Financial giants have made a conspicuous bearish move on Walt Disney. Our analysis of options history for Walt Disney DIS revealed 10 unusual trades.

Delving into the details, we found 30% of traders were bullish, while 70% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $183,536, and 6 were calls, valued at $281,843.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $111.0 and $135.0 for Walt Disney, spanning the last three months.

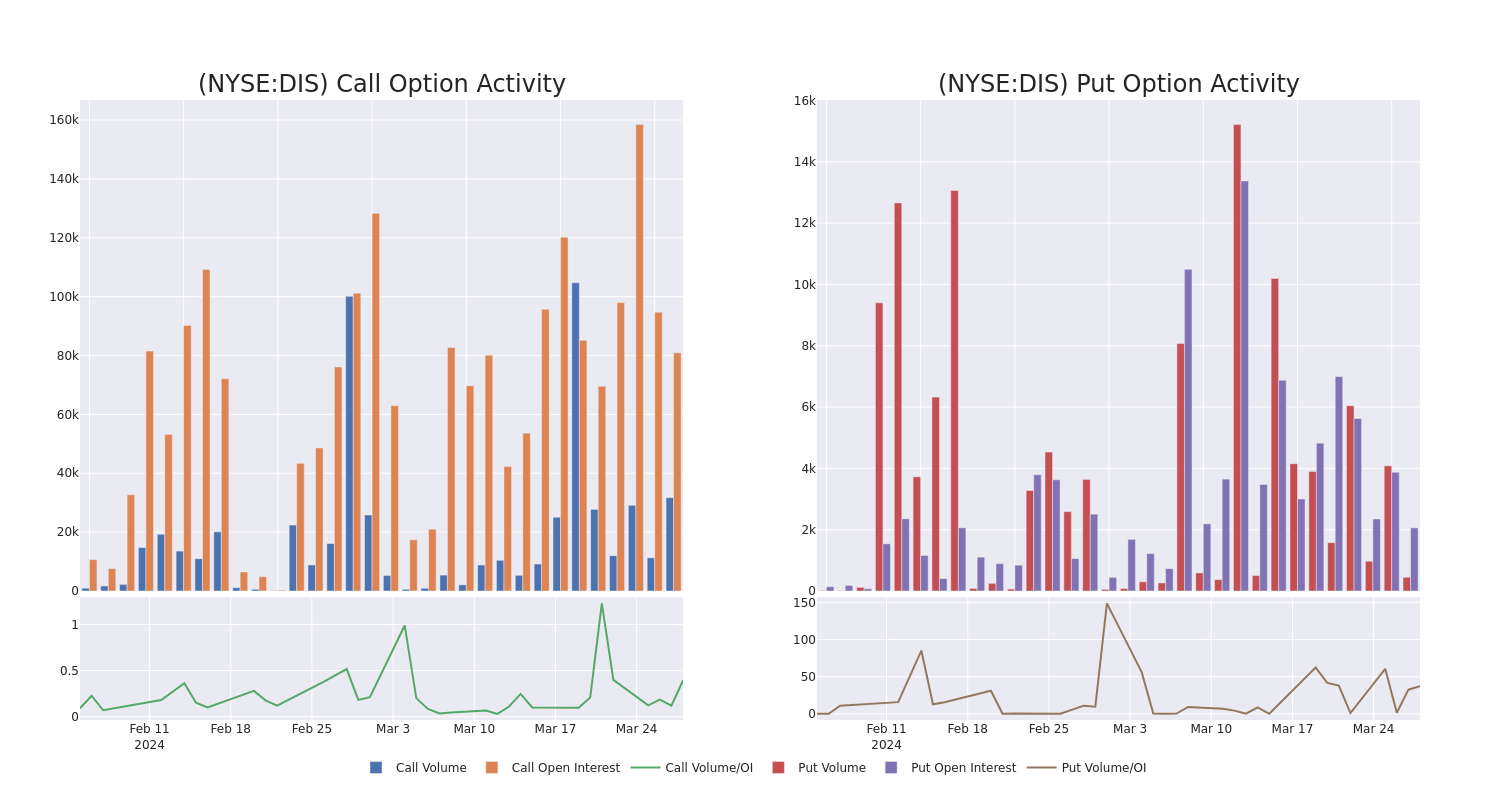

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Walt Disney's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Walt Disney's whale trades within a strike price range from $111.0 to $135.0 in the last 30 days.

Walt Disney Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| DIS | CALL | SWEEP | BULLISH | 04/19/24 | $115.00 | $89.5K | 29.3K | 880 |

| DIS | PUT | TRADE | BEARISH | 04/19/24 | $122.00 | $70.3K | 182 | 335 |

| DIS | CALL | TRADE | NEUTRAL | 05/17/24 | $120.00 | $62.7K | 9.9K | 188 |

| DIS | CALL | SWEEP | BEARISH | 04/19/24 | $120.00 | $46.5K | 32.4K | 29.0K |

| DIS | PUT | SWEEP | BULLISH | 04/05/24 | $120.00 | $44.0K | 1.0K | 1 |

About Walt Disney

Disney operates in three global business segments: entertainment, sports, and experiences. Entertainment and experiences both benefit from franchises and characters the firm has created over the course of a century. Entertainment includes the ABC broadcast network, several cable television networks, and the Disney+ and Hulu streaming services. Within the segment, Disney also engages in movie and television production and distribution, with content licensed to movie theaters, other content providers, or, increasingly, kept in-house for use on Disney's own streaming platform and television networks. The sports segment houses ESPN and the ESPN+ streaming service. Experiences contains Disney's theme parks and vacation destinations, and also benefits from merchandise licensing.

Following our analysis of the options activities associated with Walt Disney, we pivot to a closer look at the company's own performance.

Walt Disney's Current Market Status

- With a trading volume of 4,455,237, the price of DIS is up by 1.06%, reaching $122.26.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 41 days from now.

Professional Analyst Ratings for Walt Disney

4 market experts have recently issued ratings for this stock, with a consensus target price of $134.5.

- An analyst from Raymond James downgraded its action to Outperform with a price target of $128.

- An analyst from Barclays has elevated its stance to Overweight, setting a new price target at $135.

- An analyst from Morgan Stanley persists with their Overweight rating on Walt Disney, maintaining a target price of $135.

- Maintaining their stance, an analyst from UBS continues to hold a Buy rating for Walt Disney, targeting a price of $140.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Walt Disney options trades with real-time alerts from Benzinga Pro.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.