High-rolling investors have positioned themselves bearish on General Motors GM, and it's important for retail traders to take note. \This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in GM often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 17 options trades for General Motors. This is not a typical pattern.

The sentiment among these major traders is split, with 41% bullish and 58% bearish. Among all the options we identified, there was one put, amounting to $97,200, and 16 calls, totaling $1,070,247.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $28.0 to $47.0 for General Motors over the last 3 months.

Analyzing Volume & Open Interest

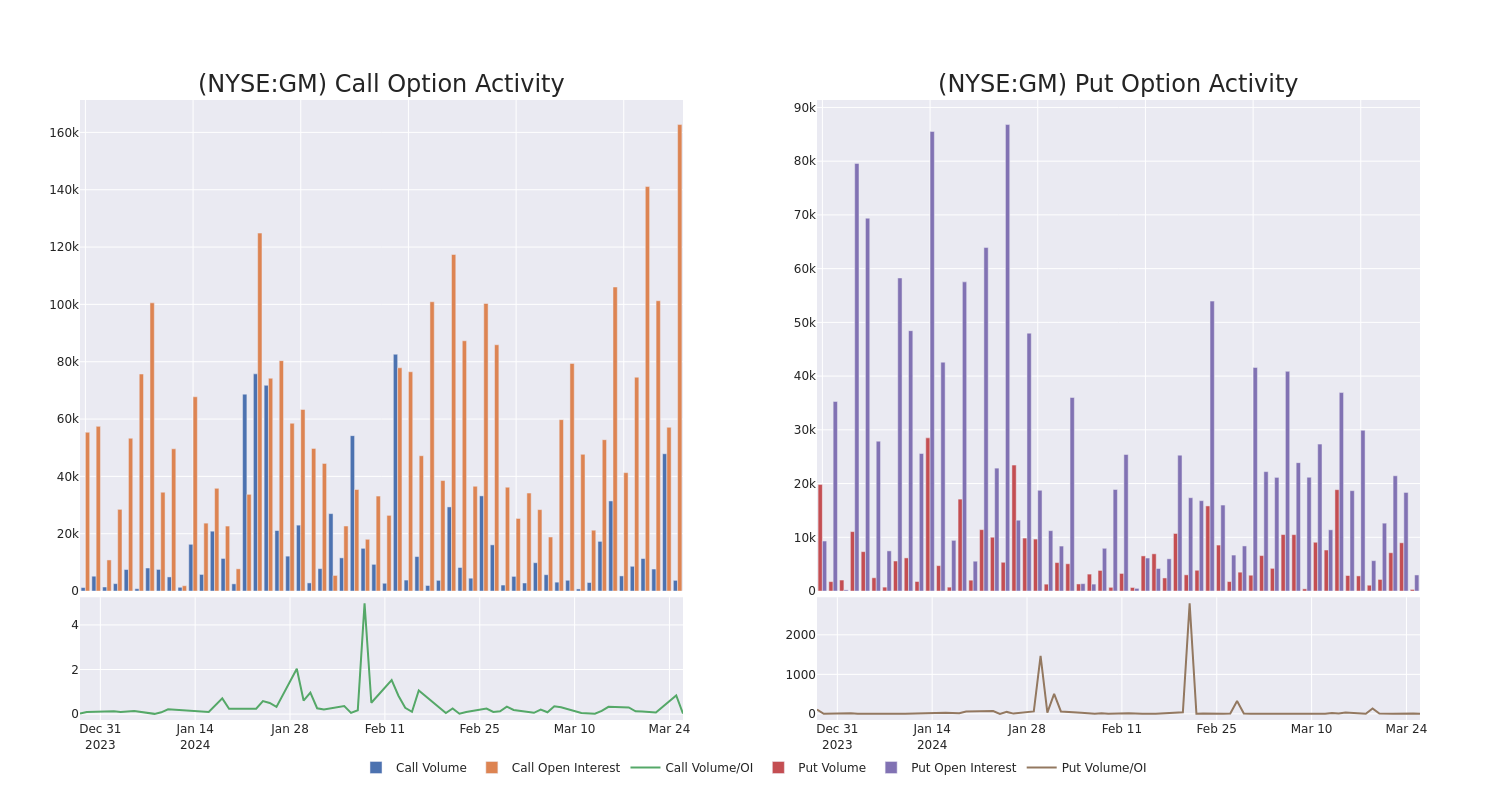

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for General Motors's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across General Motors's significant trades, within a strike price range of $28.0 to $47.0, over the past month.

General Motors Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| GM | CALL | TRADE | BEARISH | 09/20/24 | $28.00 | $163.0K | 1.4K | 100 |

| GM | CALL | SWEEP | BULLISH | 10/18/24 | $42.00 | $142.6K | 1.5K | 300 |

| GM | CALL | SWEEP | BULLISH | 01/17/25 | $33.00 | $126.0K | 14.5K | 100 |

| GM | PUT | SWEEP | BEARISH | 06/20/25 | $40.00 | $97.2K | 2.9K | 300 |

| GM | CALL | SWEEP | NEUTRAL | 06/21/24 | $42.00 | $91.7K | 20.5K | 491 |

About General Motors

General Motors Co. emerged from the bankruptcy of General Motors Corp. (old GM) in July 2009. GM has eight brands and operates under four segments: GM North America, GM International, Cruise, and GM Financial. The United States now has four brands instead of eight under old GM. The company regained its U.S. market share leader crown in 2022, after losing it to Toyota due to the chip shortage in 2021. 2023's share was 16.5%. GM's Cruise autonomous vehicle arm has previously done driverless geofenced AV robotaxi services in San Francisco and other cities but stopped in late 2023 after an accident. It should restart in at least one city in 2024. GM owns over 80% of Cruise. GM Financial became the company's captive finance arm in October 2010 via the purchase of AmeriCredit.

After a thorough review of the options trading surrounding General Motors, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is General Motors Standing Right Now?

- Currently trading with a volume of 2,803,869, the GM's price is up by 0.28%, now at $43.67.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 28 days.

What The Experts Say On General Motors

2 market experts have recently issued ratings for this stock, with a consensus target price of $46.0.

- In a cautious move, an analyst from Piper Sandler downgraded its rating to Neutral, setting a price target of $44.

- An analyst from Mizuho persists with their Buy rating on General Motors, maintaining a target price of $48.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for General Motors with Benzinga Pro for real-time alerts.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.