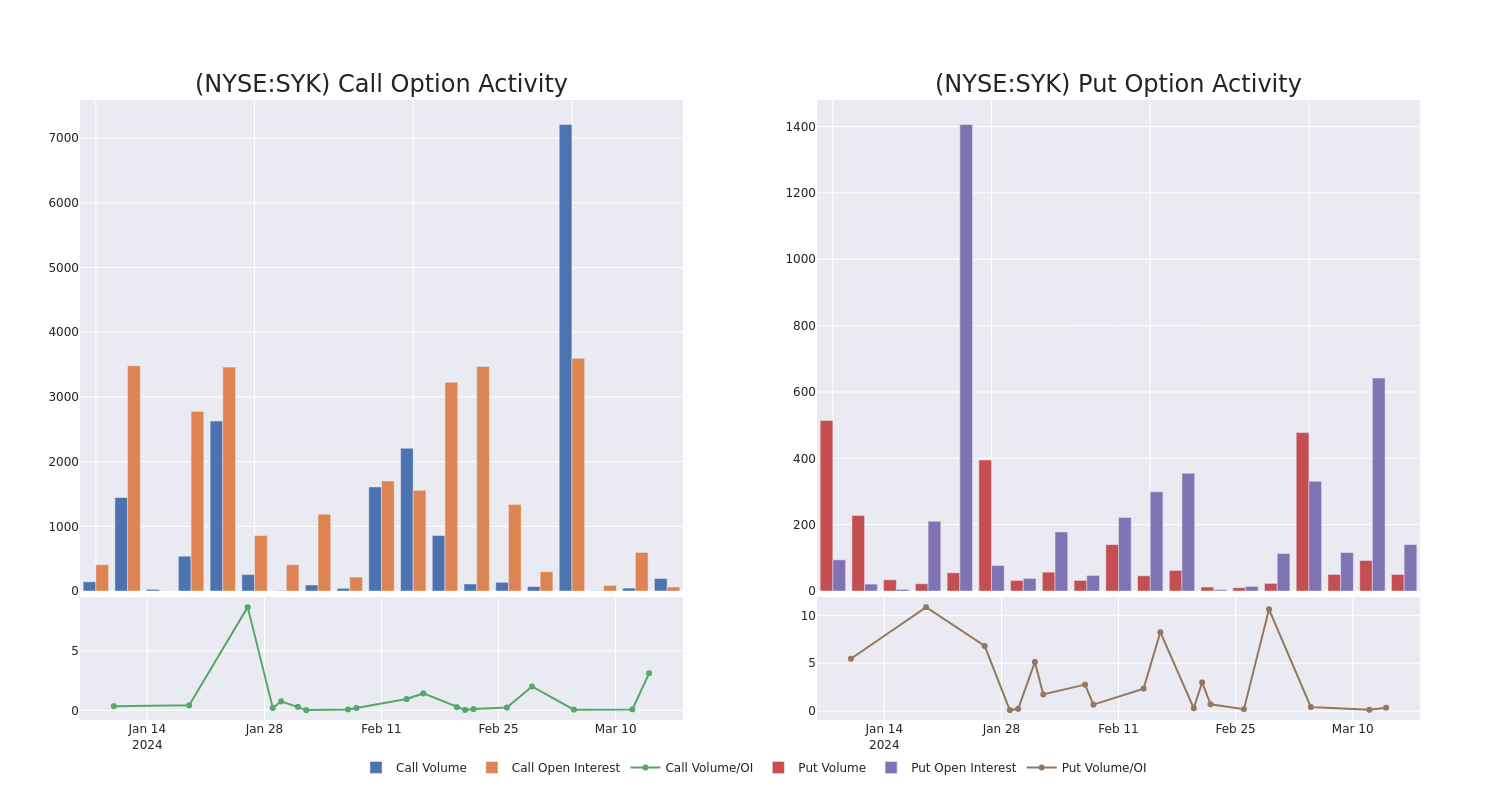

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Stryker's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Stryker's substantial trades, within a strike price spectrum from $300.0 to $370.0 over the preceding 30 days.

Stryker Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| SYK | CALL | SWEEP | BEARISH | 03/15/24 | $320.00 | $198.0K | 412 | 9 |

| SYK | CALL | TRADE | NEUTRAL | 03/15/24 | $320.00 | $99.0K | 412 | 105 |

| SYK | CALL | TRADE | BULLISH | 09/20/24 | $370.00 | $51.9K | 109 | 0 |

| SYK | CALL | TRADE | BEARISH | 03/15/24 | $340.00 | $47.1K | 471 | 142 |

| SYK | CALL | SWEEP | BEARISH | 03/15/24 | $340.00 | $39.2K | 471 | 51 |

About Stryker

Stryker designs, manufactures, and markets an array of medical equipment, instruments, consumable supplies, and implantable devices. The product portfolio includes hip and knee replacements, endoscopy systems, operating room equipment, embolic coils, hospital beds and gurneys, and spinal devices. Stryker remains one of the three largest competitors in reconstructive orthopedic implants and holds the leadership position in operating room equipment. Just over one fourth of Stryker's total revenue currently comes from outside the United States.

After a thorough review of the options trading surrounding Stryker, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Stryker

- Trading volume stands at 673,368, with SYK's price down by -0.84%, positioned at $352.66.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 45 days.

What The Experts Say On Stryker

In the last month, 1 experts released ratings on this stock with an average target price of $360.0.

- In a cautious move, an analyst from RBC Capital downgraded its rating to Outperform, setting a price target of $360.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Stryker options trades with real-time alerts from Benzinga Pro.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.