Financial giants have made a conspicuous bullish move on Eaton Corp. Our analysis of options history for Eaton Corp ETN revealed 8 unusual trades.

Delving into the details, we found 50% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $172,032, and 4 were calls, valued at $186,780.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $240.0 to $340.0 for Eaton Corp during the past quarter.

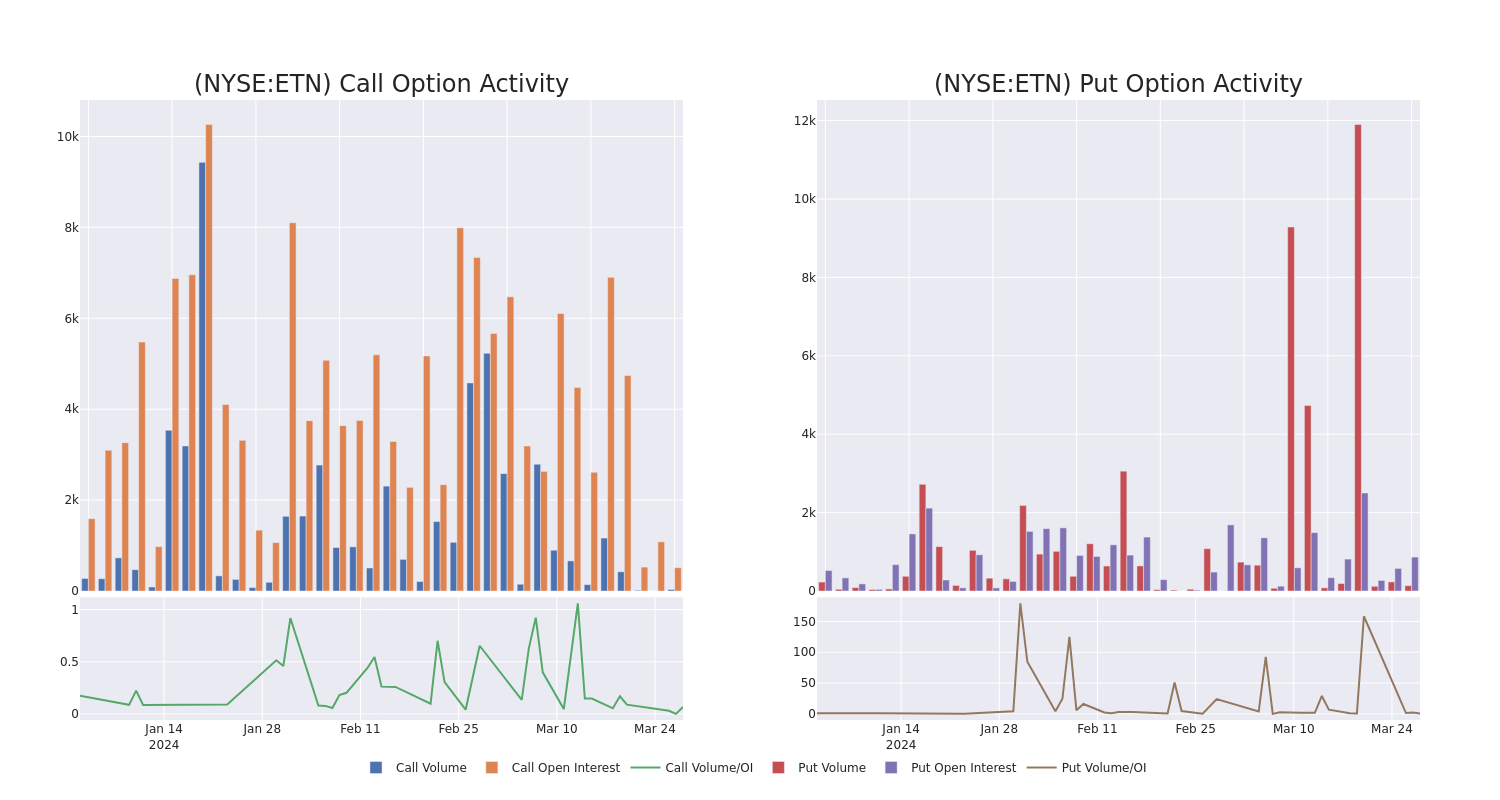

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Eaton Corp's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Eaton Corp's substantial trades, within a strike price spectrum from $240.0 to $340.0 over the preceding 30 days.

Eaton Corp 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| ETN | CALL | TRADE | BULLISH | 01/16/26 | $300.00 | $62.8K | 47 | 15 |

| ETN | PUT | SWEEP | BEARISH | 06/21/24 | $320.00 | $62.6K | 697 | 36 |

| ETN | CALL | SWEEP | BULLISH | 07/19/24 | $240.00 | $62.3K | 121 | 8 |

| ETN | PUT | SWEEP | BEARISH | 06/21/24 | $320.00 | $43.7K | 697 | 61 |

| ETN | PUT | SWEEP | BEARISH | 06/21/24 | $310.00 | $35.5K | 84 | 40 |

About Eaton Corp

Eaton is a diversified power management company operating for over 100 years. The company operates through various segments, including electrical Americas, electrical global, aerospace, vehicle, and eMobility. Eaton's portfolio can broadly be divided into two halves. One part of its portfolio is housed under its industrial sector umbrella, which serves a large variety of end markets like commercial vehicles, general aviation, and trucks. The other portion is Eaton's electrical sector portfolio, which serves data centers, utilities, and the residential end market, among others. While the company receives favorable tax treatment with its Ireland domicile, most of its operations are in the U.S.

After a thorough review of the options trading surrounding Eaton Corp, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Eaton Corp

- Currently trading with a volume of 250,900, the ETN's price is down by 0.0%, now at $314.4.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 33 days.

Professional Analyst Ratings for Eaton Corp

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $325.8.

- An analyst from Goldman Sachs persists with their Buy rating on Eaton Corp, maintaining a target price of $328.

- Consistent in their evaluation, an analyst from RBC Capital keeps a Sector Perform rating on Eaton Corp with a target price of $286.

- An analyst from Mizuho persists with their Buy rating on Eaton Corp, maintaining a target price of $340.

- Consistent in their evaluation, an analyst from B of A Securities keeps a Buy rating on Eaton Corp with a target price of $330.

- Consistent in their evaluation, an analyst from Berenberg keeps a Buy rating on Eaton Corp with a target price of $345.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Eaton Corp options trades with real-time alerts from Benzinga Pro.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.