Benzinga's options scanner just detected over 16 options trades for Intuit INTU summing a total amount of $1,132,096.

At the same time, our algo caught 9 for a total amount of 1,125,462.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $600.0 and $900.0 for Intuit, spanning the last three months.

Volume & Open Interest Development

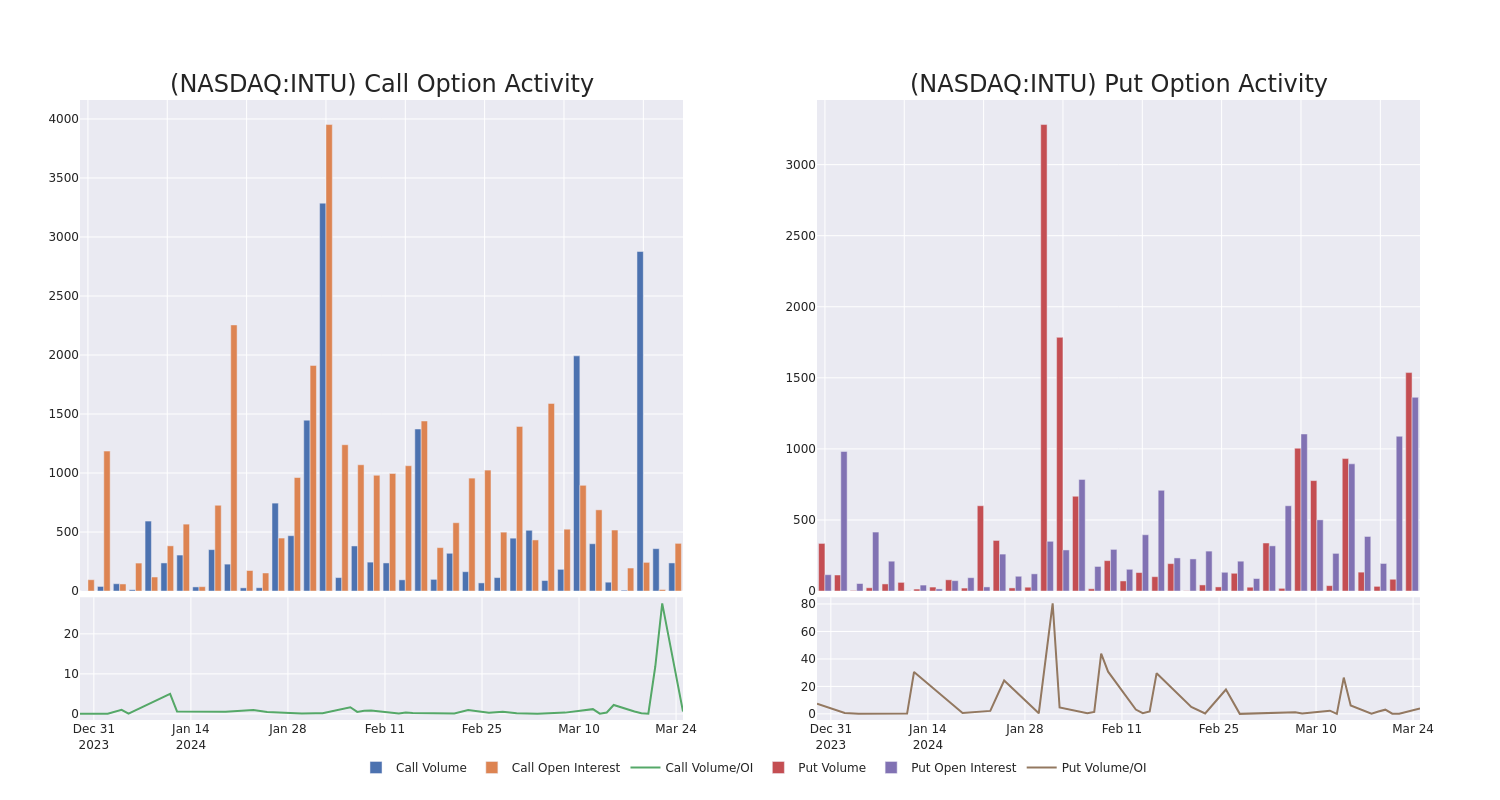

In today's trading context, the average open interest for options of Intuit stands at 196.33, with a total volume reaching 1,775.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Intuit, situated within the strike price corridor from $600.0 to $900.0, throughout the last 30 days.

Intuit Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| INTU | PUT | SWEEP | BEARISH | 06/21/24 | $610.00 | $227.2K | 57 | 122 |

| INTU | PUT | SWEEP | BULLISH | 06/21/24 | $600.00 | $201.1K | 1.0K | 328 |

| INTU | PUT | SWEEP | BULLISH | 06/21/24 | $600.00 | $185.1K | 1.0K | 450 |

| INTU | PUT | SWEEP | BULLISH | 06/21/24 | $600.00 | $164.7K | 1.0K | 106 |

| INTU | PUT | SWEEP | BULLISH | 06/21/24 | $600.00 | $123.5K | 1.0K | 450 |

About Intuit

Intuit is a provider of small-business accounting software (QuickBooks), personal tax solutions (TurboTax), and professional tax offerings (Lacerte). Founded in the mid-1980s, Intuit controls the majority of U.S. market share for small-business accounting and DIY tax-filing software.

Present Market Standing of Intuit

- With a volume of 966,212, the price of INTU is down -0.72% at $639.09.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 57 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Intuit, Benzinga Pro gives you real-time options trades alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.