Financial giants have made a conspicuous bearish move on Palo Alto Networks. Our analysis of options history for Palo Alto Networks PANW revealed 29 unusual trades.

Delving into the details, we found 44% of traders were bullish, while 55% showed bearish tendencies. Out of all the trades we spotted, 10 were puts, with a value of $760,855, and 19 were calls, valued at $1,301,150.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $200.0 and $370.0 for Palo Alto Networks, spanning the last three months.

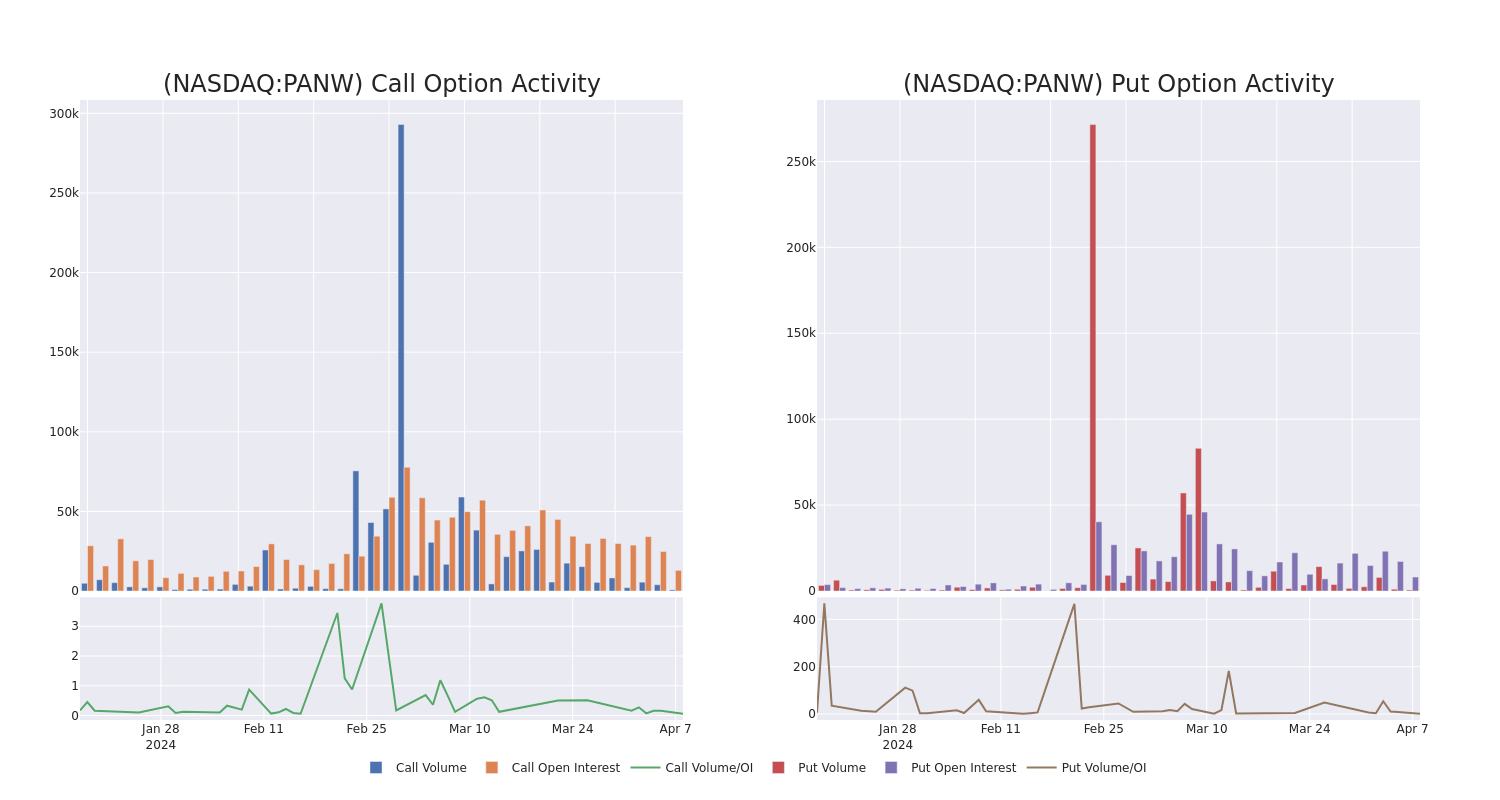

Volume & Open Interest Trends

In today's trading context, the average open interest for options of Palo Alto Networks stands at 1007.9, with a total volume reaching 1,350.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Palo Alto Networks, situated within the strike price corridor from $200.0 to $370.0, throughout the last 30 days.

Palo Alto Networks 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PANW | CALL | SWEEP | BEARISH | 01/16/26 | $49.3 | $48.4 | $49.05 | $310.00 | $490.5K | 292 | 0 |

| PANW | PUT | TRADE | NEUTRAL | 01/16/26 | $25.5 | $25.3 | $25.4 | $220.00 | $381.0K | 896 | 157 |

| PANW | CALL | SWEEP | BULLISH | 08/16/24 | $21.4 | $21.25 | $21.4 | $280.00 | $173.3K | 169 | 84 |

| PANW | CALL | SWEEP | BULLISH | 06/21/24 | $26.0 | $25.8 | $26.0 | $260.00 | $85.8K | 351 | 0 |

| PANW | PUT | TRADE | BEARISH | 01/16/26 | $70.55 | $69.55 | $70.55 | $310.00 | $70.5K | 18 | 0 |

About Palo Alto Networks

Palo Alto Networks is a platform-based cybersecurity vendor with product offerings covering network security, cloud security, and security operations. The California-based firm has more than 85,000 customers across the world, including more than three fourths of the Global 2000.

Having examined the options trading patterns of Palo Alto Networks, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Palo Alto Networks Standing Right Now?

- With a trading volume of 1,620,902, the price of PANW is up by 0.18%, reaching $269.5.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 43 days from now.

What The Experts Say On Palo Alto Networks

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $340.0.

- An analyst from Stifel has revised its rating downward to Buy, adjusting the price target to $330.

- An analyst from Redburn Atlantic has decided to maintain their Buy rating on Palo Alto Networks, which currently sits at a price target of $350.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Palo Alto Networks with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.