Financial giants have made a conspicuous bearish move on JD.com. Our analysis of options history for JD.com JD revealed 11 unusual trades.

Delving into the details, we found 36% of traders were bullish, while 63% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $941,595, and 8 were calls, valued at $770,355.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $24.0 to $35.0 for JD.com over the recent three months.

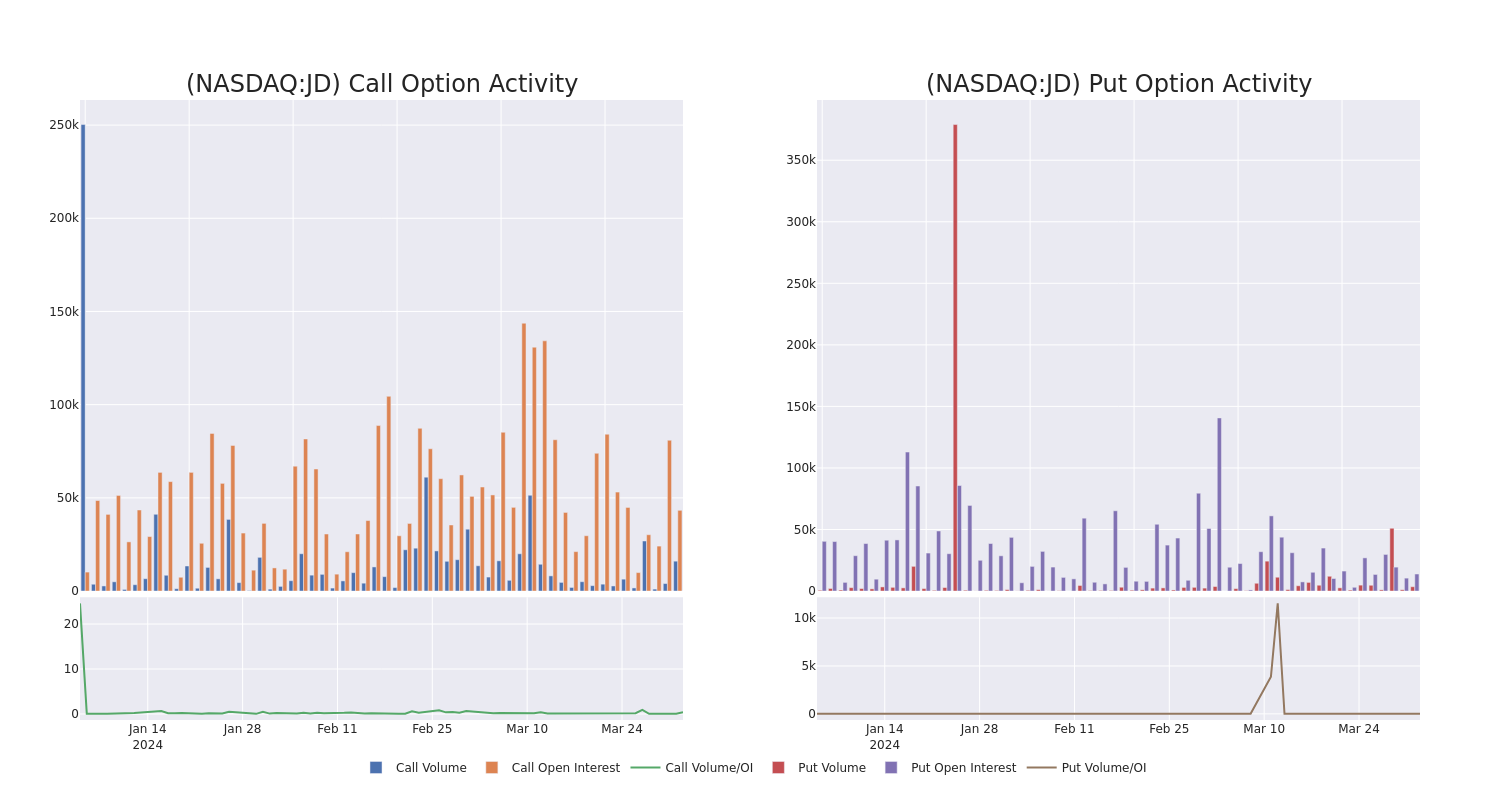

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for JD.com's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of JD.com's whale trades within a strike price range from $24.0 to $35.0 in the last 30 days.

JD.com Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JD | PUT | TRADE | BULLISH | 06/21/24 | $2.46 | $2.43 | $2.44 | $27.50 | $732.0K | 13.4K | 3.0K |

| JD | CALL | SWEEP | BEARISH | 05/17/24 | $0.59 | $0.56 | $0.57 | $32.00 | $205.8K | 1.2K | 3.6K |

| JD | CALL | SWEEP | BEARISH | 05/17/24 | $0.77 | $0.75 | $0.75 | $31.00 | $150.4K | 16.1K | 2.0K |

| JD | PUT | SWEEP | BEARISH | 04/19/24 | $3.45 | $3.4 | $3.4 | $30.50 | $130.2K | 227 | 383 |

| JD | CALL | SWEEP | BULLISH | 05/17/24 | $0.73 | $0.72 | $0.73 | $31.00 | $106.6K | 16.1K | 3.5K |

About JD.com

JD.com is a leading e-commerce platform with its 2022 China GMV being similar to Pinduoduo (GMV not reported), on our estimate, but still lower than Alibaba. it offers a wide selection of authentic products with speedy and reliable delivery. The company has built its own nationwide fulfilment infrastructure and last-mile delivery network, staffed by its own employees, which supports both its online direct sales, its online marketplace and omnichannel businesses.

In light of the recent options history for JD.com, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of JD.com

- With a volume of 5,011,612, the price of JD is down -0.39% at $27.65.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 37 days.

Expert Opinions on JD.com

In the last month, 5 experts released ratings on this stock with an average target price of $33.4.

- An analyst from Susquehanna has decided to maintain their Neutral rating on JD.com, which currently sits at a price target of $28.

- Maintaining their stance, an analyst from HSBC continues to hold a Buy rating for JD.com, targeting a price of $39.

- Consistent in their evaluation, an analyst from JP Morgan keeps a Neutral rating on JD.com with a target price of $28.

- Maintaining their stance, an analyst from Mizuho continues to hold a Buy rating for JD.com, targeting a price of $33.

- Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on JD.com with a target price of $39.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for JD.com with Benzinga Pro for real-time alerts.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.