Investors with significant funds have taken a bearish position in Equinix EQIX, a development that retail traders should be aware of.

This was brought to our attention today through our monitoring of publicly accessible options data at Benzinga. The exact nature of these investors remains a mystery, but such a major move in EQIX usually indicates foreknowledge of upcoming events.

Today, Benzinga's options scanner identified 19 options transactions for Equinix. This is an unusual occurrence. The sentiment among these large-scale traders is mixed, with 5% being bullish and 94% bearish. Of all the options we discovered, 18 are puts, valued at $3,563,670, and there was a single call, worth $36,380.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $770.0 and $890.0 for Equinix, spanning the last three months.

Analyzing Volume & Open Interest

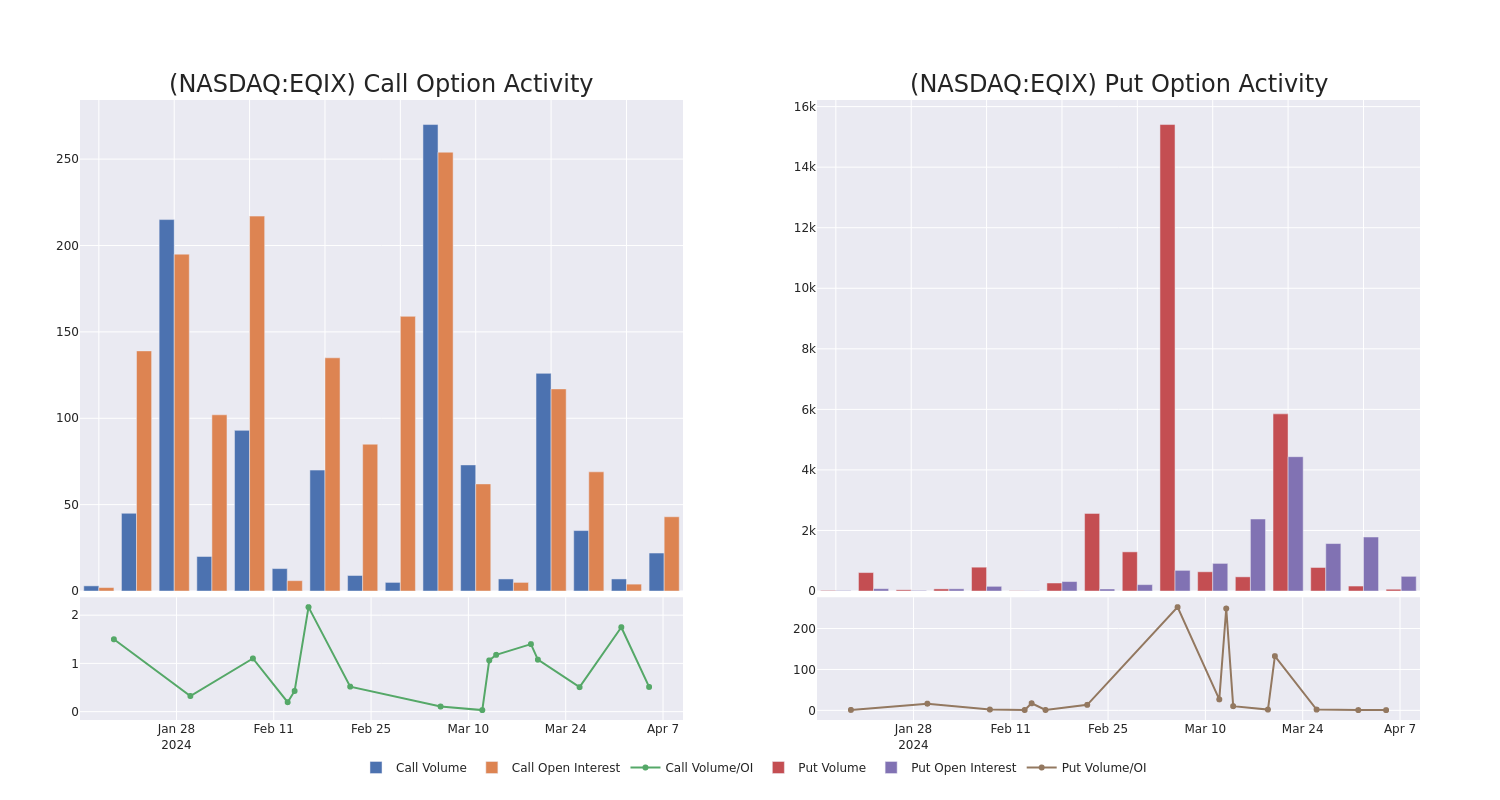

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Equinix's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Equinix's whale trades within a strike price range from $770.0 to $890.0 in the last 30 days.

Equinix Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EQIX | PUT | TRADE | NEUTRAL | 05/17/24 | $77.4 | $71.3 | $74.5 | $850.00 | $499.1K | 136 | 50 |

| EQIX | PUT | TRADE | NEUTRAL | 04/19/24 | $85.2 | $78.4 | $82.0 | $860.00 | $410.0K | 323 | 50 |

| EQIX | PUT | TRADE | BEARISH | 04/19/24 | $77.0 | $73.6 | $77.0 | $860.00 | $385.0K | 323 | 0 |

| EQIX | PUT | SWEEP | BEARISH | 04/19/24 | $105.0 | $100.6 | $105.0 | $880.00 | $304.5K | 107 | 107 |

| EQIX | PUT | SWEEP | BEARISH | 04/19/24 | $105.2 | $101.8 | $105.2 | $880.00 | $231.4K | 107 | 47 |

About Equinix

Equinix operates 260 data centers in 71 markets worldwide. It generates 44% of total revenue in the Americas, 35% in Europe, the Middle East, and Africa, and 21% in Asia-Pacific. The firm has more than 10,000 customers, including 2,100 network providers, that are dispersed over five verticals: cloud and IT services, content providers, network and mobile services, financial services, and enterprise. About 70% of Equinix's revenue comes from renting space to tenants and related services, and more than 15% comes from interconnection. Equinix operates as a real estate investment trust.

In light of the recent options history for Equinix, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Equinix

- Trading volume stands at 313,903, with EQIX's price down by -3.46%, positioned at $773.54.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 21 days.

Expert Opinions on Equinix

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $904.4.

- Consistent in their evaluation, an analyst from Truist Securities keeps a Buy rating on Equinix with a target price of $950.

- An analyst from Stifel downgraded its action to Buy with a price target of $960.

- Maintaining their stance, an analyst from Morgan Stanley continues to hold a Equal-Weight rating for Equinix, targeting a price of $762.

- Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on Equinix with a target price of $950.

- Reflecting concerns, an analyst from HSBC lowers its rating to Hold with a new price target of $900.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Equinix options trades with real-time alerts from Benzinga Pro.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.