Deep-pocketed investors have adopted a bearish approach towards Valero Energy VLO, and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in VLO usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 13 extraordinary options activities for Valero Energy. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 15% leaning bullish and 84% bearish. Among these notable options, 4 are puts, totaling $132,312, and 9 are calls, amounting to $559,290.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $120.0 and $185.0 for Valero Energy, spanning the last three months.

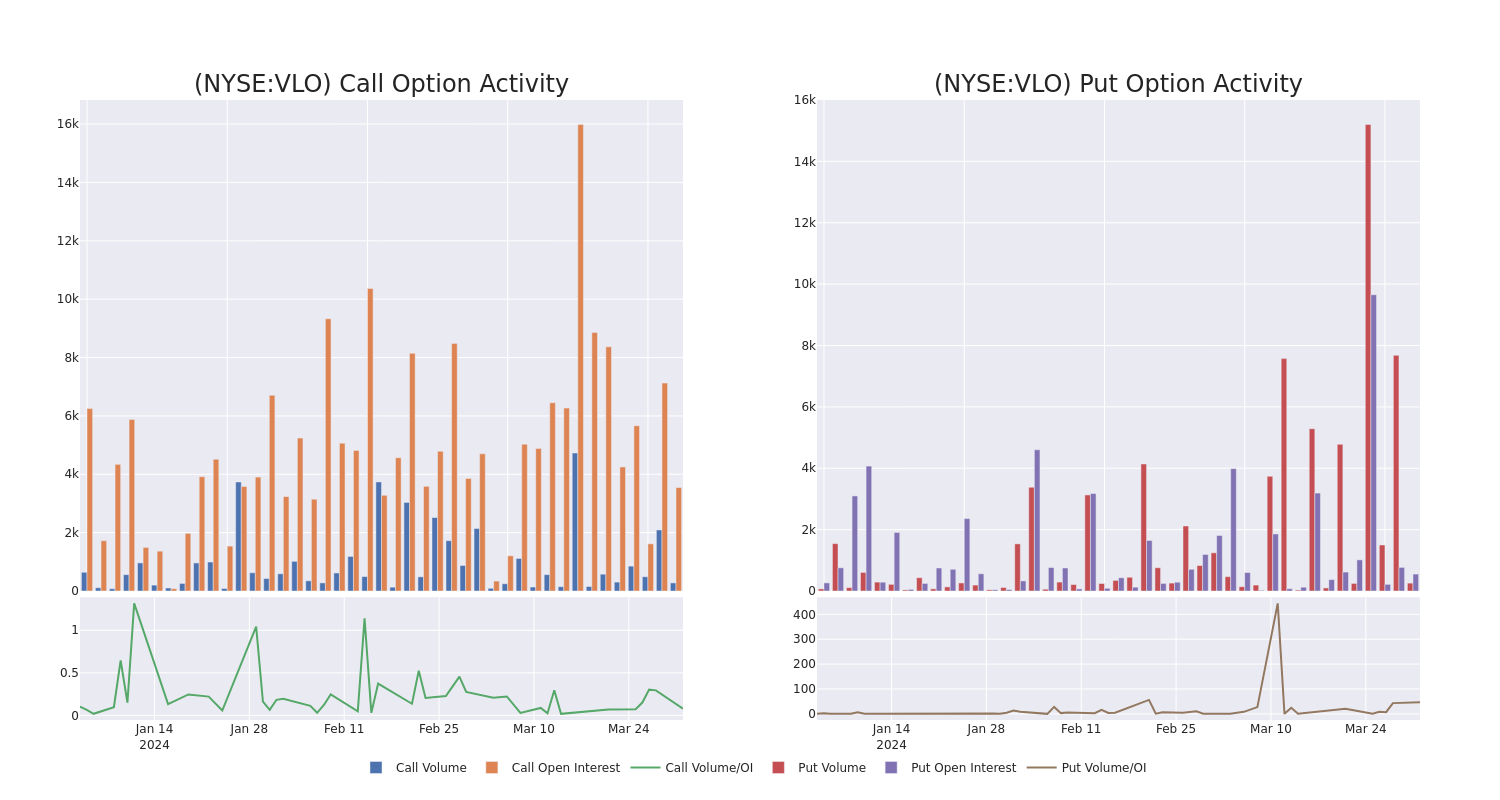

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Valero Energy's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Valero Energy's significant trades, within a strike price range of $120.0 to $185.0, over the past month.

Valero Energy Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VLO | CALL | SWEEP | BEARISH | 06/21/24 | $35.2 | $34.9 | $34.9 | $135.00 | $209.4K | 927 | 72 |

| VLO | CALL | TRADE | BEARISH | 01/16/26 | $33.65 | $32.55 | $32.89 | $170.00 | $65.7K | 186 | 20 |

| VLO | CALL | TRADE | NEUTRAL | 05/03/24 | $4.3 | $4.0 | $4.15 | $175.00 | $62.2K | 3 | 150 |

| VLO | CALL | TRADE | BEARISH | 04/19/24 | $26.3 | $24.5 | $24.5 | $145.00 | $49.0K | 1.3K | 1 |

| VLO | CALL | TRADE | BULLISH | 01/17/25 | $21.9 | $21.5 | $21.9 | $170.00 | $43.8K | 525 | 20 |

About Valero Energy

Valero Energy is one of the largest independent refiners in the United States. It operates 15 refineries with a total throughput capacity of 3.2 million barrels a day in the United States, Canada, and the United Kingdom. Valero also owns 12 ethanol plants with capacity of 1.6 billion gallons a year and holds a 50% stake in Diamond Green Diesel, which has capacity to produce 1.2 billion gallons per year of renewable diesel.

Following our analysis of the options activities associated with Valero Energy, we pivot to a closer look at the company's own performance.

Valero Energy's Current Market Status

- Currently trading with a volume of 2,073,114, the VLO's price is up by 1.34%, now at $172.98.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 24 days.

What The Experts Say On Valero Energy

In the last month, 5 experts released ratings on this stock with an average target price of $178.2.

- An analyst from Wells Fargo has decided to maintain their Equal-Weight rating on Valero Energy, which currently sits at a price target of $171.

- An analyst from Goldman Sachs persists with their Sell rating on Valero Energy, maintaining a target price of $171.

- Maintaining their stance, an analyst from Piper Sandler continues to hold a Overweight rating for Valero Energy, targeting a price of $161.

- In a positive move, an analyst from B of A Securities has upgraded their rating to Buy and adjusted the price target to $210.

- An analyst from JP Morgan has decided to maintain their Overweight rating on Valero Energy, which currently sits at a price target of $178.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Valero Energy with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.