Investors with a lot of money to spend have taken a bullish stance on Norwegian Cruise Line NCLH.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with NCLH, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 14 uncommon options trades for Norwegian Cruise Line.

This isn't normal.

The overall sentiment of these big-money traders is split between 50% bullish and 50%, bearish.

Out of all of the special options we uncovered, 9 are puts, for a total amount of $510,466, and 5 are calls, for a total amount of $322,320.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $17.0 to $27.5 for Norwegian Cruise Line over the recent three months.

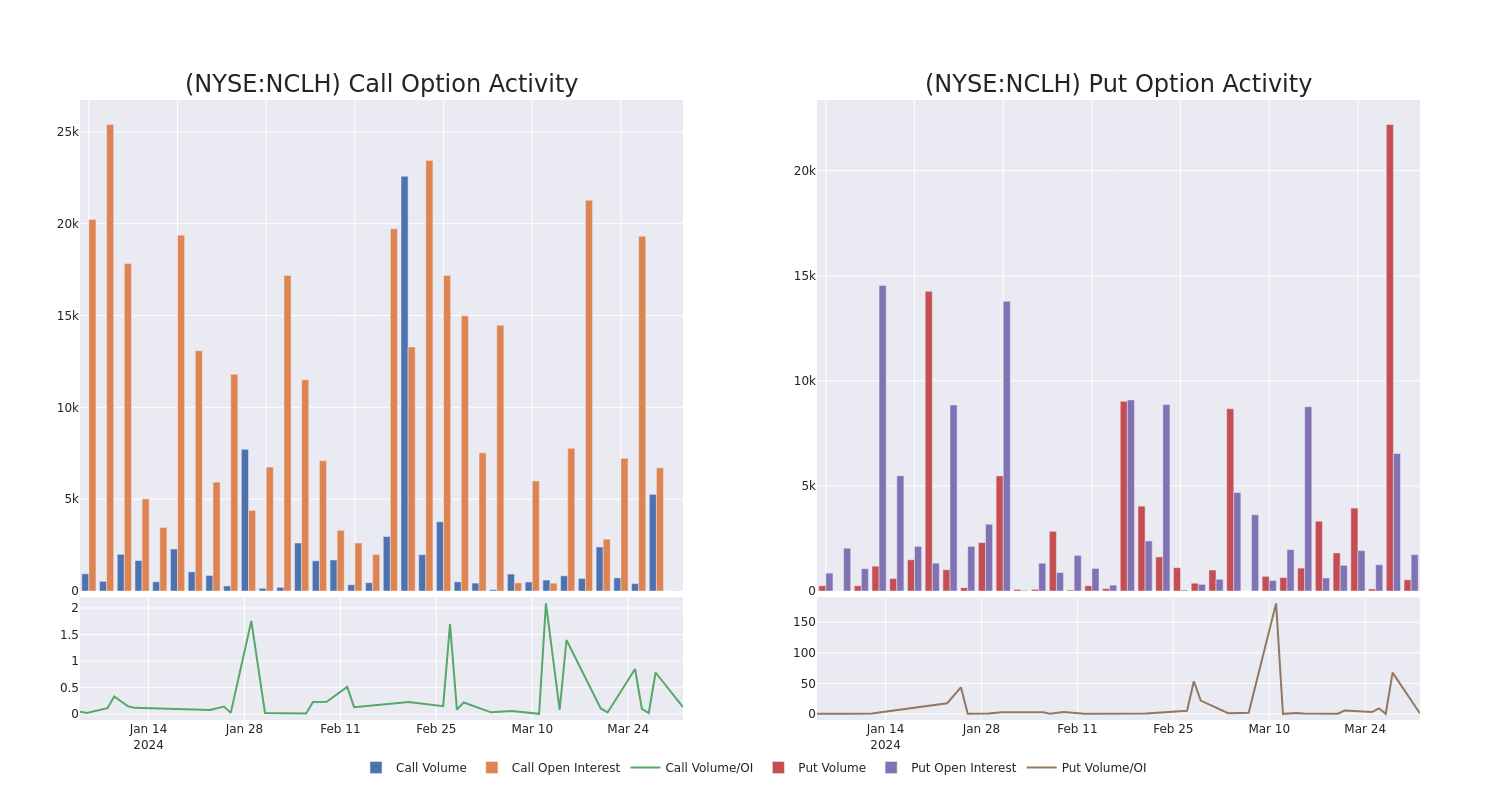

Volume & Open Interest Development

In today's trading context, the average open interest for options of Norwegian Cruise Line stands at 2634.88, with a total volume reaching 8,555.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Norwegian Cruise Line, situated within the strike price corridor from $17.0 to $27.5, throughout the last 30 days.

Norwegian Cruise Line Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NCLH | PUT | TRADE | BEARISH | 05/17/24 | $0.54 | $0.49 | $0.53 | $17.50 | $265.0K | 12.5K | 5.0K |

| NCLH | CALL | TRADE | BEARISH | 09/20/24 | $4.7 | $3.8 | $4.0 | $18.00 | $80.0K | 1.8K | 200 |

| NCLH | CALL | SWEEP | BULLISH | 09/20/24 | $3.5 | $3.4 | $3.47 | $18.00 | $69.9K | 1.8K | 987 |

| NCLH | CALL | SWEEP | BULLISH | 09/20/24 | $3.45 | $3.4 | $3.44 | $18.00 | $69.0K | 1.8K | 587 |

| NCLH | CALL | SWEEP | BULLISH | 09/20/24 | $3.45 | $3.4 | $3.45 | $18.00 | $68.9K | 1.8K | 787 |

About Norwegian Cruise Line

Norwegian Cruise Line is the world's third-largest cruise company by berths (around 66,500). It operates 32 ships across three brands —Norwegian, Oceania, and Regent Seven Seas—offering both freestyle and luxury cruising. The company redeployed its entire fleet as of May 2022. With five passenger vessels on order among its brands through 2028, representing 16,000 incremental berths, Norwegian is increasing capacity faster than its peers, expanding its brand globally. Norwegian sails to around 700 global destinations.

In light of the recent options history for Norwegian Cruise Line, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Norwegian Cruise Line

- Currently trading with a volume of 11,509,674, the NCLH's price is down by -2.58%, now at $20.4.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 27 days.

Professional Analyst Ratings for Norwegian Cruise Line

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $18.333333333333332.

- Reflecting concerns, an analyst from Goldman Sachs lowers its rating to Neutral with a new price target of $19.

- Consistent in their evaluation, an analyst from Morgan Stanley keeps a Underweight rating on Norwegian Cruise Line with a target price of $15.

- In a cautious move, an analyst from Mizuho downgraded its rating to Neutral, setting a price target of $21.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Norwegian Cruise Line, Benzinga Pro gives you real-time options trades alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.