Deep-pocketed investors have adopted a bullish approach towards Roblox RBLX, and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in RBLX usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 9 extraordinary options activities for Roblox. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 55% leaning bullish and 44% bearish. Among these notable options, 6 are puts, totaling $220,642, and 3 are calls, amounting to $93,636.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $25.0 and $70.0 for Roblox, spanning the last three months.

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Roblox options trades today is 1580.0 with a total volume of 4,449.00.

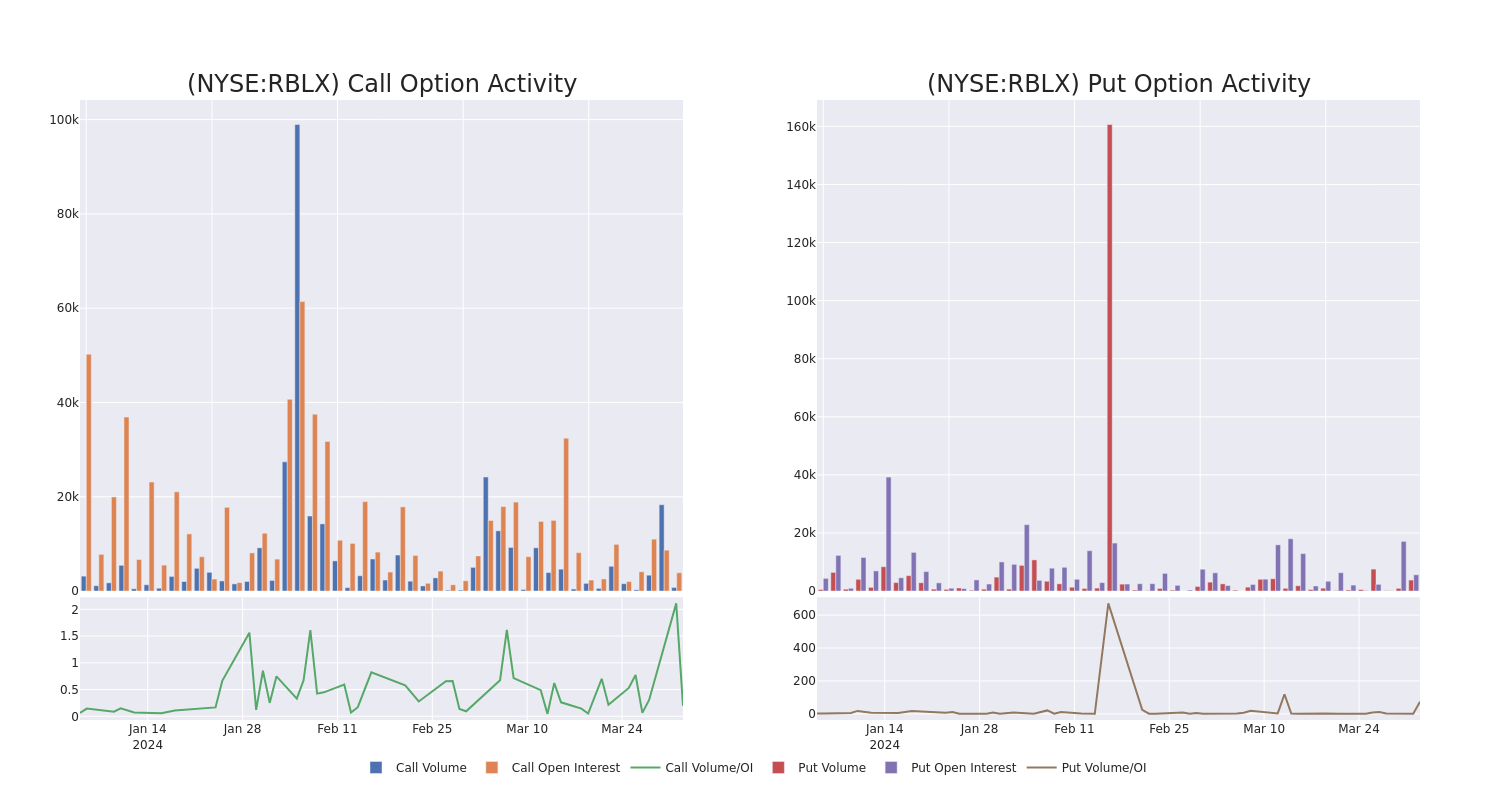

In the following chart, we are able to follow the development of volume and open interest of call and put options for Roblox's big money trades within a strike price range of $25.0 to $70.0 over the last 30 days.

Roblox Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RBLX | PUT | SWEEP | BULLISH | 06/21/24 | $5.75 | $5.65 | $5.7 | $40.00 | $57.0K | 3.4K | 100 |

| RBLX | PUT | SWEEP | BULLISH | 09/20/24 | $4.2 | $4.15 | $4.2 | $35.00 | $46.6K | 2.1K | 909 |

| RBLX | CALL | SWEEP | BEARISH | 01/16/26 | $3.85 | $3.7 | $3.72 | $70.00 | $37.1K | 1.4K | 100 |

| RBLX | PUT | SWEEP | BEARISH | 05/10/24 | $1.55 | $1.42 | $1.55 | $33.00 | $34.8K | 11 | 600 |

| RBLX | PUT | SWEEP | BULLISH | 05/10/24 | $1.52 | $1.47 | $1.47 | $33.00 | $29.4K | 11 | 200 |

About Roblox

Roblox operates an online video game platform that lets young gamers create, develop, and monetize games (or "experiences") for other players. The firm effectively offers its developers a hybrid of a game engine, publishing platform, online hosting and services, marketplace with payment processing, and social network. The platform is a closed garden that Roblox controls, earning revenue in multiple places while benefiting from outsourced game development. Unlike traditional video game publishers, Roblox is more focused on the creation of new tools and monetization techniques for its developers then creating new games or franchises.

Having examined the options trading patterns of Roblox, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Roblox

- Trading volume stands at 2,764,176, with RBLX's price down by -2.48%, positioned at $36.9.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 36 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Roblox with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.