Investors with a lot of money to spend have taken a bullish stance on Deere DE.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with DE, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 14 uncommon options trades for Deere.

This isn't normal.

The overall sentiment of these big-money traders is split between 50% bullish and 50%, bearish.

Out of all of the special options we uncovered, 5 are puts, for a total amount of $267,930, and 9 are calls, for a total amount of $348,974.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $330.0 to $490.0 for Deere over the last 3 months.

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Deere's options for a given strike price.

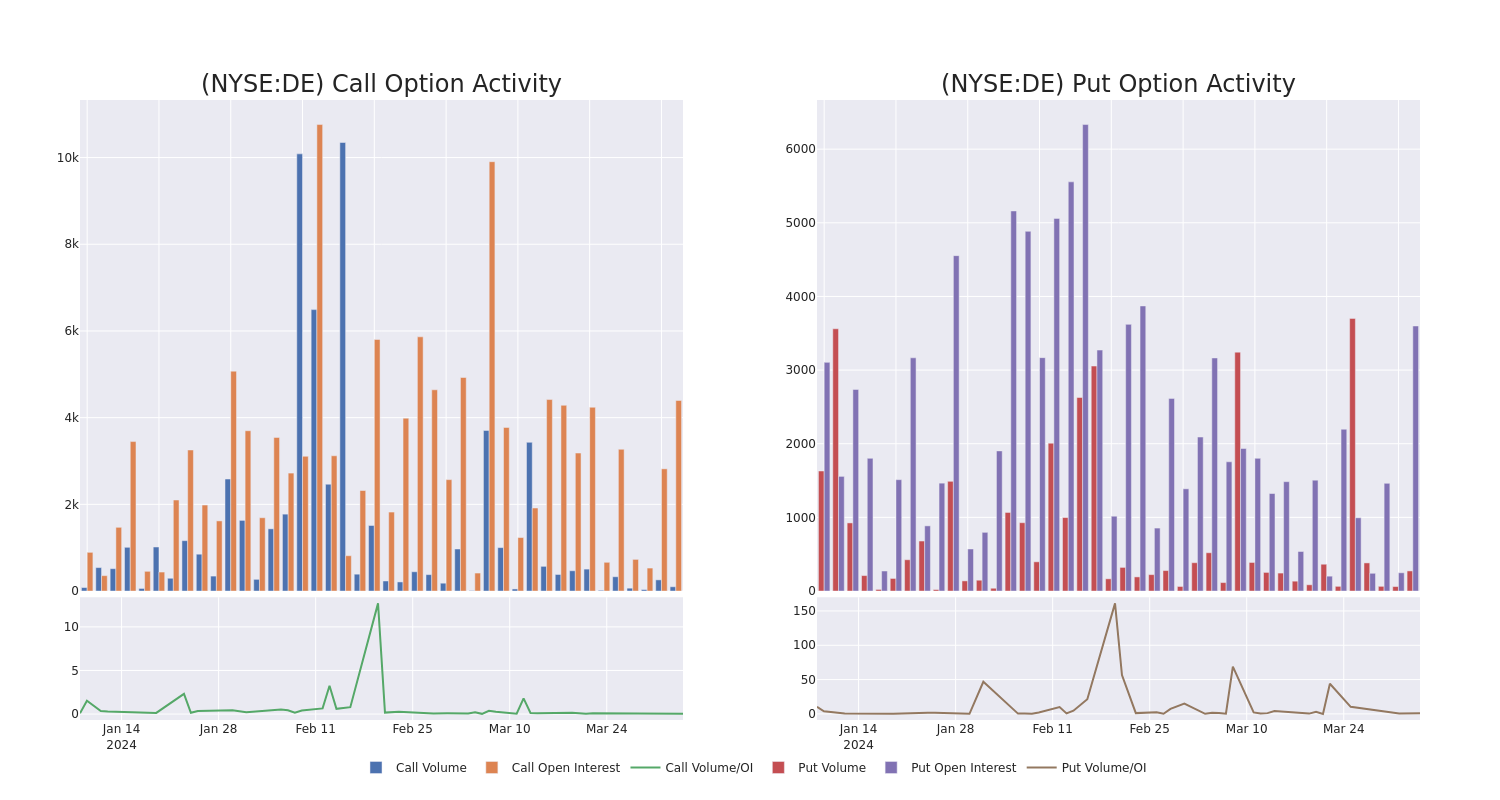

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Deere's whale activity within a strike price range from $330.0 to $490.0 in the last 30 days.

Deere Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DE | PUT | SWEEP | BULLISH | 01/17/25 | $9.15 | $8.35 | $8.35 | $330.00 | $123.5K | 1.7K | 148 |

| DE | CALL | SWEEP | NEUTRAL | 06/21/24 | $28.25 | $25.3 | $27.0 | $400.00 | $62.1K | 1.5K | 23 |

| DE | CALL | TRADE | NEUTRAL | 01/17/25 | $62.7 | $59.3 | $60.83 | $380.00 | $60.8K | 486 | 5 |

| DE | CALL | SWEEP | BEARISH | 04/05/24 | $2.07 | $1.7 | $1.89 | $407.50 | $51.9K | 60 | 11 |

| DE | CALL | TRADE | BEARISH | 04/19/24 | $45.45 | $39.45 | $41.73 | $370.00 | $41.7K | 905 | 0 |

About Deere

Deere is the world's leading manufacturer of agricultural equipment, producing some of the most recognizable machines in the heavy machinery industry. The company is divided into four reportable segments: production and precision agriculture, small agriculture and turf, construction and forestry, and John Deere Capital. Its products are available through an extensive dealer network, which includes over 2,000 dealer locations in North America and approximately 3,700 locations globally. John Deere Capital provides retail financing for machinery to its customers, in addition to wholesale financing for dealers, which increases the likelihood of Deere product sales.

Present Market Standing of Deere

- Currently trading with a volume of 770,574, the DE's price is up by 1.07%, now at $410.38.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 43 days.

What The Experts Say On Deere

1 market experts have recently issued ratings for this stock, with a consensus target price of $494.0.

- Reflecting concerns, an analyst from Truist Securities lowers its rating to Buy with a new price target of $494.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Deere options trades with real-time alerts from Benzinga Pro.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.