Financial giants have made a conspicuous bearish move on Sea. Our analysis of options history for Sea SE revealed 8 unusual trades.

Delving into the details, we found 37% of traders were bullish, while 62% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $440,588, and 2 were calls, valued at $62,940.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $45.0 to $75.0 for Sea during the past quarter.

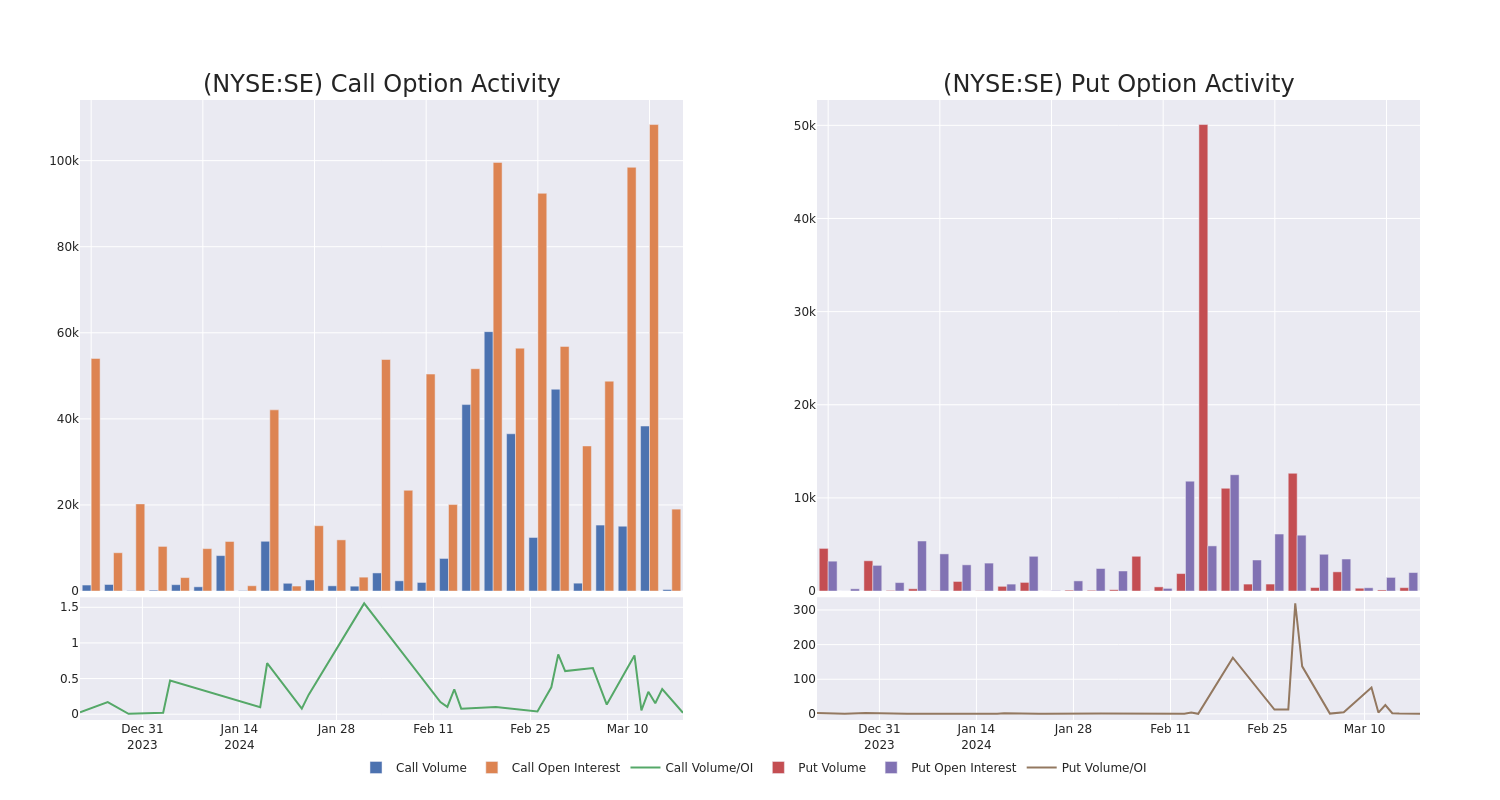

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Sea's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Sea's whale trades within a strike price range from $45.0 to $75.0 in the last 30 days.

Sea Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| SE | PUT | SWEEP | BEARISH | 01/17/25 | $45.00 | $120.0K | 1.2K | 4 |

| SE | PUT | SWEEP | NEUTRAL | 05/17/24 | $55.00 | $100.0K | 1.2K | 2 |

| SE | PUT | SWEEP | BEARISH | 05/17/24 | $55.00 | $86.9K | 1.2K | 241 |

| SE | PUT | TRADE | BEARISH | 05/17/24 | $60.00 | $76.1K | 828 | 1 |

| SE | CALL | SWEEP | BULLISH | 01/17/25 | $45.00 | $37.0K | 2.8K | 20 |

About Sea

Sea operates Southeast Asia's largest e-commerce company, Shopee, in terms of gross merchandise value and number of transactions. Sea started as a gaming business, Garena, but in 2015 expanded into e-commerce, which is now the main growth driver. Shopee is a hybrid C2C and B2C marketplace platform operating in eight core markets. Indonesia accounts for 35% of GMV, with the rest split mainly among Taiwan, Vietnam, Thailand, Malaysia, and the Philippines. For Garena, Free Fire was the most downloaded game in January 2022 and accounted for 74% of gaming revenue in 2021. Sea's third business, SeaMoney, provides mostly credit lending.

After a thorough review of the options trading surrounding Sea, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Sea Standing Right Now?

- With a trading volume of 1,932,141, the price of SE is down by -2.07%, reaching $56.65.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 56 days from now.

Expert Opinions on Sea

In the last month, 5 experts released ratings on this stock with an average target price of $67.8.

- Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Sea with a target price of $68.

- An analyst from Morgan Stanley persists with their Equal-Weight rating on Sea, maintaining a target price of $65.

- Maintaining their stance, an analyst from Benchmark continues to hold a Buy rating for Sea, targeting a price of $78.

- An analyst from HSBC persists with their Buy rating on Sea, maintaining a target price of $76.

- Consistent in their evaluation, an analyst from TD Cowen keeps a Market Perform rating on Sea with a target price of $52.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Sea options trades with real-time alerts from Benzinga Pro.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.