Benzinga's options scanner has just identified more than 16 option transactions on DraftKings DKNG, with a cumulative value of $487,129. Concurrently, our algorithms picked up 5 puts, worth a total of 194,509.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $2.5 to $65.0 for DraftKings over the recent three months.

Insights into Volume & Open Interest

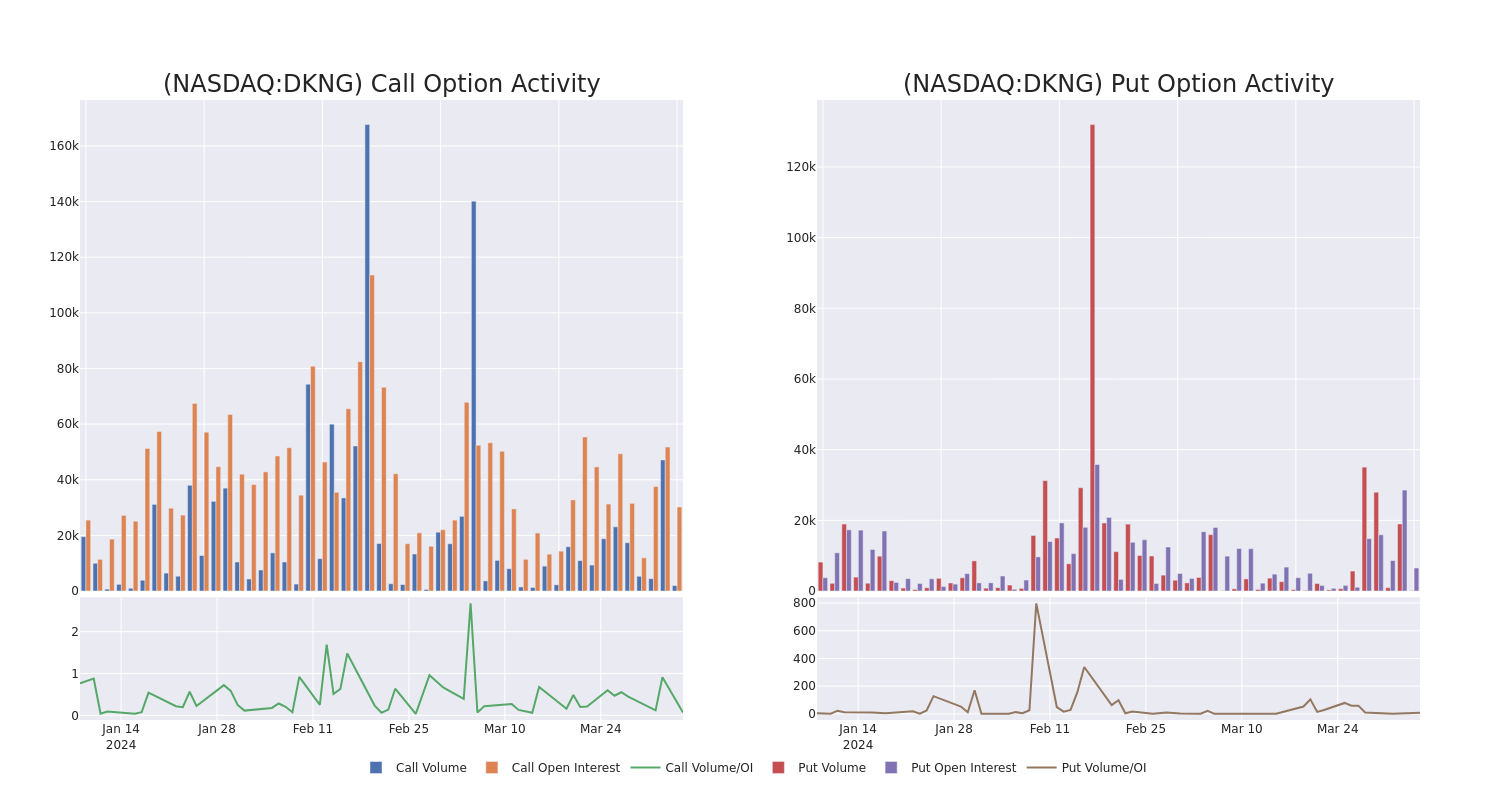

In today's trading context, the average open interest for options of DraftKings stands at 2624.86, with a total volume reaching 2,114.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in DraftKings, situated within the strike price corridor from $2.5 to $65.0, throughout the last 30 days.

DraftKings Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DKNG | CALL | SWEEP | BEARISH | 01/17/25 | $6.05 | $6.0 | $6.0 | $55.00 | $69.6K | 3.6K | 314 |

| DKNG | PUT | SWEEP | BULLISH | 05/17/24 | $4.4 | $4.3 | $4.3 | $47.00 | $64.5K | 3.2K | 6 |

| DKNG | CALL | TRADE | BULLISH | 04/19/24 | $6.45 | $6.4 | $6.45 | $40.00 | $63.8K | 672 | 205 |

| DKNG | CALL | SWEEP | BEARISH | 01/17/25 | $6.05 | $6.0 | $6.0 | $55.00 | $42.6K | 3.6K | 423 |

| DKNG | PUT | SWEEP | BULLISH | 05/10/24 | $3.55 | $3.5 | $3.55 | $46.00 | $42.2K | 120 | 0 |

About DraftKings

DraftKings got its start in 2012 as an innovator in daily fantasy sports. Then, following a Supreme Court ruling in 2018 that allowed states to legalize online sports wagering, the company expanded into online sports and casino gambling, where it generally holds the number two or three revenue share position across states in which it competes. DraftKings is now live with online sports betting in 24 states (46% of the U.S. population) and iGaming in seven states (11% of U.S.), with both products available to around 40% of Canada's population. The company also operates a non-fungible token commissioned-based marketplace and develops and licenses online gaming products.

After a thorough review of the options trading surrounding DraftKings, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is DraftKings Standing Right Now?

- Trading volume stands at 12,971,007, with DKNG's price up by 3.79%, positioned at $47.09.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 27 days.

Expert Opinions on DraftKings

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $55.4.

- An analyst from Mizuho has revised its rating downward to Buy, adjusting the price target to $58.

- Consistent in their evaluation, an analyst from Needham keeps a Buy rating on DraftKings with a target price of $58.

- Maintaining their stance, an analyst from Susquehanna continues to hold a Positive rating for DraftKings, targeting a price of $54.

- Reflecting concerns, an analyst from JMP Securities lowers its rating to Market Outperform with a new price target of $52.

- Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for DraftKings, targeting a price of $55.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest DraftKings options trades with real-time alerts from Benzinga Pro.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.