Investors with a lot of money to spend have taken a bearish stance on Palo Alto Networks PANW.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with PANW, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 34 uncommon options trades for Palo Alto Networks.

This isn't normal.

The overall sentiment of these big-money traders is split between 38% bullish and 61%, bearish.

Out of all of the special options we uncovered, 10 are puts, for a total amount of $591,441, and 24 are calls, for a total amount of $3,119,656.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $200.0 to $600.0 for Palo Alto Networks over the recent three months.

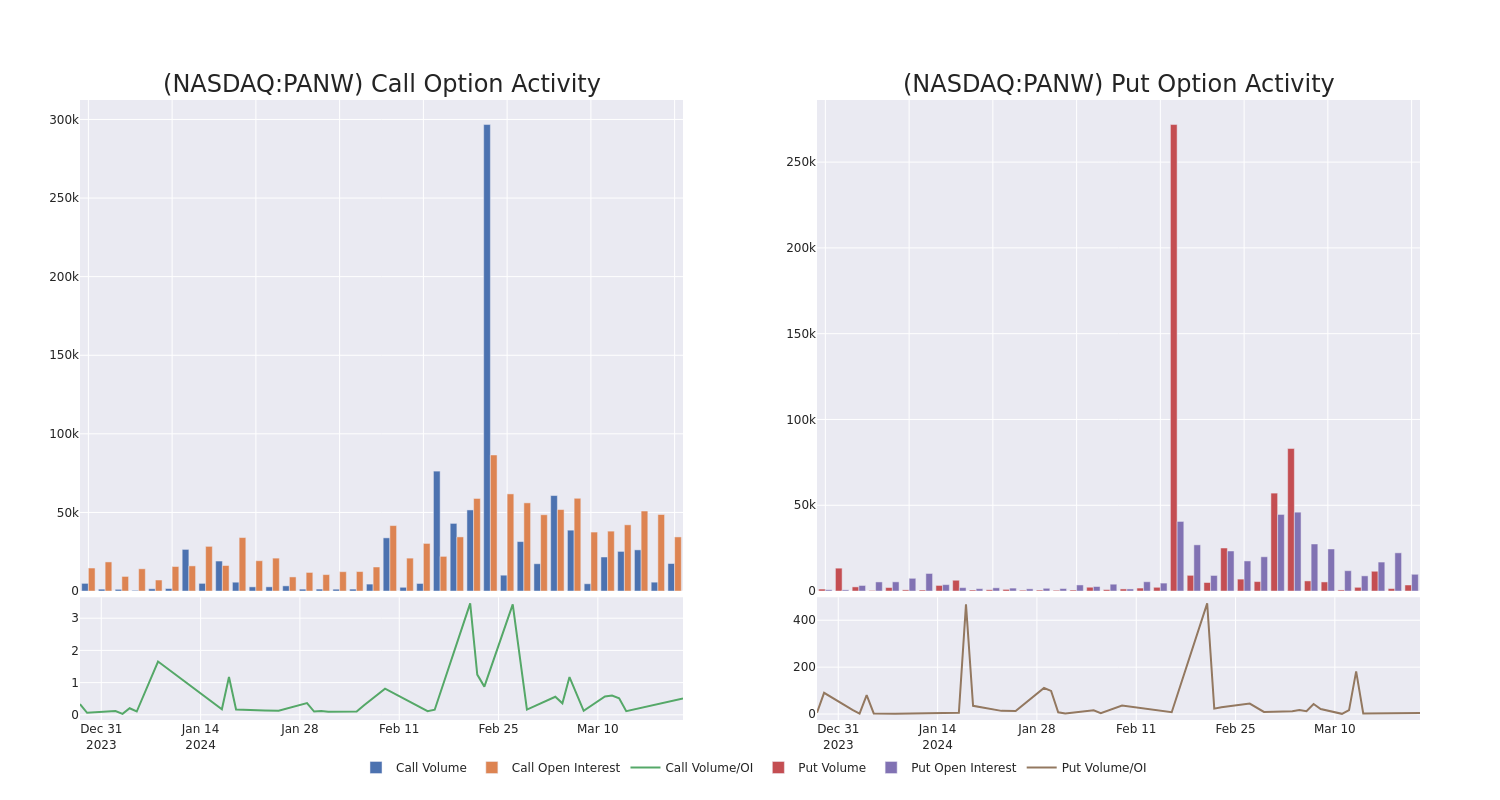

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Palo Alto Networks's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Palo Alto Networks's substantial trades, within a strike price spectrum from $200.0 to $600.0 over the preceding 30 days.

Palo Alto Networks Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| PANW | CALL | TRADE | BEARISH | 01/17/25 | $320.00 | $1.8M | 1.1K | 600 |

| PANW | CALL | SWEEP | BULLISH | 06/21/24 | $280.00 | $266.0K | 4.8K | 100 |

| PANW | PUT | TRADE | BEARISH | 01/17/25 | $600.00 | $158.0K | 0 | 5 |

| PANW | CALL | TRADE | BEARISH | 01/17/25 | $270.00 | $146.2K | 702 | 27 |

| PANW | CALL | TRADE | BEARISH | 09/19/25 | $300.00 | $109.0K | 267 | 19 |

About Palo Alto Networks

Palo Alto Networks is a platform-based cybersecurity vendor with product offerings covering network security, cloud security, and security operations. The California-based firm has more than 85,000 customers across the world, including more than three fourths of the Global 2000.

In light of the recent options history for Palo Alto Networks, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Palo Alto Networks

- With a trading volume of 1,258,978, the price of PANW is up by 0.66%, reaching $286.96.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 56 days from now.

Expert Opinions on Palo Alto Networks

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $335.0.

- An analyst from Redburn Atlantic persists with their Buy rating on Palo Alto Networks, maintaining a target price of $350.

- An analyst from Susquehanna has decided to maintain their Positive rating on Palo Alto Networks, which currently sits at a price target of $325.

- Reflecting concerns, an analyst from Stifel lowers its rating to Buy with a new price target of $330.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Palo Alto Networks, Benzinga Pro gives you real-time options trades alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.