Investors with a lot of money to spend have taken a bullish stance on Charter Communications CHTR.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CHTR, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 12 uncommon options trades for Charter Communications.

This isn't normal.

The overall sentiment of these big-money traders is split between 50% bullish and 50%, bearish.

Out of all of the special options we uncovered, 7 are puts, for a total amount of $359,094, and 5 are calls, for a total amount of $327,130.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $200.0 to $300.0 for Charter Communications over the recent three months.

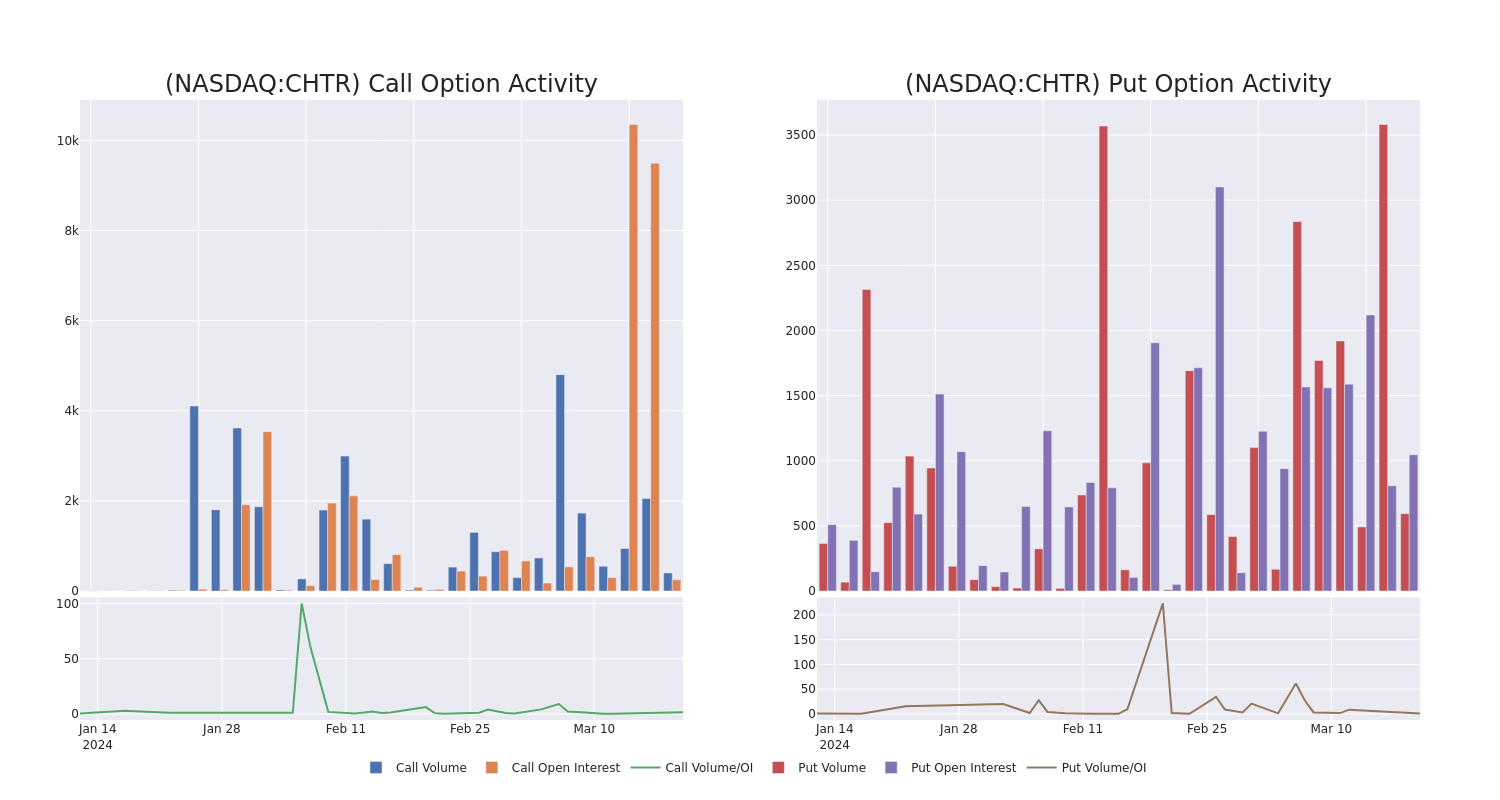

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Charter Communications's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Charter Communications's substantial trades, within a strike price spectrum from $200.0 to $300.0 over the preceding 30 days.

Charter Communications Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| CHTR | CALL | SWEEP | BULLISH | 04/19/24 | $290.00 | $162.5K | 196 | 257 |

| CHTR | PUT | TRADE | BULLISH | 06/21/24 | $300.00 | $59.2K | 1.0K | 82 |

| CHTR | PUT | SWEEP | BEARISH | 06/21/24 | $300.00 | $56.6K | 1.0K | 143 |

| CHTR | PUT | TRADE | BEARISH | 06/21/24 | $300.00 | $54.2K | 1.0K | 28 |

| CHTR | PUT | SWEEP | BULLISH | 06/21/24 | $300.00 | $51.9K | 1.0K | 165 |

About Charter Communications

Charter is the product of the 2016 merger of three cable companies, each with a decades-long history in the business: Legacy Charter, Time Warner Cable, and Bright House Networks. The firm now holds networks capable of providing television, internet access, and phone services to roughly 56 million U.S. homes and businesses, around 40% of the country. Across this footprint, Charter serves 30 million residential and 2 million commercial customer accounts under the Spectrum brand, making it the second-largest U.S. cable company behind Comcast. The firm also owns, in whole or in part, sports and news networks, including Spectrum SportsNet (long-term local rights to Los Angeles Lakers games), SportsNet LA (Los Angeles Dodgers), SportsNet New York (New York Mets), and Spectrum News NY1.

Having examined the options trading patterns of Charter Communications, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Charter Communications's Current Market Status

- Currently trading with a volume of 1,002,240, the CHTR's price is down by -0.41%, now at $297.35.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 37 days.

What Analysts Are Saying About Charter Communications

2 market experts have recently issued ratings for this stock, with a consensus target price of $352.5.

- Reflecting concerns, an analyst from Rosenblatt lowers its rating to Neutral with a new price target of $335.

- Showing optimism, an analyst from Bernstein upgrades its rating to Outperform with a revised price target of $370.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Charter Communications, Benzinga Pro gives you real-time options trades alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.